Crypto.com becomes latest bank run victim, but CEO says it is business as usual

Crypto.com becomes latest bank run victim, but CEO says it is business as usual Crypto.com becomes latest bank run victim, but CEO says it is business as usual

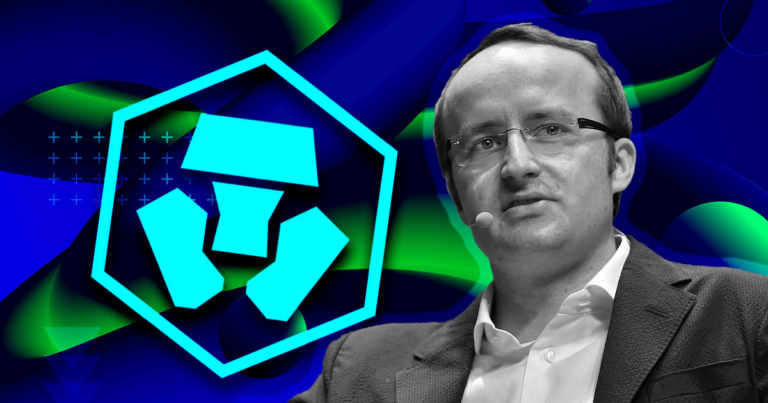

Kris Marszalek dismisses talk Crypto.com is insolvent, saying we operate a different, more prudent business model to FTX.

RISE / Flickr / CC BY 2.0. Remixed by CryptoSlate

Crypto.com CEO Kris Marszalek held an AMA on Nov. 14, addressing concerns about marketwide insolvency pressures. He said the platform is operating as usual, only at a heightened level under the current market situation.

Concerns grow over Crypto.com

On Nov. 11, Marszalek made a partial disclosure of the company’s reserves in a bid to quell insolvency rumors. However, questions remain on the efficacy of Proof of Reserves in general. Namely, assets held at a snapshot in time do not give a holistic view of balance sheet health.

On Nov. 12, it emerged Crypto.com had sent a 320,000 ETH transfer of funds to Gate.io, with 285,000 ETH later returned. Some say the purpose of the transfer was to assist Gate.io fake its Proof of Reserves by bolstering its balances sheet assets.

Marszalek later said the transfer to Gate.io was made accidentally and should have gone to a new cold wallet storage address. Addressing the shortfall in return of funds, he said the difference has now been sent back, and “we have single digit USD million balance on Gate as of now.”

“New process and features were implemented to prevent this from reoccurring.“

Responding to the accusations of accounting impropriety, Gate.io said the transfer occurred weeks before its Proof of Reserves snapshot and was not included as a result.

Clarifications on @cryptocom's transfer for the sake of transparency & education:

1) Snapshot for PoR audit taken on Oct 19. https://t.co/a4NJTN8Brj's deposit was not included https://t.co/5U5tZWFfBF

2) All 320K ETH were returned https://t.co/7G5l3YLLIhhttps://t.co/IvyiBu9aBY— Gate.io (@gate_io) November 13, 2022

However, taking into account the collapse of FTX, trust in centralized platforms is at a low, and speculation of foul play is running rampant on social media. In response, users cashed out of CRO and/or moved funds off the platform, triggering a “bank run.”

Some reported long delays for withdrawals to be honored, driving speculation that the platform is insolvent. However, Marszalek denied these reports, saying difficulties in withdrawing relate to specific tokens for reasons indirectly related to Crypto.com’s situation.

This is false. Withdrawals are working as usual, other than SRM and RAY (FTX tokens) and Gala (security incident from last week).

— Kris | Crypto.com (@kris) November 13, 2022

The CRO token faced a weekend of heavy sell pressure, hitting a local bottom of $0.0569 in the early hours of November 14 (UTC). This represents a 93% drawdown from its all-time high of $0.965 on November 24, 2021.

It is business as usual says Marszalek

Opening the AMA, Marszalek played down rumors of insolvency, saying the Crypto.com platform is operating as expected and users can deposit, withdraw, and trade.

“Most importantly, consider our platform is performing like its business as usual. People are depositing, withdrawing, people are trading. There is pretty much normal activity, just that at a heightened level.”

Further, Marszalek said Crypto.com is the most regulated crypto company in the industry, holding the most licenses and registrations from “tier 1” jurisdictions, including the U.S., Europe, Singapore, and the U.K.

Pointing out the differences between Crypto.com and FTX, the former operates a business model based on access to cryptocurrencies with profits reinvested to build a “compliant, secure infrastructure,” said Marszalek.

“These are businesses in the same industry, but we operate completely differently. We’ve got more than 70 million people on our platform globally who have downloaded our app. Our business model is very simple, we provide access to the masses to digital assets, and we take a fee for it.”

Marszalek stated that the company does not engage in irresponsible lending practices or third-party risks, adding, “we do not run a hedge fund; we do not trade customers’ assets.”

Audited proof of 1-to-1 reserves will soon verify the platform is solvent, added Marszalek.