Ethereum hits $473—and strategists are more bullish on ETH 2.0 than ever

Ethereum hits $473—and strategists are more bullish on ETH 2.0 than ever Ethereum hits $473—and strategists are more bullish on ETH 2.0 than ever

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

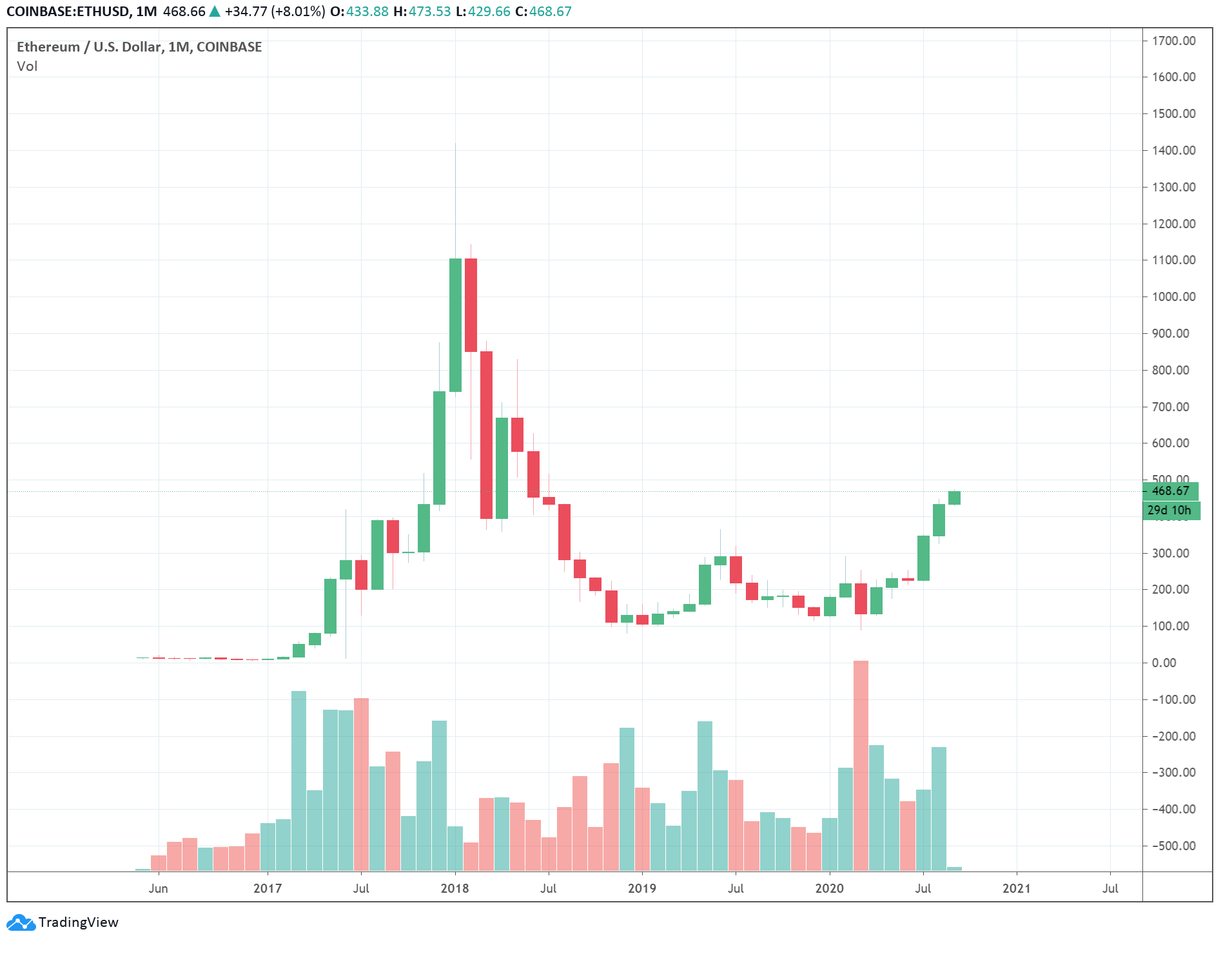

The price of Ethereum (ETH) achieved $473 for the first time since June 2018, primarily buoyed by decentralized finance (DeFi).

This time, the rally of Ethereum is driven by a noticeable spike in user activity, especially in the DeFi sector.

Strategists, including Three Arrows Capital CEO Su Zhu, say the prospect of ETH 2.0 and staking are also improving.

Why concerns that DeFi would harm staking and ETH 2.0 are not as relevant

The DeFi market is growing at an unprecedented pace. Since August 1, within a month, the total value locked in DeFi has more than doubled.

Data from DefiPulse shows the total value locked across DeFi protocols hovers at $9.19 billion, hitting a record high.

As the DeFi market began to expand, it caused mass withdrawals of ETH from exchanges. Users have started to send their ETH to DeFi platforms to stake or invest in DeFi governance tokens.

Some speculated that the active usage of ETH in the DeFi space could harm ETH 2.0 and staking.

ETH 2.0 is a major network upgrade that would bring Ethereum closer to a shift to a proof-of-stake PoS) consensus algorithm. It would allow users to stake their ETH to participate in the network and receive rewards.

Since ETH 2.0 requires users to hold onto their ETH, skeptics said the massive spike in user activity in DeFi could cause problems for ETH 2.0.

But, a management consultant known as “aftab.eth” said it is a nonissue. He explained:

“People panicking that DeFi use of $ETH is going to kill eth2 staking are missing the point. Staking rewards could be raised to whatever is needed to incentivize participation. The fact there’s so much demand for the productive use of ETH is actually VERY bullish for PoS.”

Zhu, who leads the Singapore-based investment firm Three Arrows Capital, echoed a similar sentiment. He stated:

“Agree with this. Also the fact that shittons of ETH is getting withdrawn from exchanges and being used onchain in DeFi raises average user proficiency levels immensely, which is bullish for decentralization of staking. The idea that everyone will stake on exchanges because ease is stale.”

Heading into 2021, the sentiment around Ethereum seemingly remains optimistic. The price of ETH is at a two-year high, daily transactions are approaching early 2018 levels, and the DeFi market is rapidly evolving.

What’s next for Ethereum?

There are two key catalysts buoying the momentum of Ethereum: ETH 2.0 and DeFi.

In the short to medium term, the two factors would remain as persistent catalysts for Ethereum.

Atop the fundamental strengths of the ongoing Ethereum rally, declining exchange reserves and increasing buying demand on major exchanges indicate growing momentum.

Ethereum Market Data

At the time of press 5:04 am UTC on Sep. 2, 2020, Ethereum is ranked #2 by market cap and the price is up 6.6% over the past 24 hours. Ethereum has a market capitalization of $52.93 billion with a 24-hour trading volume of $19.37 billion. Learn more about Ethereum ›

Crypto Market Summary

At the time of press 5:04 am UTC on Sep. 2, 2020, the total crypto market is valued at at $387.29 billion with a 24-hour volume of $132.27 billion. Bitcoin dominance is currently at 56.60%. Learn more about the crypto market ›