XRP is lagging behind major cryptocurrencies in 2020, what’s behind the lackluster performance?

XRP is lagging behind major cryptocurrencies in 2020, what’s behind the lackluster performance? XRP is lagging behind major cryptocurrencies in 2020, what’s behind the lackluster performance?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Since the first week of January, XRP has increased by about 50 percent against the USD. While the number seems high, the upsurge is relatively weak compared to top cryptocurrencies like Ethereum and EOS.

In the same period, Ethereum rallied by more than 100 percent against the USD, while EOS surged by well over 60 percent.

Why is the darling of the alt season struggling?

Throughout 2019, Ripple has had several high profile deals to uplift the XRP ecosystem.

The company’s deal with Moneygram, for example, significantly increased the usage of XRP in cross-border remittances in Mexico. Reports show that in a single week, Ripple processed more than $50 million worth of remittances in Mexico.

The remittance giant captures a large share of the Mexican remittance market and as of November 2019, MoneyGram is said to have processed ten percent of remittances in the country through Ripple.

MoneyGram CEO Alex Holmes said at the time:

““What I love about ODL is that we’re completely at the forefront of this technology … We’re able to settle billions of dollars in seconds. The magic really comes from pairing MoneyGram transactions with Ripple’s ODL.”

Since then, Ripple worked to further bolster the XRP ecosystem, even securing a $200 million funding round along the way joined by its long time partner SBI Holdings.

We are thrilled to announce our $200M Series C—an investment that marks a record year of company growth. The round was led by Tetragon along with SBI Holdings and @route66ventures. https://t.co/5mkbPWzug6

— Ripple (@Ripple) December 20, 2019

Yet, the price trend of XRP shows that it lacks the spark it once had. Unlike Ethereum and several other major cryptocurrencies, XRP was heavily rejected at a key resistance level, placing it at risk of a steep correction.

With bitcoin at a break or make level along with the rest of the cryptocurrency market, XRP could see a resumption of a bear market despite being down by 92 percent from its all-time high.

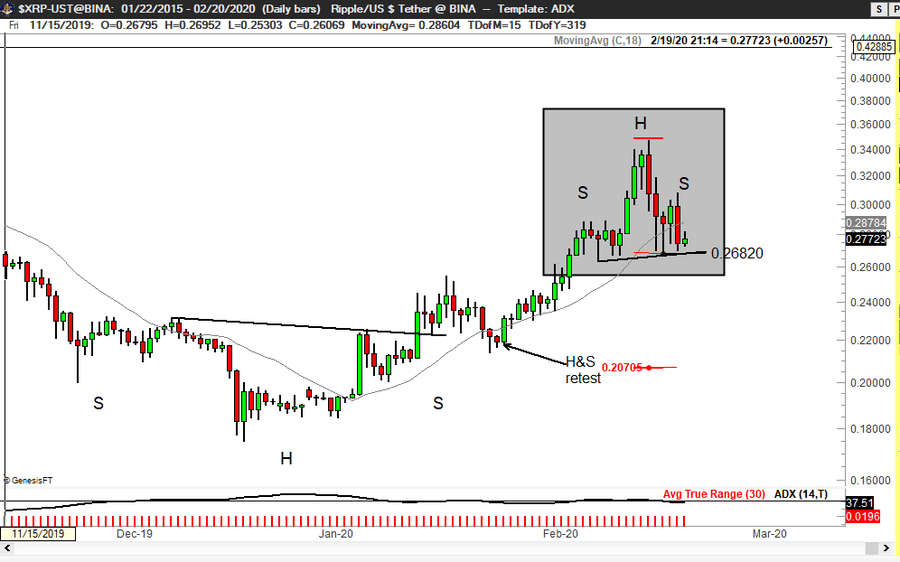

Renowned trader Peter Brandt suggested that technically, XRP is facing a potential head and shoulders pattern that could reject the upward trend it has built up since early January.

He said:

“It will be interesting to see if this H&S top plays out. If so, the target would be .2071.”

In previous alt seasons and bull cycles, XRP outperformed many major and small cryptocurrencies in the global market.

The lackluster price trend of XRP in the past two months in comparison to top crypto assets indicates that the asset needs significantly stronger momentum than other cryptocurrencies to break through key resistance levels.

Mostly technical

In the fourth quarter of 2019, Ripple sold the least amount of XRP in recent history, placing less pressure on the market.

With highly anticipated deals and less XRP on sale in the market, theoretically, the cryptocurrency should have seen a larger rally than previous bull cycles.

One possible reason behind the struggle of XRP in recent months is that its sell-off throughout 2019 may have been too intense to recover in a single bull cycle.

It may require multiple breakout attempts before cleanly breaking out of heavy resistance levels in the likes of $0.295, $0.329, and $0.83.

XRP Market Data

At the time of press 8:09 pm UTC on Feb. 24, 2020, XRP is ranked #3 by market cap and the price is down 4.46% over the past 24 hours. XRP has a market capitalization of $11.74 billion with a 24-hour trading volume of $2.46 billion. Learn more about XRP ›

Crypto Market Summary

At the time of press 8:09 pm UTC on Feb. 24, 2020, the total crypto market is valued at at $277.8 billion with a 24-hour volume of $153.78 billion. Bitcoin dominance is currently at 63.06%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant