FTX restructurers allege SBF, other execs knowingly commingled, misappropriated customer funds since inception

FTX restructurers allege SBF, other execs knowingly commingled, misappropriated customer funds since inception FTX restructurers allege SBF, other execs knowingly commingled, misappropriated customer funds since inception

FTX's founding leadership team regularly misappropriated customer funds for high-risk trades and personal luxury expenses, according to bankruptcy filings.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

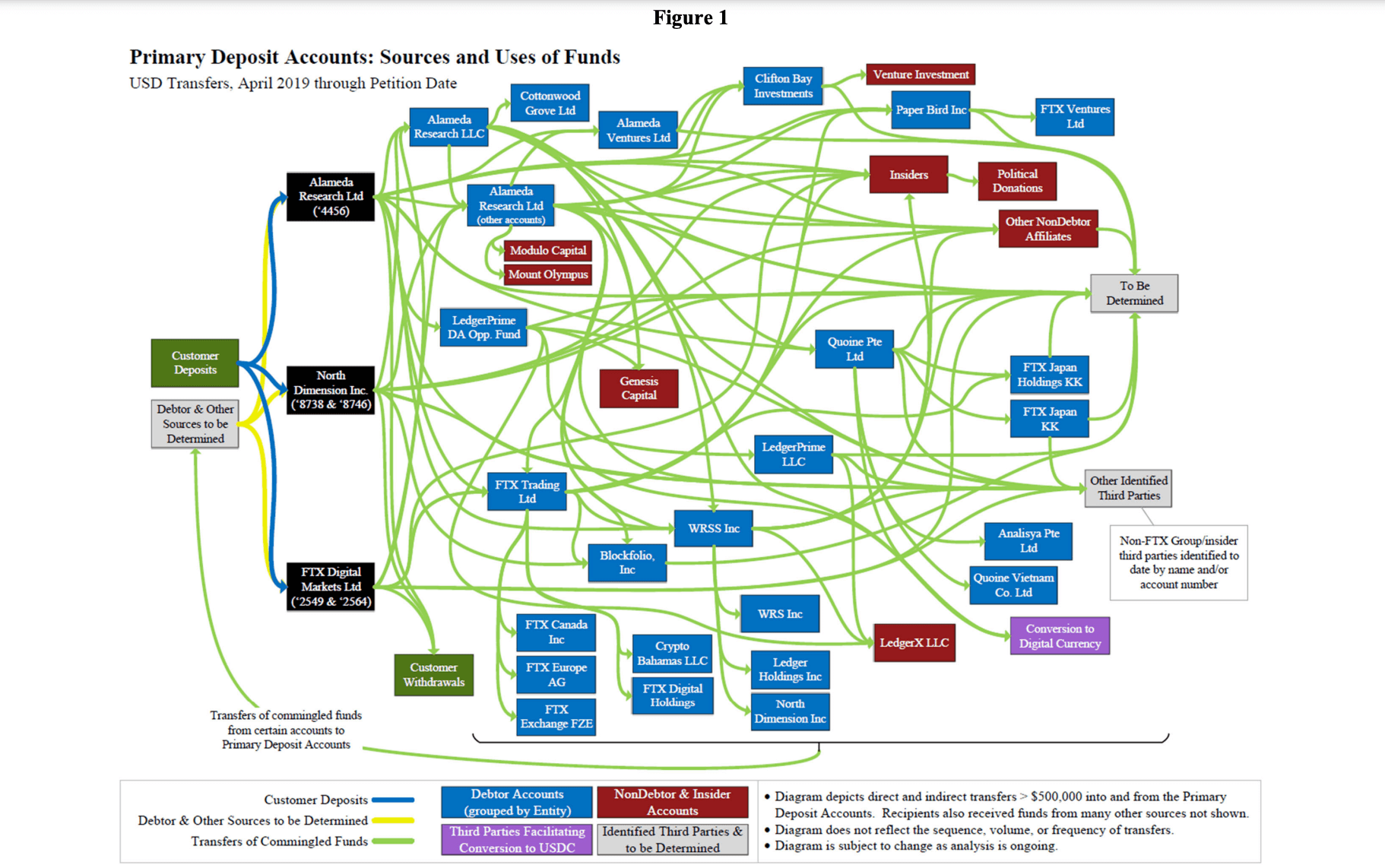

Court documents filed concerning the bankruptcy of cryptocurrency exchange FTX allege that its executives, including founder Sam Bankman-Fried, knowingly commingled and misused customer funds since the exchange’s inception.

The documents, filed by FTX’s bankruptcy recovery leadership under CEO John J. Ray III, claim that Bankman-Fried, co-founder Gary Wang, Director of Engineering Nishad Singh, and others used customer and corporate funds for speculative trading, luxury property purchases, venture investments, and political donations.

“The FTX Group commingled customer deposits and corporate funds, and misused them with abandon,” the court filing reads, continuing:

“Bankman-Fried, along with FTX.com’s co-founder, Gary Wang, and Director of Engineering, Nishad Singh (the ‘FTX Senior Executives’), and others at their direction, used commingled customer and corporate funds for speculative trading, venture investments, and the purchase of luxury properties, as well as for political and other donations designed to enhance their own power and influence.”

According to the court filing, approximately $8.7 billion in customer-deposited assets were misappropriated from the FTX.com exchange. While FTX’s leadership under Ray has repeatedly stressed the difficulty in tracing all of the misappropriated funds, its court filings have continued to reflect their efforts.

FTX filed for bankruptcy in November 2022, with CEO Sam Bankman-Fried stepping down from his role. The ensuing scandal has gone down as the largest crypto-related alleged fraud in history.

John J. Ray III, who replaced Bankman-Fried and has since led the company’s restructuring and recovery efforts, testified before Congress in December 2022, describing the FTX situation as the result of gross inexperience and a lack of basic corporate controls. He highlighted the absence of proper recordkeeping and the commingling of assets as significant challenges in assessing the final whereabouts of misappropriated funds.

FTX’s bankruptcy recovery leadership continues to work on tracing and recovering assets to maximize recoveries for stakeholders. A third report is expected to be published in August 2023.