Bitcoin breaks out of crucial 4-day range: what happens next?

Bitcoin breaks out of crucial 4-day range: what happens next? Bitcoin breaks out of crucial 4-day range: what happens next?

Photo by Pero Kalimero on Unsplash

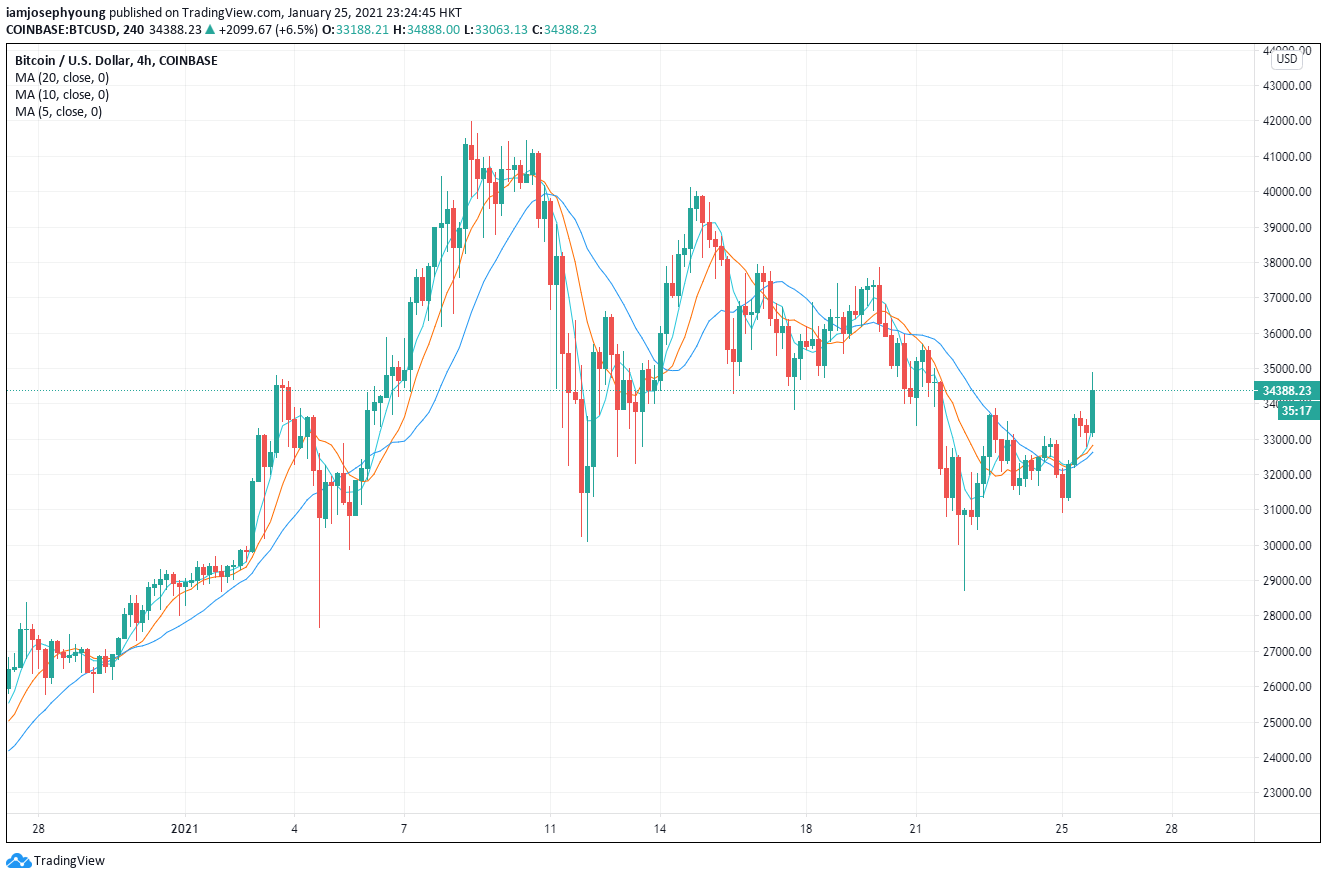

The price of Bitcoin broke out of its 4-day range, pushing above a critical technical resistance level at $33,800. This upside movement is important because it sets BTC up for a potential retest of the $40,000 resistance area.

$37,800 is the big roadblock before $40,000 for Bitcoin

Technically, Bitcoin has to cleanly break through the $37,800 level to potentially rally towards the $40,000 to $42,000 range once again.

Bitcoin has consolidated for a much longer period than many expected. But, if the momentum of BTC picks up again, the long consolidation period could allow the BTC rally to gain steam.

Atop the favorable technical structure, various macro and fundamental factors could further buoy the momentum of BTC in the foreseeable future.

For instance, Rafael Schultze-Kraft, the CTO at Glassnode, said that around $70 billion worth of capital flew into Bitcoin in the past 30 days. The monthly capital inflow is bigger than the market cap of Bitcoin in September 2017. He wrote:

“The total amount of capital inflows into #Bitcoin in the past 30 days (as estimated by realized cap), is as high as the whole $BTC market cap in Sept 2017 and early 2019: ~$70 billion USD.”

The consistently high capital inflow into Bitcoin is critical to sustaining the upward momentum of BTC.

In previous bull trends, like the rally of BTC to $14,000 in 2019, rallies were primarily driven by the overleveraged futures market.

While this allowed Bitcoin to rally quickly in a short period of time, it made BTC vulnerable to extreme corrections.

The overleveraged nature of the Bitcoin market was one of the main reasons why it dropped to sub-$4,000 on March 12, in the infamous crash.

The high-net-worth and institutional investor-driven rally makes the current BTC uptrend more stable, which is why BTC has not seen 35% to 40% corrections in recent months, unlike in previous cycles.

Tyler Winklevoss, the CEO at Gemini and the billionaire cryptocurrency investor, said that he has spoken to a large number of hedge fund managers about Bitcoin than ever before.

The combination of favorable macro statistics and the genuine increase in appetite for Bitcoin from institutions put BTC in a prime position for a recovery rally. Winklevoss said:

“The amount of hedge fund managers and investors that I’ve been talking to lately about #Bitcoin has never been greater. Even the most conservative of them are worried about the future of the US dollar. They all want to learn how to stack sats to protect their funds and themselves.”

What’s next?

In the near term, there are four key resistance levels: $36,630, $37,800, $40,000, $42,000.

The price of BTC is most likely to retest $36,630 in the foreseeable future and then move towards $37,800. The latter level is a bigger resistance area, so BTC could face a sell-off at that level, as it remains the last roadblock towards the previous high.

Bitcoin Market Data

At the time of press 1:06 am UTC on Jan. 26, 2021, Bitcoin is ranked #1 by market cap and the price is up 0.79% over the past 24 hours. Bitcoin has a market capitalization of $605.72 billion with a 24-hour trading volume of $59.19 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 1:06 am UTC on Jan. 26, 2021, the total crypto market is valued at at $962.33 billion with a 24-hour volume of $131.49 billion. Bitcoin dominance is currently at 62.81%. Learn more about the crypto market ›