Russians are paying up to $20,000 above market rate to buy Bitcoin

Russians are paying up to $20,000 above market rate to buy Bitcoin Russians are paying up to $20,000 above market rate to buy Bitcoin

Sanctions bite leading to the collapse of the ruble. Data suggests Russians are turning to Bitcoin to protect themselves from the fallout.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Media outlet DeFiprime.com noted Bitcoin is trading for up to $20,000 above the market rate on Russian exchanges.

DeFiprime.com jokingly called this the “matreshka premium,” as a spin on the kimchi premium, which was a prevalent phenomenon from around 2016.

Matreshka premium is a new kimchi premium 👀 $BTC trading at Russian p2p exchanges/fiat on-ramps with about $20K premium right now 😱😱😱 pic.twitter.com/XnG3o4xcxG

— defiprime (@defiprime) March 1, 2022

“Matreshka,” or the matryoshka doll, are colorfully painted wooden dolls of decreasing size nestling inside another. It is perhaps the best-known symbol of Russia, representing respect for the elderly, family unity, fertility, abundance, and the search for truth and meaning.

Although “matreshka premium” doesn’t have the same ring as kimchi premium, the two exist for similar reasons.

Blast from the past: Kimchi premium

The kimchi premium is a term used to describe the price difference between tokens on Korean exchanges compared to the rest of the world. The most significant difference was primarily seen in Bitcoin.

With the fermented cabbage dish being a Korean staple food, what better way to represent this situation?

Around 2016, North Korean leader Kim Jong-un was ramping up tensions in the region, including missile testing. Incidentally, missile launches have resumed in 2022, indicating a return to hostilities.

This led to capital controls restricting money flow into and out of Korea. The ensuing difficulties in moving money led to backlogged demand and a temporary boost in cryptocurrency prices.

“A rise in the kimchi premium can be an indicator of increased retail investment in Bitcoin by Korean investors.”

At the height of the kimchi premium, Bitcoin was trading for as high as 50% above the market rate. While it still exists today, it’s much less prevalent, coming in around 5%.

Bitcoin goes higher against expectations

Likewise, tensions between neighboring Russia and Ukraine erupted in war last week. The resultant sanctions have excluded some Russian banks from the SWIFT global payment network.

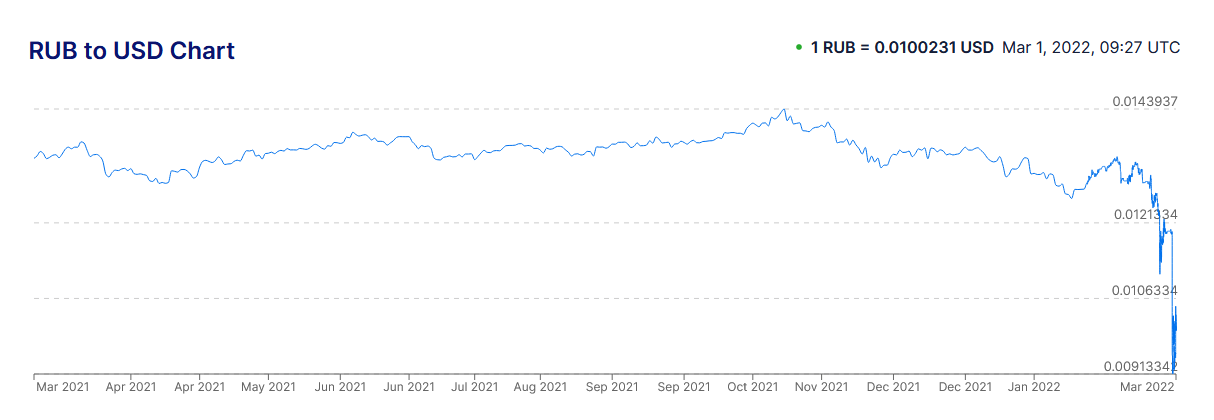

Since then, the ruble has sunk to record lows against the dollar, with 1 ruble currently worth $0.01. In response, the Russian central bank has raised rates to 20% in a bid to counter hyperinflationary pressures.

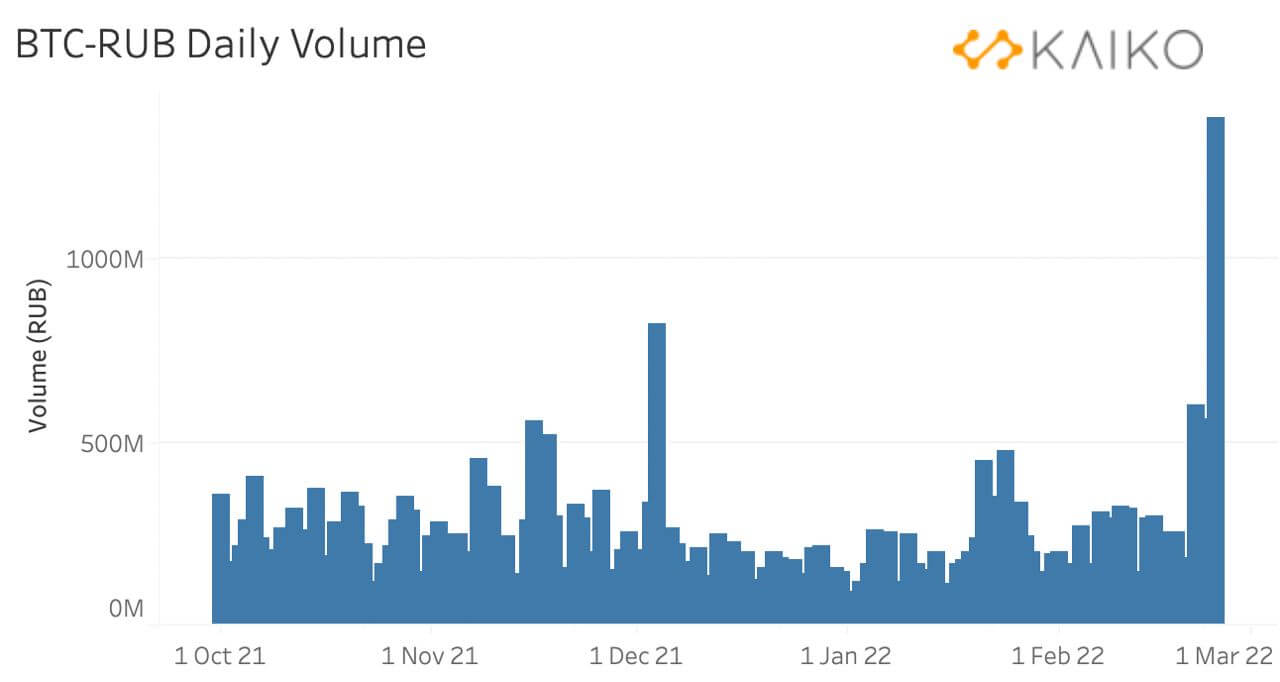

The BTC/ruble pair has seen the highest trading volume since last May. Clara Medalie, Head of Kaiko Research, said hryvnia and ruble Bitcoin trading pairs have seen increased activity “magnitudes greater” than BTC/USD.

And with the fact a “matreshka premium” exists, it’s clear many Russians see Bitcoin as a safer bet than the ruble.

The outbreak of war last week sunk Bitcoin to $34,300. But a strong performance on Monday saw an 18% upside swing to close the day at $43,000.

Despite last week’s drawdown, the Bitcoin safe haven narrative remains intact.

Farside Investors

Farside Investors

CoinGlass

CoinGlass