Will fundamental strength stop Chainlink from breaking key macro growth curve?

Will fundamental strength stop Chainlink from breaking key macro growth curve? Will fundamental strength stop Chainlink from breaking key macro growth curve?

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

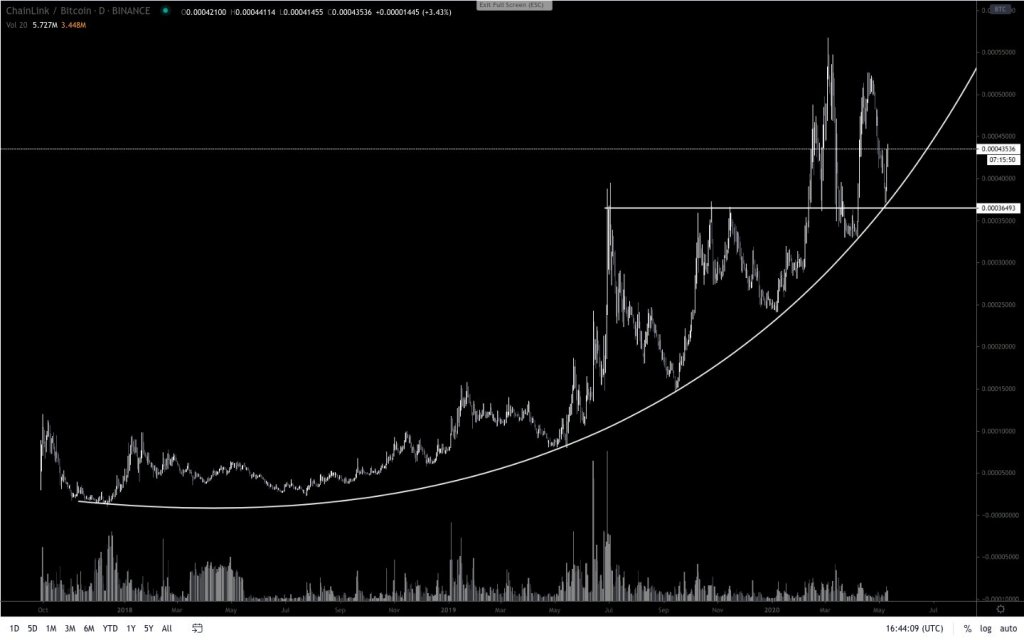

Chainlink’s immense bullishness throughout 2019 and 2020 has coincided with the emergence of a prominent growth curve that has been guiding it higher.

The reactions LINK posts to tests of this curve have been quite significant in the past, with it acting as a catalyst for some of its largest parabolic swings.

It does appear that it is only a matter of time before this growth curve is broken, however, which could mean that the era of Chainlink being the firm market leader – in terms of performance – is quickly coming to an end.

The crypto has shown signs of immense fundamental strength in the past, however, but a peak into the levels at which new LINK investors may be keen to sell their crypto at may spell trouble for its near-term trend.

Chainlink risks invalidating macro uptrend as key growth curve runs out of room

At the time of writing, Chainlink is trading down just over two percent at its current price of $3.62, marking a notable decline from daily highs of over $3.80.

It is important to note that the decline was seen today simply marks an extension of the weakness that came about as a result of the cryptocurrency’s firm rejection at highs of $4.15 seen on May 9th.

The subsequent decline following the sharp rally to these highs has led Chainlink down to the strong support that has been established within the mid-$3.00 region.

It also appears that this support has coincided closely with the key growth curve that has been established throughout the past couple of years.

One analyst named Pentoshi noted that although Chainlink is “looking tired” he doesn’t believe its rally is over yet. He does explain that a dip below this growth curve could mark a full invalidation of the uptrend seen throughout the past two years.

“LINK: The most resilient crypto of the last 3 years regardless of market conditions this animal has powered on. It has formed higher lows for years, even in crypto wide bear market. A complete outlier. Has to hold the white line or this run ends imo. Looking tired but not done.”

Will fundamental strength stop a decline beneath this curve?

Although Chainlink has seen growing fundamental strength in terms of new wallet addresses, high activity on social media, and large numbers of contributions on its GitHub, all this may not be enough to thwart a massive selloff.

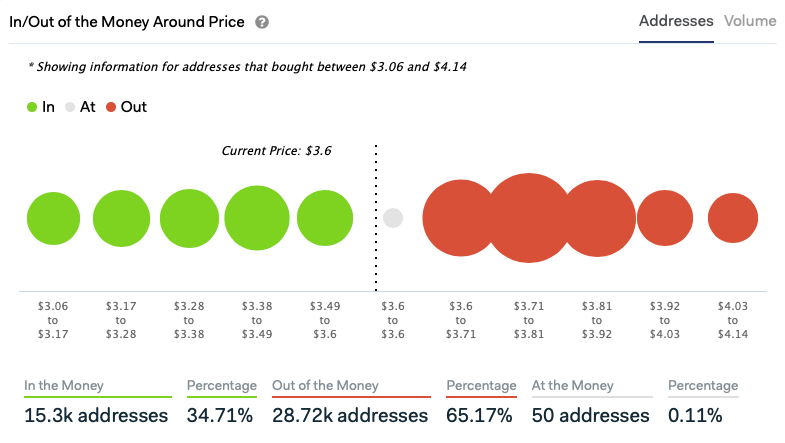

Data from the blockchain analytics platform IntoTheBlock reveals that the number of wallets that acquired LINK in the upper-$3.00 region far outweigh those that acquired it in the lower-$3.00 region.

This signals that Chainlink may face some heavy resistance at just below $4.00 that stops it from seeing a bullish response to its latest growth curve visit.

Chainlink Market Data

At the time of press 6:01 am UTC on May. 12, 2020, Chainlink is ranked #12 by market cap and the price is down 2.91% over the past 24 hours. Chainlink has a market capitalization of $1.29 billion with a 24-hour trading volume of $489.58 million. Learn more about Chainlink ›

Crypto Market Summary

At the time of press 6:01 am UTC on May. 12, 2020, the total crypto market is valued at at $238.95 billion with a 24-hour volume of $184.03 billion. Bitcoin dominance is currently at 67.08%. Learn more about the crypto market ›

CoinGlass

CoinGlass  Arkham Intelligence

Arkham Intelligence