CryptoSlate Daily wMarket Update – Nov. 29: Bitcoin briefly trades above $17K as market rally continues

CryptoSlate Daily wMarket Update – Nov. 29: Bitcoin briefly trades above $17K as market rally continues CryptoSlate Daily wMarket Update – Nov. 29: Bitcoin briefly trades above $17K as market rally continues

The wMarket Update condenses the most important price movements in the crypto markets over the reporting period, published 07:45 ET on weekdays.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

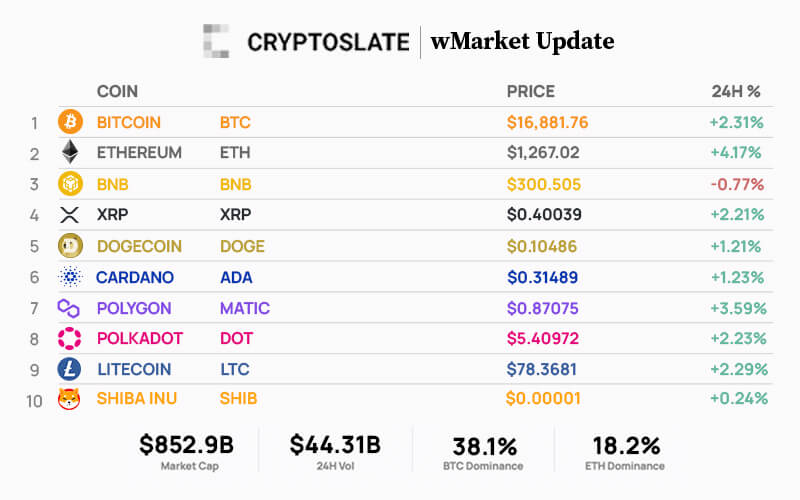

The cryptocurrency market cap saw net inflows of $15.72 billion over the last 24 hours and currently stands at $852.9 billion from $837.18 billion — up 1.89% over the reporting period.

Bitcoin and Ethereum’s market cap increased by 2.32% and 4.17% to $324.54 billion and $155.13 billion, respectively.

All top 10 cryptocurrencies posted gains over the reporting period except for Binance Coin (BNB), which recorded a loss of 0.77%. BTC and ETH gained 2.31% and 4.17%, respectively.

Over the reporting period, USD Coin’s (USDC) and BinanceUSD’s (BUSD) market cap decreased to $43.28 billion and $22.17 billion, respectively. Meanwhile, Tether’s (USDT) market cap slightly increased to $65.35 billion.

Bitcoin

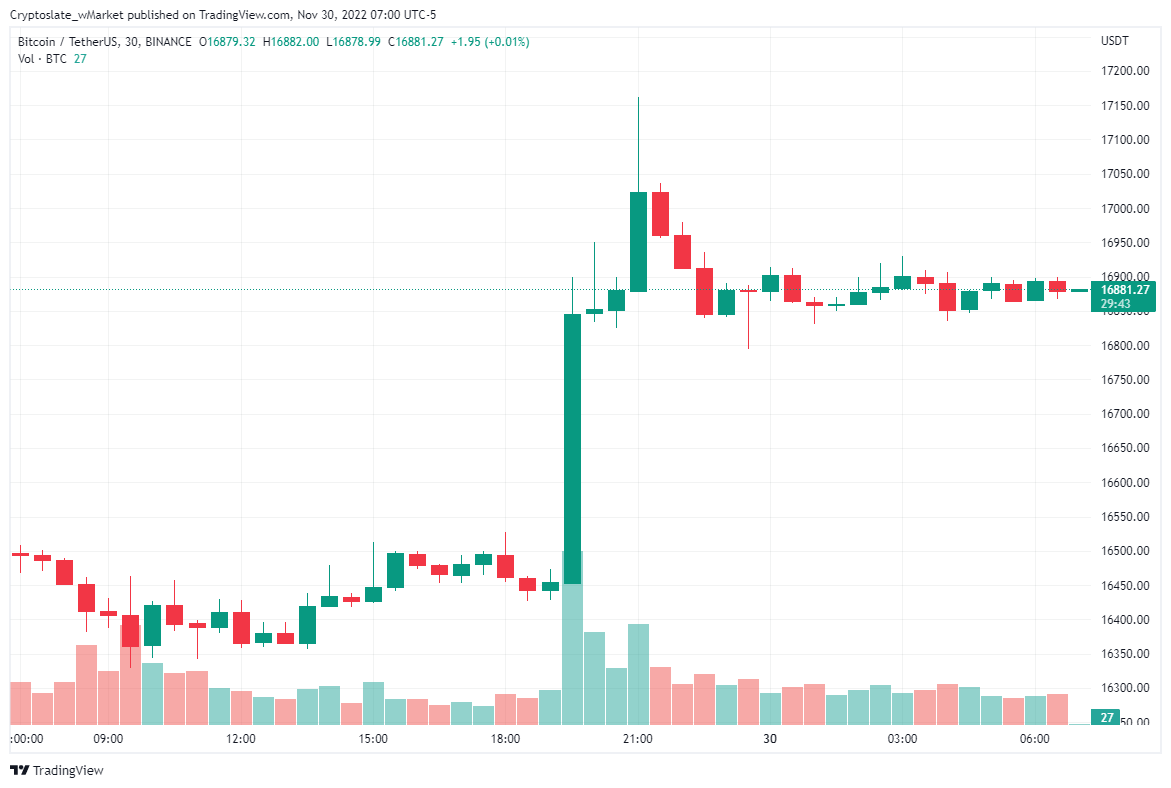

Over the reporting period, Bitcoin gained 2.31% to trade at $16,881 as of 07:00 ET. Its market dominance increased to 38.1% from 37.9% over the reporting period.

During the last 24 hours, Bitcoin briefly traded above $17,000 around 21:00 UTC before retracing to its current levels. The flagship digital asset bottomed at around $16,366.

Ethereum

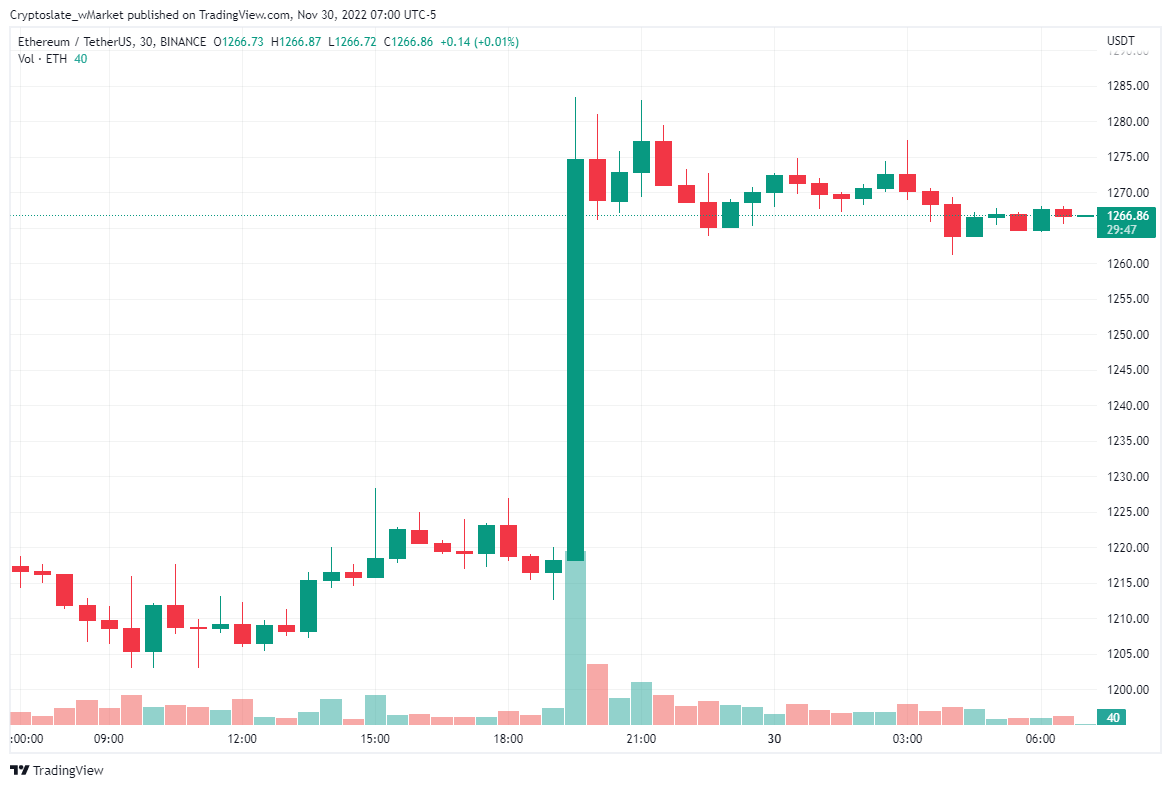

ETH posted 4.17% gains over the last 24 hours to trade at $1,267 as of 07:00 ET. As a result, its market dominance increased to 18.2 from 17.8% over the reporting period.

Ethereum’s price action mostly mirrored Bitcoin. ETH printed a giant green candle around 19:00 UTC, pushing its value to as high as $1,276 before retracing to its current level.

Top 5 Gainers

Icon

ICX is the day’s biggest gainer, growing by 23.7% over the last 24 hours to $0.209 as of press time. The token has grown by over 24% in the last seven days. Its market cap stood at $192.38 million.

Symbol

XYM grew 15.67% over the reporting period to $0.036. Its market cap stood at $202.88 million.

Kyber Network

KNC saw 15.08% gains in the last 24 hours to trade at $0.72 as of press time. The DeFi token has grown by 20.92% over the last seven days. Its market cap stood at $118.39 million.

Fantom

FTM is one of the day’s biggest gainers. The layer1 blockchain network native token increased by 12.53% in the last 24 hours to $0.24 as of press time. Its market cap stood at $617.05 million

Telcoin

TEL is on the top gainer’s list for the second consecutive day. It rose by 11.22% over the reporting period to $0.0029. Its market cap stood at $189.59 million.

Top 5 Losers

HI

HI is the day’s biggest loser, shedding 6.77% of its value to trade at $0.03080 as of press time. The Ethereum-based token has been on a downward trend in the past 30 days, losing over 37% of its value. Its market cap stood at $89.27 million.

Ren

REN lost 5.92% of its value over the reporting period to trade at $0.10479 as of press time. Its market cap stood at $104.68 million.

Hashflow

HFT lost the gain’s it made on Nov. 28. The DEX token fell 5.46% in the last 24 hours to $0.54. Its market cap stood at $88.69 million.

Secret

SCRT plunged by 3.95% to $0.79. The privacy-focused token had seen over 14% gains in the last seven days. Its market cap stood at $129.62 million.

Link

LN is among the day’s biggest losers for the second consecutive day. The token decreased by 3.8% in the last 24 hours to $23.43. Its market cap stood at $146.51 million.