Bloomberg: Ethereum, XRP et al. likely to remain below June 2019 Peak until BTC hits $20k

Bloomberg: Ethereum, XRP et al. likely to remain below June 2019 Peak until BTC hits $20k Bloomberg: Ethereum, XRP et al. likely to remain below June 2019 Peak until BTC hits $20k

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

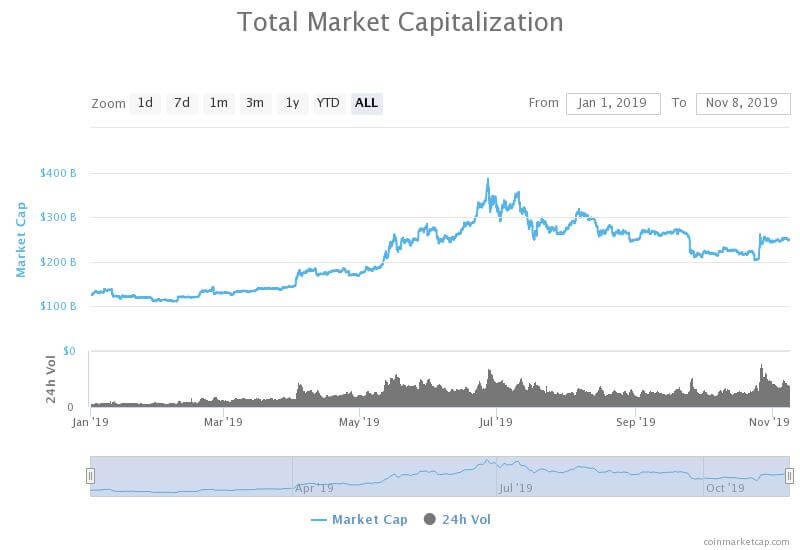

Researchers behind a monthly cryptocurrency report entitled “Bloomberg Crypto Outlook” said that Ethereum, XRP, and other digital assets included in BGCI are unlikely to recover to June 2019 levels until Bitcoin achieves a record high, Three Arrows Capital CEO Su Zhu observed on Twitter.

Bloomberg's monthly crypto market columnist is bullish BTCUSD and BTC.D pic.twitter.com/rdNp4Dmnvr

— Su Zhu (@zhusu) November 7, 2019

The Bloomberg report read:

“We think Bitcoin would need to revisit all-time highs for the BGCI to extend above its June apex… We expect the broader market, as measured by the Bloomberg Galaxy Crypto Index, to have little chance of further advancement absent a higher Bitcoin price.”

BGCI mentioned in the report, short for Bloomberg Galaxy Crypto Index, include Bitcoin, Ethereum, Monero, XRP, and Zcash, primarily measuring the performance of major alternative cryptocurrencies traded in USD.

Bitcoin expected to range for awhile

Currently, technical analysts generally remain cautiously optimistic towards the short term trend of bitcoin and the rest of the cryptocurrency market.

Throughout the past two weeks, since bitcoin’s abrupt increase to $10,600 on October 26, the Bitcoin price has been ranging in between $9,100 to $9,500, unable to break out or below key resistance or support levels.

Cryptocurrency trader Josh Rager said:

“Funding rate had a major increase overnight, meaning traders are going long & it certainly makes me cautious to be on the side w/ the majority I still lean bullish w/ being over $9200 but certainly do not count out a strong move to the downside even w/ the gap being ‘filled.’”

As Bitcoin ranges and sell pressure builds based on increasing sell limit orders across major exchanges, the dominant cryptocurrency is expected to continue to consolidate or break down below, creating a difficult environment for alternative cryptocurrencies like Ethereum and XRP.

Bloomberg researchers said:

“Our primary on-chain indicators—transactions and active addresses from Coinmetrics—point to an upwardly biased market stuck within a range.”

What’s behind the gloomy sentiment around alternative cryptocurrencies like Ethereum and XRP?

Ethereum and XRP have shown strong fundamentals as of late with the usage of the Ethereum network on the rise as a result of the increasing popularity of decentralized finance (DeFi) and the sentiment around XRP have improved with the anticipation of the Swell conference.

However, during times of uncertainty, investors tend to move away from alternative cryptocurrencies to more stable options like Tether and Bitcoin, which could make it more challenging for Ethereum, XRP, and other alternative cryptocurrencies to reach June levels.

In June 2019, when the Bitcoin price peaked at $14,000, Ethereum price was hovering at $310 and XRP was at around $0.43.

With alternative cryptocurrencies continuing to slump despite being down by 80 to 90 percent from their record highs, a further leg down by bitcoin to the low $8,000 could result in a deeper pullback for Ethereum and XRP.