Australian Bitcoin miner Iris sets 20 EH/s hash rate target as US mining falters

Australian Bitcoin miner Iris sets 20 EH/s hash rate target as US mining falters Australian Bitcoin miner Iris sets 20 EH/s hash rate target as US mining falters

The miner's ambitious hash rate goal would place it at the top spot in the Bitcoin mining industry.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

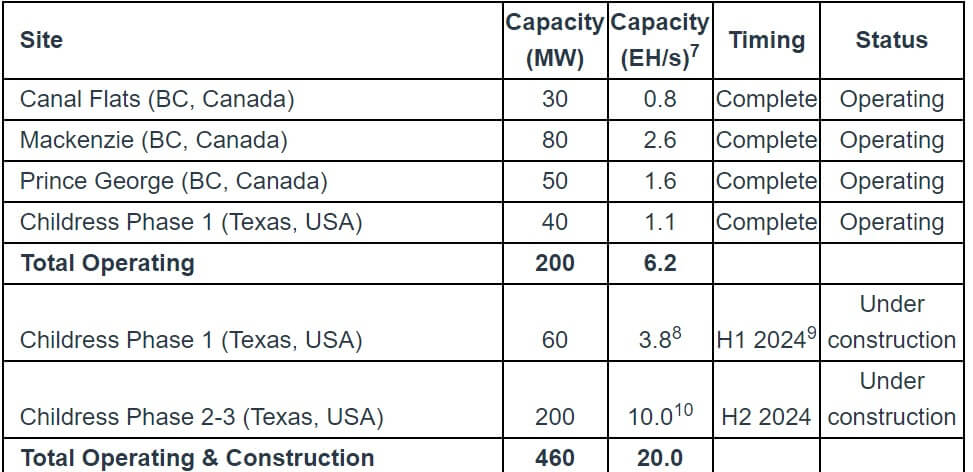

Australian Bitcoin mining company Iris Energy has outlined ambitious plans to ramp up its hash rate to 20 exahashes per second (EH/s) by the latter part of this year, as detailed in a Feb. 7 update.

To achieve this significant milestone, Iris agreed with Bitmain to secure 10 EH/s of new T21 miners at a fixed rate of $14/TH/s. This agreement encompasses 1 EH/s of immediate additional miner acquisitions and grants options for 9 EH/s of miner purchases exercisable in the latter part of the year.

Meanwhile, Iris needs to boost its operational capacity by a significant 222% to achieve its targeted hash rate, which would position it as a leading BTC mining entity in realized hash rate, surpassing competitors like RIot Platforms, Marathon Digital, and Core Scientific, as per data from theminermag.

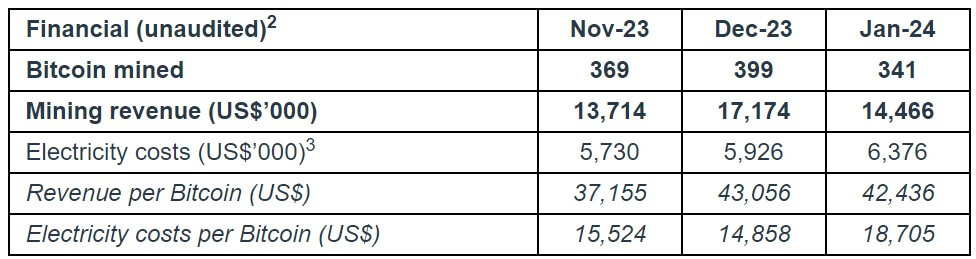

As of Feb. 6, Iris has already enhanced its operational capacity to 6.2 EH/s from 2.2 EH/s in Nov. 2023, boasting a mining efficiency of 24.8 joules per terahash (J/TH) throughout January.

Declined BTC production

Despite Iris’s ambitious goals for the year, the miner Bitcoin production dropped by 15% to 341 BTC in January. The decline in revenue was primarily due to reduced transaction fees on the network, higher electricity costs, and decreased market volatility at one of its mining centers.

“The increase in electricity costs per Bitcoin mined ($18.7k vs. $14.9k in December) was primarily attributable to lower network transaction fees as well as higher electricity prices and reduced market volatility at Childress,” Iris explained.

This downturn in Bitcoin production mirrors trends observed among other leading BTC miners based out of the United States.

Marathon Digital reported a substantial 42% month-over-month decrease in Bitcoin production, citing temporary disruptions such as weather-related issues and equipment failures leading to site outages. Consequently, it only mined 1,084 BTC in January, down from 1,853 BTC in December.

Riot Platforms also experienced a decline in monthly Bitcoin production, from 619 BTC in December 2023 to 520 BTC in January. CEO Jason Les attributed this decrease to the firm’s efforts to stabilize the grid by curtailing energy usage amidst heightened electricity demand following extreme cold weather in Texas.

Core Scientific, recently relisted on Nasdaq, recorded a drop in Bitcoin production in January. Despite an increase in its energized hash rate, the firm’s monthly production decreased from 1,177 BTC in December to 1,027 BTC in January, marking a notable decline despite its strong performance throughout 2023.