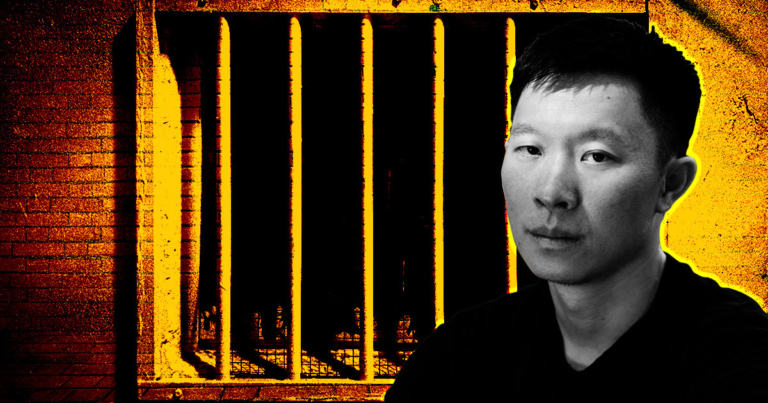

3AC co-founder fears Jail term over liquidator’s misrepresentation

3AC co-founder fears Jail term over liquidator’s misrepresentation 3AC co-founder fears Jail term over liquidator’s misrepresentation

Three Arrows Capital co-founder Su Zhu alleged that liquidators misled the Singapore high court about the structure of 3AC and the role he and co-founder Kyle Davies played in it.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Three Arrows Capital co-founder Su Zhu is worried he and other company directors could face jail terms for contempt of court due to the liquidators’ misrepresentation, Bloomberg News reported on August 26.

The court-appointed liquidators for 3AC Teneo said the co-founders of the embattled firm have been uncooperative, saying Zhu and his partner, Kyle Davies, provided “rather selective and piecemeal disclosures” about the bankrupt hedge fund assets.

While Zhu has vehemently denied this allegation on Twitter, he submitted an affidavit in person in Bangkok, Thailand, on August 19 to further defend his position.

Bloomberg news citing a copy of the notarized document reported that Zhu alleged that the liquidators misled the Singapore high court about the structure of 3AC and the role he and Davies played in the system.

Zhu listed several business entities and claimed to be the director of Three Arrows Capital Pte Ltd (TACPL), registered in Singapore in 2013 until its license ended on July 31, 2021.

He also listed two feeder funds, Three Arrows Fund LP (TAFLP), registered in Delaware, US, and Three Arrows Fund Ltd (TAFL) in the British Virgin Islands.

According to Zhu, TACPL stopped being the investment manager for the master and feeder funds on September 1, 2021. At that point, another entity, ThreeAC Ltd, registered in the British Virgin Islands, became the investment manager.

Zhu continued that since the entity where he identifies as a director is no longer the investment manager, it is nearly impossible for TACPL to provide all the information that liquidators demand.

According to the report, the entity is worried “about the potentially draconian consequences arising from the Liquidators’ exercise of their wide powers.”

Meanwhile, Teneo has secured a court approval granting it access to 3AC’s assets in Singapore.