Here’s how the Norwegian Government now indirectly holds over 570 Bitcoin

Here’s how the Norwegian Government now indirectly holds over 570 Bitcoin Here’s how the Norwegian Government now indirectly holds over 570 Bitcoin

Photo by Michael Fousert on Unsplash

Bitcoin adoption has already reached the high coffers of the Norwegian government, albeit in an indirect manner.

Norway now holds Bitcoin

As per a report by on-chain analytics firm Arcane Research, the Norwegian Government Pension Fund, also known as the Oil Fund, is exposed to the Bitcoin market by way of its holdings in enterprise software firm MicroStrategy, which itself holds over $375 million worth of the pioneer digital asset.

One may ask, “Why does MicroStrategy holding Bitcoin mean the Norwegian Fund owns Bitcoin?,” it’s because before any publicly-listed company pursues an outsized investment such as real estate in foreign lands or the purchase of other assets using treasury funds, an approval from a majority of the shareholders (or all) is required.

Once approved, all shareholders then conduct a strict due-diligence of the asset their money is flowing into, meaning the Norwegian Fund both approved and accepted the decision of MicroStrategy to purchase and hold Bitcoin.

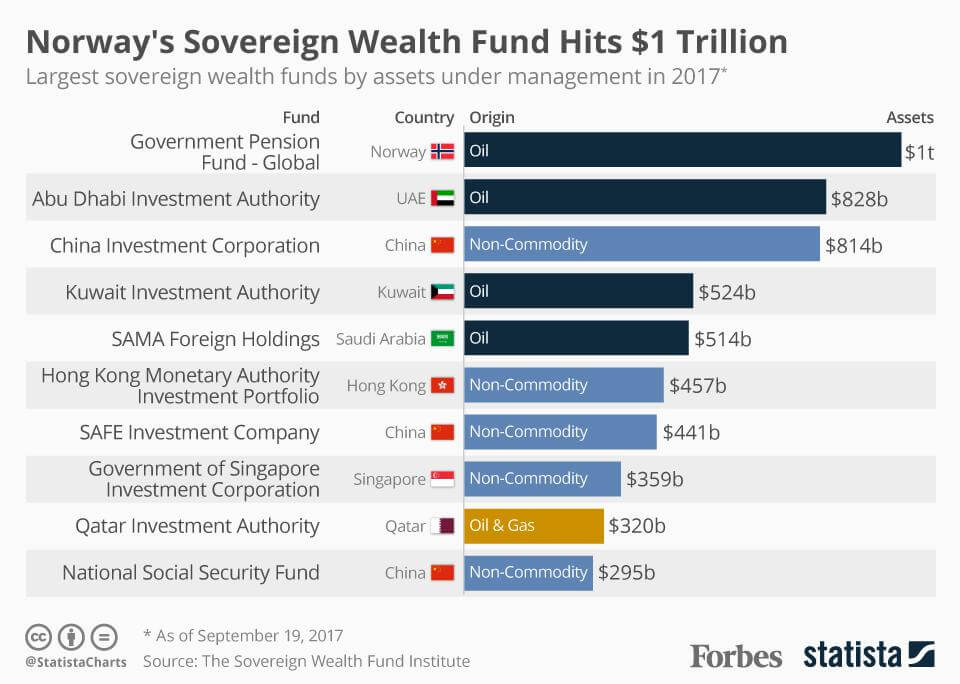

The fund’s not a small one either. The Norwegian Government Pension Fund, also known as the Oil Fund has over US$1 trillion in assets, including 1.4% of all global stocks and shares, making it the world’s largest sovereign wealth fund, said the report.

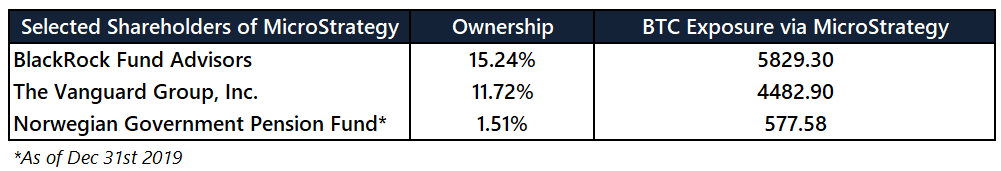

Arcane noted in its blog, “Through its ownership stakes in MicroStrategy (1.51% as of December 31, 2019), the Norwegian Government Pension Fund now indirectly holds 577.6 bitcoin (~57.5 MNOK, 6.3m USD).”

More Bitcoin?

The metric makes the Norwegian government one of the first developed countries to be exposed to the burgeoning Bitcoin market. It joins fund managers like Paul Tudor Jones and others to turn to the digital asset class as a hedge against global inflation and a bleak economic outlook.

Arcane further noted that the Pension Fund may have additional Bitcoin exposure via other investments, apart from the exposure to Bitcoin via MicroStrategy.

Meanwhile, two of the world’s largest equity and investment funds — Vanguard and Blackrock Advisors — are also now in the ownership of Bitcoin by way of their investments in MicroStrategy, said Arcane:

“BlackRock (5829.3 BTC ~ 63.8m USD) and The Vanguard Group (4482.9 BTC ~ 49.1m USD) holds sizable Bitcoin exposure through their ownership stakes at MicroStrategy.”

The Norwegian Fund’s approval of the purchase of Bitcoin is an extension of the country’s favorable policies around digital currencies and assets.

Reports suggest Norway is now “effectively cashless” and is pushing for both regulation and infrastructure to become a wholly cashless nation by 2030.

Only now, Bitcoin’s in for that ride.