Binance dominance fell to 44% last year amid mounting regulatory and legal woes

Binance dominance fell to 44% last year amid mounting regulatory and legal woes Binance dominance fell to 44% last year amid mounting regulatory and legal woes

Binance faced substantial regulatory issues from authorities in the U.S. and Europe.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

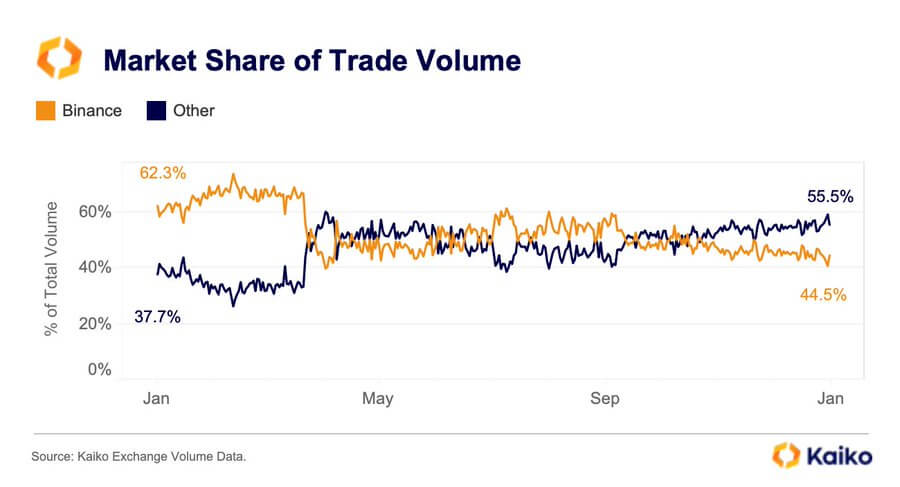

Crypto exchange Binance’s market share experienced a significant decline last year to 44.5%, according to data from Paris-based crypto intelligence platform Kaiko.

This decline follows a three-year upward trend, where Binance’s market share surged from 22% in 2020 to peak at 60% in 2022. However, the subsequent regulatory hurdles across several jurisdictions contributed to the downturn of its market share during the past year.

Binance regulatory issues

Due to regulatory non-compliance issues in 2023, Binance withdrew from Canada, the United Kingdom, and various European countries, including Austria, Cyprus, the Netherlands, and others.

However, the primary catalyst for its market share decline stems from the regulatory problems it encountered in the United States, where federal agencies like the Commodities Futures Trading Commission (CFTC), the Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN), and the Office of Foreign Assets Control (OFAC), brought legal actions against it.

The Justice Department said Binance, the world’s largest crypto exchange, prioritized growth and profits over compliance with U.S. law and was charged accordingly.

The regulatory actions resulted in its CEO and co-founder Changpeng Zhao’s resignation and the agreement of a record $4.3 billion settlement with the authorities. Zhao is currently in the U.S., awaiting sentencing for his role at the crypto trading platform.

Despite this development, the U.S. Securities and Exchange Commission (SEC) remains a formidable challenge for Binance, with pending charges against the exchange and its U.S. affiliate. The regulator alleges that the firm was involved in listing unregistered securities, asset commingling, and market manipulation.

Additionally, the SEC classified Binance-related cryptocurrencies like BNB and the BUSD stablecoin as securities.

Notwithstanding the market share decline and regulatory battles, Binance attracted 40 million new users in 2023, increasing its user base to 170 million worldwide. The company also stated that it spent over $200 million to bolster its regulatory compliance efforts last year.