Economic turbulence in 2020 sparks boom in crypto-based CeFi lending

Economic turbulence in 2020 sparks boom in crypto-based CeFi lending Economic turbulence in 2020 sparks boom in crypto-based CeFi lending

Photo by Julian Dufort on Unsplash

Crypto-based centralized finance (CeFi) platforms appear to be the beneficiary of the economic events seen throughout the past fiscal quarter.

According to a recent quarterly update, popular CeFi platform BlockFi saw a 100 percent revenue surge in Q2 2020, signaling that users are increasingly turning away from traditional avenues to fulfill their financial needs.

The rise of CeFi has also coincided closely with the ongoing decentralized finance (DeFi) boom that the crypto markets have witnessed in recent times.

The growth trends seen by these two sectors do point to a shift in the financial landscape, possibly induced by a growing mistrust in institutions.

Crypto lending platform BlockFi sees 100% surge in Q2 revenue

BlockFi – a popular lending platform – posted in their quarterly update that they saw a meteoric 100% surge in quarterly revenue over the past few months.

This increase has been driven by an influx of new users to the platform. According to the post, during the week of Bitcoin’s mining rewards halving event, a total of 7,000 newly funded accounts were opened.

Over the next year, the crypto lending platform forecasts that it will generate a total of $50 million in revenue.

While speaking about this growth, BlockFi CEO and co-founder, Zac Prince, explained that this marks a paradigm shift in which digital finance is outpacing traditional finance.

“The crypto financial services space is maturing and we can see a clear turning point today where traditional finance is being outpaced by digital.”

Their growth has also been fueled by the recent release of their mobile app, as well as the onboarding of several strategic partners, including Three Arrows Capital and Poolin.

In the months ahead, BlockFi plans to enlist more institutional lenders and expand its presence outside of the US.

DeFi grows in tandem with CeFi

There is a long-held debate within the crypto industry regarding the merits of CeFi versus DeFi.

Data does show that the two sectors appear to be growing in tandem.

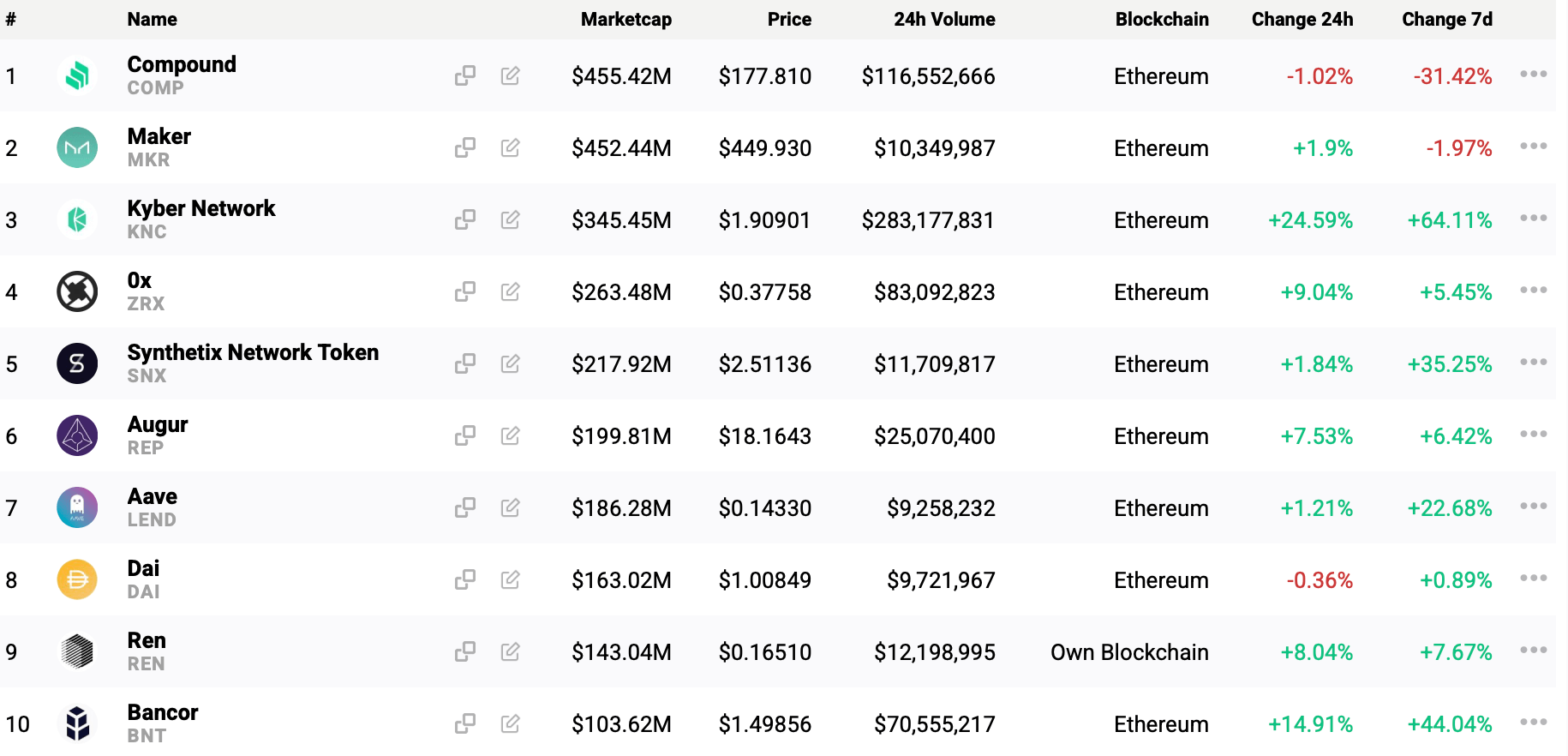

According to proprietary data from CryptoSlate, the crypto assets within the DeFi sector now have an aggregated market cap of $3.17 billion. Over the past seven days, many of these tokens are trading up over 20 percent.

This growth has stemmed from the increasing utilization of many decentralized lending protocols like Compound, Maker, and others.

It does appear that recent global events – which have rattled the economy and caused unprecedented unemployment – accelerated the pace at which individuals are turning away from traditional finance and towards a bourgeoning crypto-based financial ecosystem.

Elon Musk

Elon Musk