Cardano (ADA) trading volume craters as on-chain data points to weakness

Cardano (ADA) trading volume craters as on-chain data points to weakness Cardano (ADA) trading volume craters as on-chain data points to weakness

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Cardano (ADA) has seen some intense gains over the past few months, with its recovery from its March lows far outpacing that seen by both Bitcoin and most of its other peers.

This upwards momentum has shown some signs of stalling as of late, however, as the cryptocurrency has not been able to break above a key resistance level that halted its rally in late-May.

Investors now appear to be showing some signs of losing interest in the cryptocurrency, with its trading volume cratering over the past several days and weeks.

This comes as on-chain indicators also flash some warning signs for what could come next.

One such warning sign would be the massive decline seen in the number of active ADA wallet addresses. This metric is pointing to severe underlying weakness amongst the digital asset’s buyers.

Cardano trading volume see sharp decline as price enters consolidation phase

Cardano’s price rallied to highs of nearly $0.09 earlier this month before facing some intense resistance.

From this point, it declined to lows of $0.07 before entering a consolidation channel. At the present moment, ADA is trading up over 2% at its current price of $0.08, marking a slight outperformance of Bitcoin.

The uptrend Cardano has seen over the past several months has been intense, leading it up from yearly lows of roughly $0.02.

This climb was driven by a massive influx of volume from traders, but it is now showing signs of faltering.

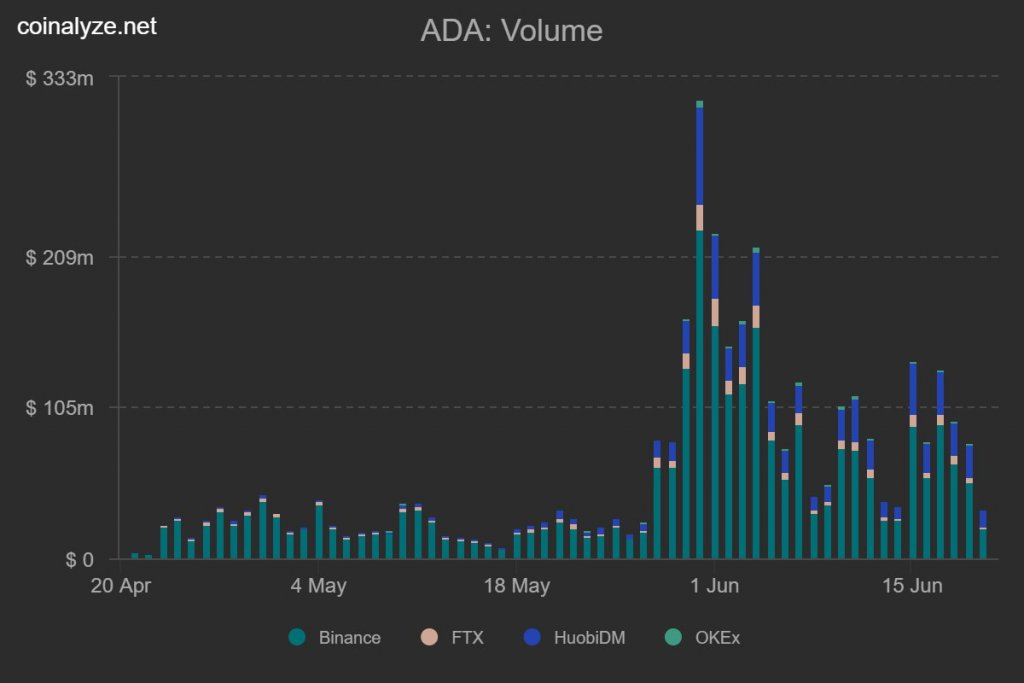

According to data from analytics platform Coinalyze, trading volume for ADA futures and options across Binance, FTX, HuobiDM, and OKEx have all cratered over the past few weeks.

This trend is clearly elucidated while looking towards the below chart:

ADA active address data seems to paint a grim picture for its underlying strength

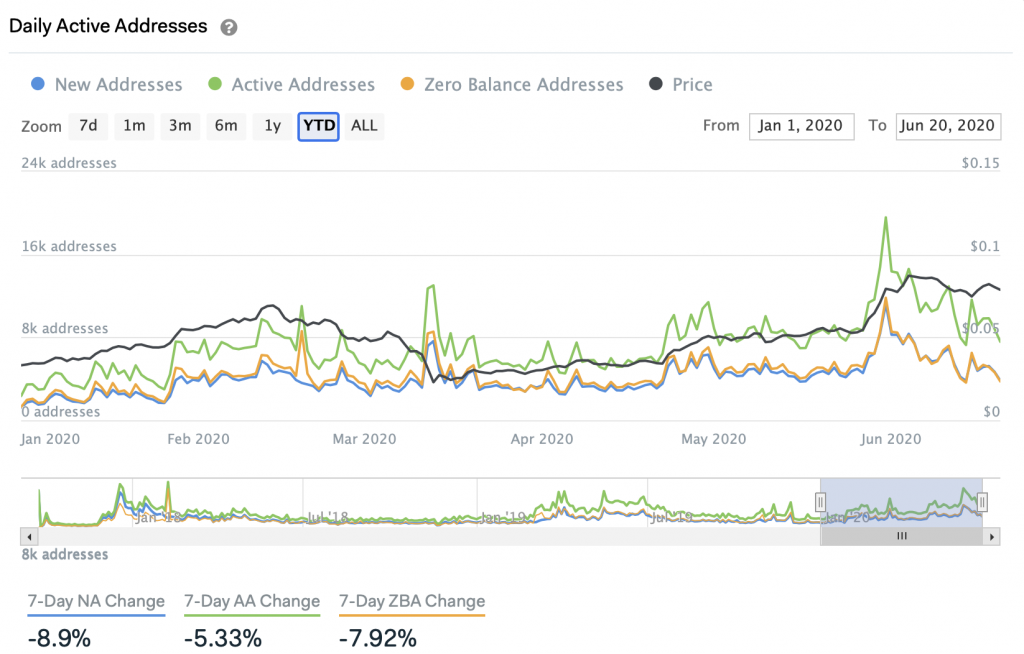

In tandem with this declining volume, Cardano’s number of active wallet addresses has also plunged.

According to data from blockchain analytics platform IntoTheBlock, the number of active ADA addresses reached a local peak on May 31st, hitting a high of 19,580.

This number has been declining ever since, and just hit 7,570 today.

Other metrics of its on-chain strength have declined as well, including the number of new addresses and the cryptocurrency’s large transaction volume.

All of this points to a notable slowdown in the cryptocurrency’s uptrend.

Unless Bitcoin exits its current trading range and proceeds to climb higher, it does not appear that Cardano’s buyers have enough underlying strength to further extend its momentum independent of the rest of the market.

Cardano Market Data

At the time of press 5:40 am UTC on Jun. 22, 2020, Cardano is ranked #11 by market cap and the price is up 0.57% over the past 24 hours. Cardano has a market capitalization of $2.08 billion with a 24-hour trading volume of $159.55 million. Learn more about Cardano ›

Crypto Market Summary

At the time of press 5:40 am UTC on Jun. 22, 2020, the total crypto market is valued at at $267.16 billion with a 24-hour volume of $55.8 billion. Bitcoin dominance is currently at 64.67%. Learn more about the crypto market ›