Beware of false narratives: stock-to-flow and halving not bullish for Bitcoin, claims report

Beware of false narratives: stock-to-flow and halving not bullish for Bitcoin, claims report Beware of false narratives: stock-to-flow and halving not bullish for Bitcoin, claims report

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

2020 has been a turbulent year for Bitcoin and the aggregated cryptocurrency market, with bulls having firm control over the benchmark digital asset throughout all of January and most of February, before losing their strength to sellers in March.

This heightened volatility has occurred against a backdrop of bearishness within the global economy, which – like Bitcoin – peaked in February before the lethal COVID-19 virus began rapidly spreading, leading many economies to reach a virtual standstill.

The pressure created by this pandemic has proven to be devastating for nearly all major global markets, with some benchmark stock indices seeing single-month losses in March of nearly the same size as those incurred during previous depressions.

The crypto market – despite previous narratives regarding them being independent from the global economy – plunged alongside everything else, with Bitcoin seeing an unprecedented decline from highs of $10,500 to lows of $3,800 in a matter of mere days.

Now, a new report from a Seattle-based crypto hedge fund explains that hope-inducing narratives currently surrounding Bitcoin may be largely underpinned by false assumptions, potentially causing significant damage to the markets once these narratives are invalidated.

Report suggests “halving” and “stock-to-flow” models may be false narratives

In a recently released report from the Seattle-based hedge fund Strix Leviathan, the group takes a critical approach to analyzing the merits of the bullish narratives currently circulating throughout the cryptocurrency community.

In the near-term, Bitcoin’s upcoming mining rewards “halving” event is widely anticipated to give the crypto reason to run, with many analysts pointing to the roughly 50 percent inflation reduction and subsequent miner capitulation as reasons why it may catalyze upwards momentum.

Strix Leviathan, however, notes that the halving being bullish hinges on the key assumption that miners have been selling all, or most, of their mined crypto on a monthly basis.

In reality, this may not be the case, as they explain that many mining operations still hold a significant amount of BTC, while tapping into collateralized loans in order to fund their operations.

“Reality – Not all miner rewards are sold. A meaningful amount of mined BTC is sitting on balance sheets as miners both speculate and utilize BTC-collateralized loans to run and expand operations. The impact of a supply-side cut on price is uncertain at best and minimal at worst.”

The halving isn’t the only hope-inducing narrative circulating within the crypto industry, as many investors are looking towards Bitcoin’s stock-to-flow (S2F) model as a reason why the benchmark crypto could be trading at close to $100,000 by the year’s end.

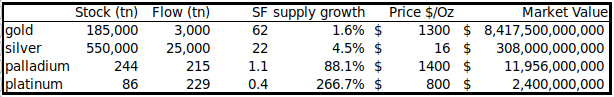

This economic model – popularized by Bitcoin commentator and analyst “PlanB” – quantifies Bitcoin’s scarcity by its stock/flow, which for BTC equates to being 1 / supply growth rate.

Strix Leviathan claims that in order for S2F to be bullish, one must assume that market participants are not actively predicting (or “pricing in”) the impacts of Bitcoin’s imminent supply reduction.

They note that contrary to this assumption, investors have been anticipating halving events from Bitcoin’s genesis in 2009, and data shows that there is little evidence to prove that this recurring event is the impetus for the crypto’s past parabolic price cycles.

“Reality – Bitcoin’s supply schedule is the major selling point by crypto-evangelists… Market participants have been anticipating this halving and all future halvings since 2009 when there was only one participant. Previous research Strix Leviathan conducted suggests that the impact of halving events are indiscernible from broader market sentiment.”

What does this all mean for Bitcoin?

Based on the above reasoning, it is a strong possibility that the price action seen throughout the rest of 2020 will negate all of the bullish narratives that are currently kindling hope within the crypto market.

The price action seen throughout February and March has already done damage to BTC from a fundamental standpoint, with its incredibly close correlation to the U.S. equities market fully negating the “digital gold” narrative that was previously pervasive within the industry.

It does seem as though the negation of these narratives in it of themselves can do damage to the cryptocurrency’s price, as traders who built positions based on optimistic expectations may exit the market following the negations of these narratives.

Despite this, some prominent Bitcoin thought leaders do believe that there is merit to simple economic models like S2F.

As previously reported by CryptoSlate, Adam Back – the CEO and co-founder of Blockstream – spoke about the stock-to-flow model in a tweet, noting that it seems to be based on logical assumptions.

“It’s just a back tested curve fit to historic data, affirmed by co-integration stats test. What’s not to believe? More interesting is interpreting why, given good fit. It does seem logical that rate of supply halving, other things being equal, would tend to drive up price.”

There’s no doubt that Bitcoin’s relative youth makes it incredibly hard to decipher and predict market movements based on historical precedent, but how the crypto’s price trends in the coming nine months should offer significant insight into the validity of these keenly watched narratives.

Bitcoin Market Data

At the time of press 9:27 am UTC on Apr. 25, 2020, Bitcoin is ranked #1 by market cap and the price is down 3.4% over the past 24 hours. Bitcoin has a market capitalization of $113.82 billion with a 24-hour trading volume of $33.56 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 9:27 am UTC on Apr. 25, 2020, the total crypto market is valued at at $175.63 billion with a 24-hour volume of $107.98 billion. Bitcoin dominance is currently at 64.78%. Learn more about the crypto market ›

Deribit

Deribit