Understanding DAICOs – Vitalik Buterin’s Method To Fix ICOs

Understanding DAICOs – Vitalik Buterin’s Method To Fix ICOs Understanding DAICOs – Vitalik Buterin’s Method To Fix ICOs

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Although Bitcoin is the preeminent cryptocurrency, it has always been buoyed by Ethereum, a highly valued and differently abled blockchain platform.

Unlike Bitcoin, which was developed to facilitate digital p2p transactions, Ethereum is a blockchain platform intended to be a launching pad for other digital currencies and decentralized organizations. So far, it’s been pretty successful.

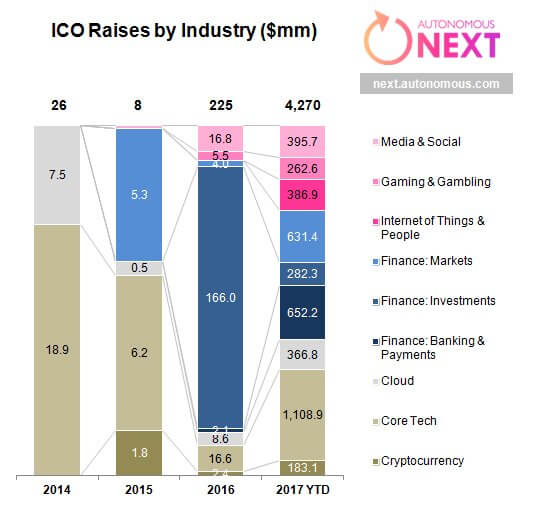

Initial Coin Offerings (ICOs) have exploded as Ethereum has risen to prominence. By the end of 2017, more than $4 billion would be raised through this process with the Ethereum blockchain being the primary conduit for these launches.

The total cryptocurrency market cap grew from less than $20 billion to over $800 billion before the recent downturn. This massive growth is, in many ways, the result of Ethereum’s platform. So far, there have been nearly 26,000 digital token launches on the Ethereum blockchain totaling billions of dollars in combined market cap.

However, Ethereum’s leaders have frequently expressed discomfort with the situation. Fabian Vogelstellar, a prominent Ethereum developer, told CoinDesk back in November,

“The problem right now is that too many people outside the blockchain space focus on tokens and ICOs; franklin speaking, it’s the least interesting part of Ethereum.”

A New Model

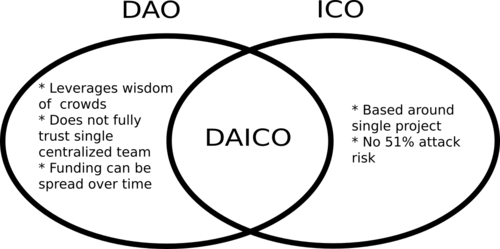

Fortunately, Ethereum is trying to do something about this. In an effort improve both the DAO and ICO process, Ethereum co-founder, Vitalik Buterin, is proposing a new model. Dubbed DAICO, its name is a combination of the decentralized application and initial coin offering acronyms.

In theory, the DAICO model would blend components of the DAO (decentralized autonomous organization) and the ICO (initial coin offering) model to create a more sustainable and more ethical approach to raising capital.

Its theories and procedures help proliferate Ethereum’s desire to see blockchain-based applications and cryptocurrencies thrive in the long term.

How it Works

Under the DAICO model, a development team publishes a DAICO contract that begins in “contribution mode.” The contract would outline the methods for contributing Ether to the project and the particulars of the token sale.

When the contribution period ends, it is no longer possible to contribute ether to the project, and the tokens become tradeable.

Most importantly, the DAICO model allows token holders to vote on raising the tap or putting a contract into “withdraw mode.” Using this process, token holders can choose by quorum the rate of funding for the development team. In this way, the DAICO model is a lot more like the measures put in place by more traditional fundraising models.

As Buterin notes,

“The intention is that the voters start off by giving the development team a reasonable and not-too-high monthly budget, and raise it over time as the team demonstrates its ability to competently execute with its existing budget.”

Buterin went on to further sate the significance of voters being able to shut down a project if they were unhappy with its progress:

“If the voters are very unhappy with the development team’s progress, they can always vote to shut the DAICO down entirely and get their money back.”

Of course, any vote is subject to a 51% attack, in which an individual or collaborative group owns more than 50% of the voting rights, and thus can control the entire project through their voting rights.

However, Buterin is quick to note that there are measures that can lessen this risk. Moreover, compared to the abundance of fraudulent or ridiculous ICOs, it seems like a worthy gamble.

Only time will tell whether DAICOs become an integral part of the cryptocurrency ecosystem, but it is good to know that some of the smartest minds in the space are thinking about ways to improve the existing solutions.

Farside Investors

Farside Investors