USDT market cap sets new all-time high in spite of regulatory concerns

USDT market cap sets new all-time high in spite of regulatory concerns USDT market cap sets new all-time high in spite of regulatory concerns

Tether continues to dominate the stablecoin market despite concerns over its reserves and regulatory issues.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The market capitalization of Tether’s USDT has surpassed the previous all-time high of $83.2 billion, according to a June 1 statement from the stablecoin issuer.

Data from DeFillama showed that around half of USDT’s circulating supply, 42.86 billion, is sitting on the Tron blockchain, while 33.37 billion of its supply is on Ethereum.

The stablecoin also has a sizeable supply on other blockchain networks like Binance Smart Chain, Polygon, Solana, Avalanche, and others.

Tether’s transparency data for June first shows total assets of $85.6 billion and liabilities of 83.2 billion, a $2.4 billion liquidity cushion.

Tether’s growth in 2023

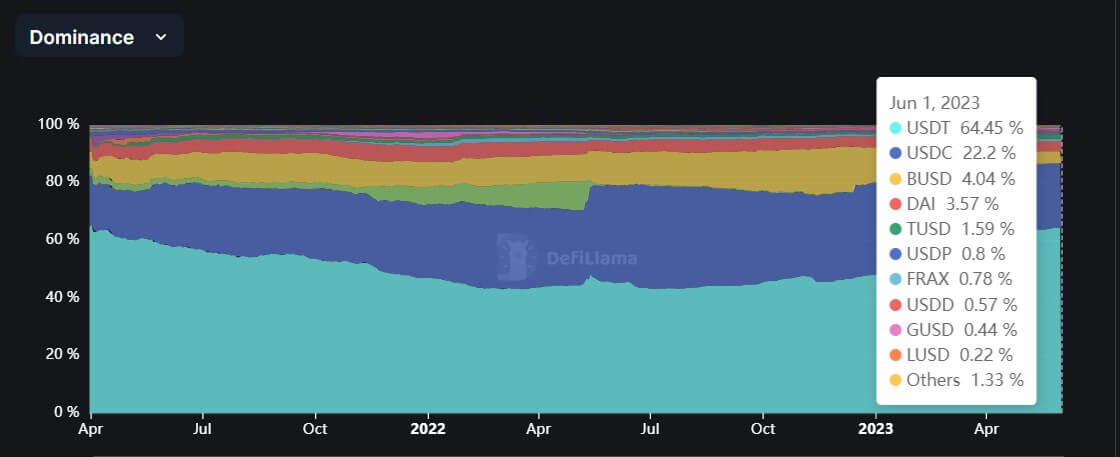

Tether’s USDT has enjoyed significant growth in the current year, adding roughly $17 billion to its market cap. During that period, its market dominance also touched a two-year high of

In 2023, Tether reported a strong first quarter and intentions to invest its profits in Bitcoin. Additionally, the crypto firm expanded its business into BTC mining, and its USDT stablecoin was integrated into the digital payments platform Strike.

Tether’s CTO Paolo Ardoino said the firm’s growth is a testament to its “battle-tested resilience in the face of market volatility and our industry-leading transparency practices.”

Concerns remain over USDT

Meanwhile, Terra’s algorithmic stablecoin implosion and the subsequent collapse of several crypto-related firms last year have placed more regulatory focus on Tether.

Several media reports have highlighted issues with its opaque reserves, and some hedge funds have bet on its possible collapse.

More recently, an SEC’s former official John Reed Stark described the firm as a “mammoth house of cards” and urged regulators to ban it. According to Stark, the stablecoin issuer operates in a regulatory vacuum, adding that its quarterly attestation cannot replace an audit.

Tether’s success is more pronounced considering the regulatory upheaval that has battled its major rivals like Binance USD (BUSD) and USD Coin (USDC).

However, Tether has consistently maintained that it has no exposure to collapsed crypto firms and has touted its business practices.

Update June 1:Title was changed to be more specific about market cap.

Mentioned in this article

Ethereum

Ethereum  TRON

TRON  Solana

Solana  Polygon

Polygon  Tether

Tether  USD Coin

USD Coin  Binance USD

Binance USD  Paxos

Paxos  Circle

Circle  Tether Limited

Tether Limited  Strike

Strike  Paolo Ardoino

Paolo Ardoino