A top Bitcoin whale picked up 3,706 BTC amidst brutal dip, data shows

A top Bitcoin whale picked up 3,706 BTC amidst brutal dip, data shows A top Bitcoin whale picked up 3,706 BTC amidst brutal dip, data shows

BTC whales step up at a time when market uncertainty remains fearful.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

A top-four Bitcoin address added an additional 3,706 BTC today, paying a total of $1 in the process. This equates to an average token price of $32,941 per BTC.

Despite the ongoing market uncertainty triggered by Elon Musk’s energy FUD last month, data suggests, since late May, Bitcoin whales have started adding to their BTC holdings.

Top Bitcoin address continues stacking

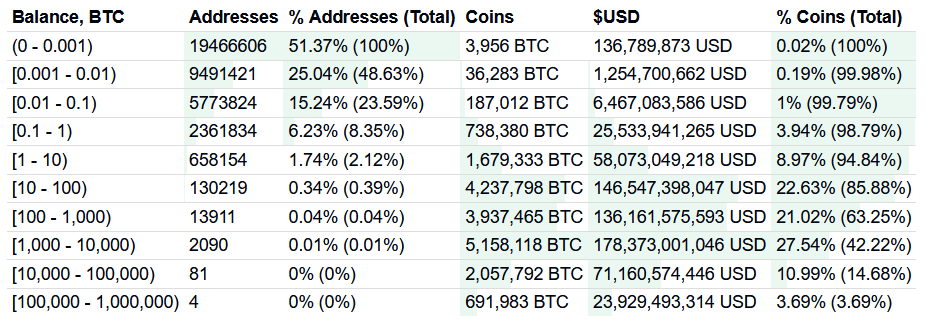

A Bitcoin whale is generally defined as an entity holding more than 1,000 BTC. Data shows just 2,175 addresses match this criterion. They account for 0.01% of all addresses but control 42% of all tokens.

However, the pseudo-anonymous nature of Bitcoin, and the fact that holders can split their tokens over many addresses, thus disguising their total holdings, makes it difficult to determine the actual number of whales in existence.

Nonetheless, this Bitcoin address (1P5ZEDWTKTFGxQjZphgWPQUpe554WKDfHQ) added a hefty 3,706 BTC to its balance today, bringing its total holdings to 112,594BTC ($3.7 billion).

The address falls within the top category of holders, a balance of between 100,000 and 1,000,000 BTC, of which only four addresses qualify (however, it’s difficult to pinpoint if it belongs to a single individual, a crypto fund, a group of individuals, or a crypto exchange).

The 46% decline in BTC price since hitting an all-time high of $65k in mid-April has spooked the market. The knock-on effects are still being felt now, with market sentiment today remaining at the extreme fear level.

However, buyers stepped up yesterday to halt the sliding price action, leading to a bounce at around the $30k level.

A solid trading range of between $30k and $40k has now formed. The question is, will we see more ranging over the next few weeks and months, or was yesterday’s bounce the start of the renewed bull run?

This latest $122 million whale buy suggests big-time investors remain unphased by the uncertainty and extreme volatility.

Other whales are also buying

Research conducted by market analysts Santiment showed that BTC whales also began offloading during the recent price decline. This saw a contraction of around 130k BTC from whale accounts.

For the purposes of their analysis, Santiment’s definition of a whale is an address holding between 100 and 10,000 BTC.

“Between Bitcoin’s price ATH on April 14th and its latest bottom on May 23rd, the total balance of 100-10,000 BTC addresses has shrunk by roughly 130,000 BTC, suggesting waning confidence in the top coin,” the firm said.

But this downtrend bottomed in late May. Since then, Bitcoin whale addresses added 50k BTC to their holdings, or approximately $1.95 billion. While this posts a net loss when considering the previous contraction, it still suggests confidence in the leading cryptocurrency is returning.

#Bitcoin continues to range in the $37k to $39k range, but whales are accumulating behind the scenes. Addresses with 100 to 10k $BTC have added 50,000 total $BTC to their wallets, or ~$1.95bn. Read our quick take on what this means! https://t.co/YRVzgPu5pP pic.twitter.com/OLy5JgDAFl

— Santiment (@santimentfeed) June 4, 2021