Bitcoin whale activity suggests July could be a great month for BTC

Bitcoin whale activity suggests July could be a great month for BTC Bitcoin whale activity suggests July could be a great month for BTC

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Data regarding activity surrounding Bitcoin miners offers investors significant insight into the benchmark cryptocurrency’s market conditions.

It now appears that massive miner outflows suggest that Bitcoin is positioned to see some turbulence in the near-term, as it just witnessed the second largest miner outflow since seen since it last hit $10,000.

Despite this being a potentially bearish near-term signal, it does appear that Bitcoin’s mid-term outlook remains bright due to one trend amongst the cryptocurrency’s so-called “whales.”

If history repeats itself, the cryptocurrency could be well-positioned to see significantly further upside in the coming month.

Bitcoin sees massive miner outflows; Analysts expect volatility

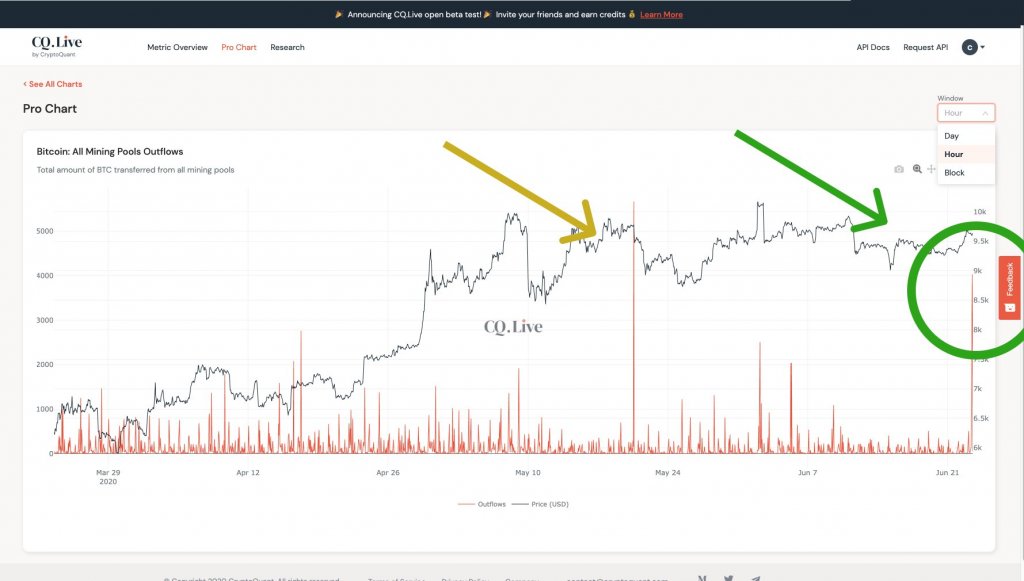

Overnight, Bitcoin miners began shifting a significant amount of their holdings out of non-exchange wallets.

Typically, outflows spike just before the crypto sees a massive selloff due to this suggesting that they are about to sell their mined BTC on the open market.

Cryptocurrency analyst Cole Garner spoke about the outflows seen last night, explaining that they were the second largest it has seen since it last touched $10,000.

He concludes that this will cause a “whole lot of selling” in the near-term.

“Big spike in miner’s outflows overnight. Second biggest since Bitcoin hit $10k. I’m expecting a whole lot of selling, starting real soon.”

This has yet to place any pressure on Bitcoin, as it is currently trading down marginally at its current price of $9,620.

One reason why this may not impact its price action in the near-term is that the crypto may have been sold through an over the counter (OTC) deal. Despite this being less bearish than it being moved to an exchange, Garner notes that it still isn’t a good sign.

“This is probably an OTC deal, since the flows don’t appear to be going to an exchange. I’d be more concerned if they were going to an exchange – still, miners moving a lot of coins is never a good sign.”

Historical data regarding whale activity suggests July will be a great month for BTC

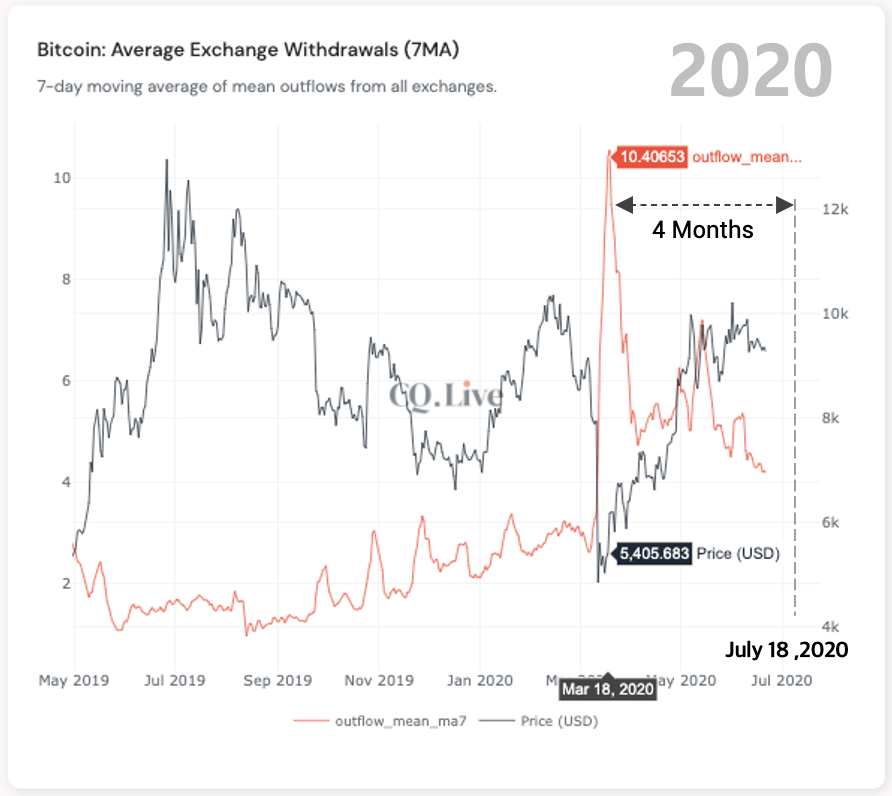

Regardless of Bitcoin potentially being positioned to see some near-term weakness, it is important to note that historic data regarding activity amongst the crypto’s “whales” seems to suggest that its next bull market could start in July.

Ki Young Ju, the CEO of analytics platform CryptoQuant, explained that exchange withdraws seen by some of BTC’s largest whales seems to paint a bullish picture for the cryptocurrency.

He specifically notes that bull markets historically tend to kick off four months after exchange withdraws hit one-year highs. This means the benchmark digital asset’s next bull run could start in mid-July.

“Buy BTC when whales send bitcoins out of the exchange. The BULL market usually starts four months after the exchange average withdrawal hits year-high… According to the latest data, the BTC bull market is likely to start in mid-July.”

How Bitcoin trends in the weeks ahead should provide valuable insight into the state of the cryptocurrency’s mid-term trend.