Bitcoin trades at discount in Korea destroying historical ‘Kimchi Premium’

Bitcoin trades at discount in Korea destroying historical ‘Kimchi Premium’ Bitcoin trades at discount in Korea destroying historical ‘Kimchi Premium’

Domestic and international pressures reshape South Korea’s Bitcoin market, favoring alternative assets.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

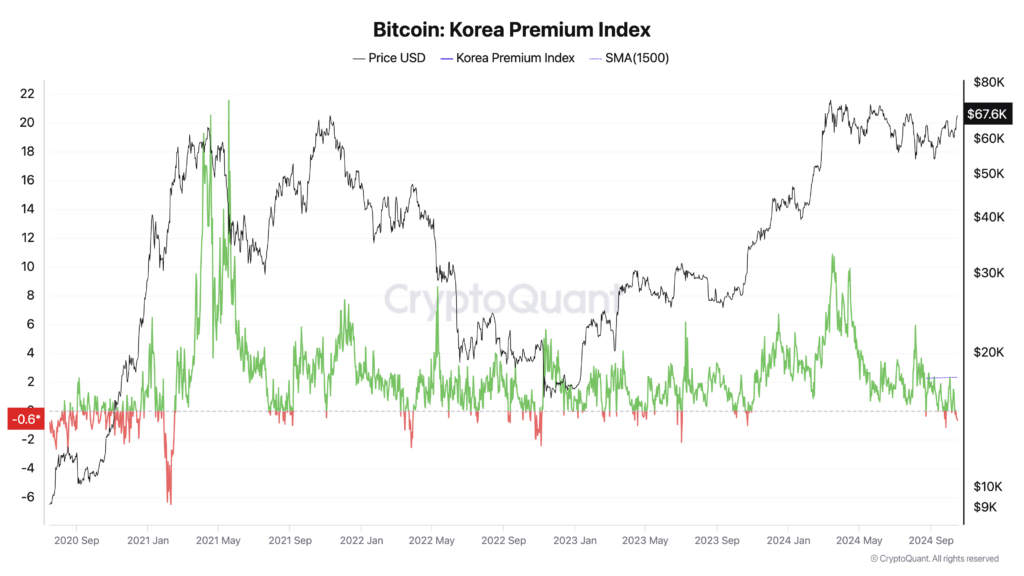

Bitcoin is trading at a discount on South Korean exchanges, reversing the traditional “kimchi premium” that has historically signaled bullish market sentiment.

Per The Korea Times, the cryptocurrency is priced approximately 700,000 won ($511.73) lower domestically compared to global exchanges, resulting in a negative premium (discount) of -0.74% as of Thursday afternoon.

This shift appears to suggest a bearish outlook among South Korean investors. Typically, a higher kimchi premium indicates strong local demand and positive sentiment, often leading to Bitcoin prices exceeding global rates. In contrast, a lower or negative premium reflects weakened enthusiasm and decreased buying pressure, potentially signaling a market correction or alignment with global valuations.

Analysts attribute this unusual discrepancy to subdued investor sentiment in South Korea and higher demand for virtual assets on foreign platforms. KP Jang, head of Xangle Research, told the Korea Times that restrictions prevent foreign and institutional investors from accessing domestic exchanges, amplifying the impact of declining retail investor demand.

A shift in trader preferences toward altcoins is also influencing the market. As Bitcoin surged globally, Korean traders began accumulating undervalued alternative cryptocurrencies, anticipating a solid fourth-quarter rally, as reported by Business Insider. These altcoins, including Tao, Sei Network, Aptos, Sui, NEAR Protocol, and The Graph, are perceived as offering higher returns, potentially diverting attention away from Bitcoin.

Declan Kim, a research analyst at DeSpread, also told the Korea Times that the altcoin market, which comprises a significant portion of domestic trading, continues to struggle amid transitional phases of new regulations. The implementation of the Virtual Asset User Protection Act is affecting market forces. Many altcoins remain unlisted on domestic exchanges compared to foreign ones, and the ban on market-making makes securing liquidity challenging.

The kimchi premium has historically been a hallmark of South Korea’s crypto market. When Bitcoin surpassed the 100 million won mark domestically in March, the premium briefly spiked to as much as 10%. A higher premium generally indicates strong local demand and bullish sentiment, often coinciding with or preceding Bitcoin price rallies. Conversely, a lower or negative premium suggests bearish sentiment and decreased buying pressure.

Data indicates a notable decline in Bitcoin-Korean won (BTC/KRW) trading volume over the past 40 days, reflecting a shift in investor focus.

Analysts expect the reverse kimchi premium to be temporary. Jang anticipates that the discrepancy will resolve soon, as such premiums have rarely persisted for long periods. He mentioned that ongoing discussions about legislation to permit corporate investments in virtual assets could improve liquidity on domestic exchanges and gradually reduce the price gap with foreign markets.

The current trading conditions reflect a complex interplay of domestic regulations, investor behaviors, and global market trends, signaling significant shifts within South Korea’s crypto landscape. The negative kimchi premium, though unusual, may ultimately lead to a more balanced and mature market as it aligns more closely with global digital asset valuations.

The last time the Kimchi Premium fell negative was in Oct. 2023, just before Bitcoin’s ETF-fueled bull run.

CoinGlass

CoinGlass

Farside Investors

Farside Investors