Crypto funds break 11-week hot streak of inflows with $16M net outflows, amid record $3.6B traded

Crypto funds break 11-week hot streak of inflows with $16M net outflows, amid record $3.6B traded Crypto funds break 11-week hot streak of inflows with $16M net outflows, amid record $3.6B traded

CoinShares reports minor outflows in cryptocurrency funds overshadowed by persistent high trading volumes and equity investments.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

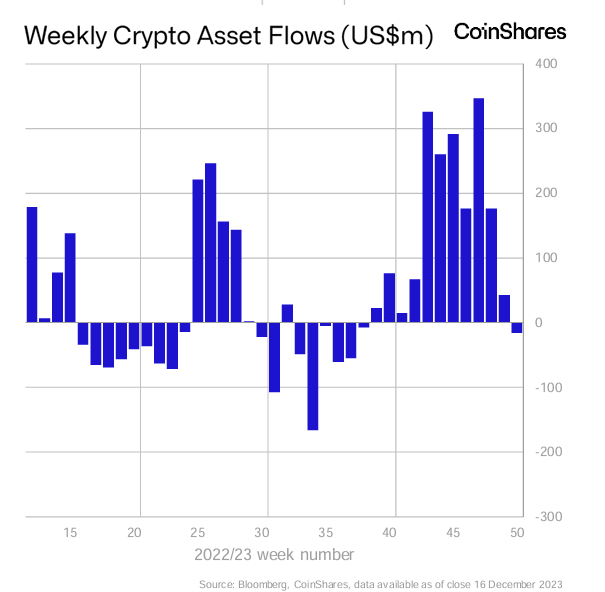

Following 11 weeks of consistent inflows into digital asset investment products, outflows totaling $16 million showcased a slight reversal in the market.

The latest CoinShares report highlights this subtle shift in the investment landscape of digital assets. The overall trading activity for the week stood at $3.6 billion, significantly higher than the year-to-date average of $1.6 billion. Despite the recent outflow, this robust trading volume spotlights a continued interest in the market.

Even in the face of a seemingly imminent spot Bitcoin ETF approval, proxy Bitcoin investments in the form of blockchain equities continued to garner positive investor sentiment. These equities saw substantial inflows totaling $122 million last week. CoinShares reports that this influx brings the total for the previous nine weeks to $294 million, marking the most significant such run on record. This robust interest in blockchain equities highlights the growing recognition of the long-term potential of blockchain technology beyond the immediate fluctuations in the crypto market.

Bitcoin was the most affected, witnessing outflows of $33 million. Even short-bitcoin positions, typically a hedge against Bitcoin’s value, saw minor outflows totaling US$0.3 million.

Contrasting with the general outflow trend, altcoins emerged as a bright spot, registering inflows of $21 million. Solana stood out with $10.6 million of inflows, far outpacing any other project. Cardano, XRP, and Chainlink followed this positive move, which collectively attracted inflows of $3 million, $2.7 million, and $2 million, respectively.

A closer look at the geographical distribution of these flows reveals a more complex picture. In the United States, outflows were most pronounced, reaching $18 million. Sweden and Germany similarly experienced outflows, albeit on a smaller scale, totaling $4 million and $10 million, respectively.

However, this trend was not universal across regions. Canada ($6.9 million) and Switzerland ($9.1 million) saw continued inflows, with Brazil at $3.5 million. CoinShares attributes this mixed pattern across different regions to profit-taking activities rather than a fundamental shift in investor sentiment toward digital assets.

Overall, the recent movements in digital asset investment reflect a diverse and dynamic market. While there are signs of cautious profit-taking, the continued high trading volumes and selective inflows into certain assets and regions indicate underlying confidence in the long-term prospects of the digital asset sector.

The full report from CoinShares is available on its website, which is released weekly on a Monday.