Coinbase Singapore now requires counterparty’s personal information to process transactions

Coinbase Singapore now requires counterparty’s personal information to process transactions Coinbase Singapore now requires counterparty’s personal information to process transactions

Coinbase warned that it might fail to process a user's crypto transactions if they fail to provide the required information.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Coinbase Singapore users must provide additional counterparty information when initiating cryptocurrency deposits or withdrawals from their accounts starting Sept. 5.

The exchange said it introduced these measures in compliance with the Monetary Authority of Singapore (MAS) regulations on anti-money laundering and countering the financing of terrorism.

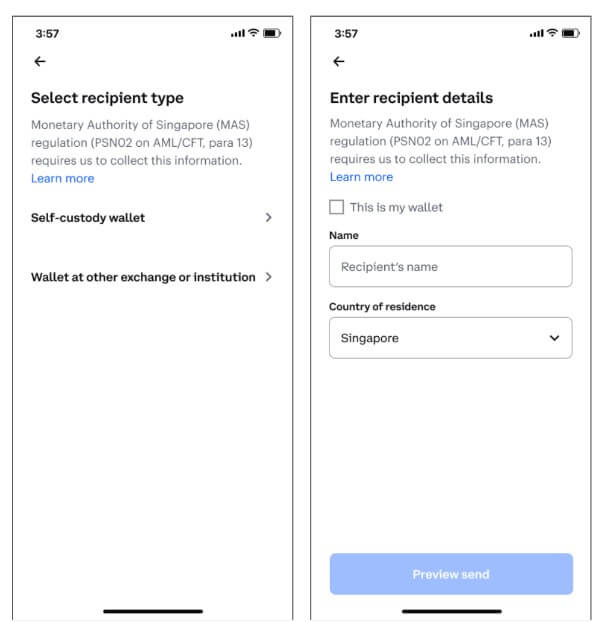

According to its website, Coinbase Singapore users are required to provide the following information when sending digital assets out of their wallets:

- Recipient’s wallet type

- Recipient’s exchange name (if the transaction is not to a self-custody wallet)

- Recipient’s full name

- Recipient’s country of residence

On the other hand, when receiving a crypto deposit from outside its platform, the exchange requires users to provide information about the sender, including full name and country of residence.

Per an emailed statement to its users seen by CryptoSlate, the exchange said it might fail to process a user’s crypto transactions if they fail to provide the required counterparty information. However, Coinbase’s website clarified that:

“This only affects users in Singapore who are sending crypto from their Coinbase exchange balance to a wallet off the Coinbase platform, or from a wallet off the Coinbase platform to their Coinbase exchange account.”

Last year, the MAS introduced measures mandating digital asset service providers to collect their users’ personal information for transactions performed on their platforms. The measure was designed to curb the use of cryptocurrencies for money laundering and other illegal activities.