Top 10 Crypto Stories of 2021

Top 10 Crypto Stories of 2021 Top 10 Crypto Stories of 2021

This year held many trends in crypto; with adoption in full swing, crypto is becoming more mainstream by the day.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

In 2021, crypto finally broke away from being just BTC and ETH into a multifaceted industry with dozens of promising chains, tokens, projects and applications.

Some of these projects, especially in GameFi, stopped being tied directly to the price of Bitcoin and began being appreciated as major developments in their own right. However, BTC also had an incredible year as it saw institutional adoption in the form of ETFs and legal tender status.

Here are the top 10 most important stories from 2021.

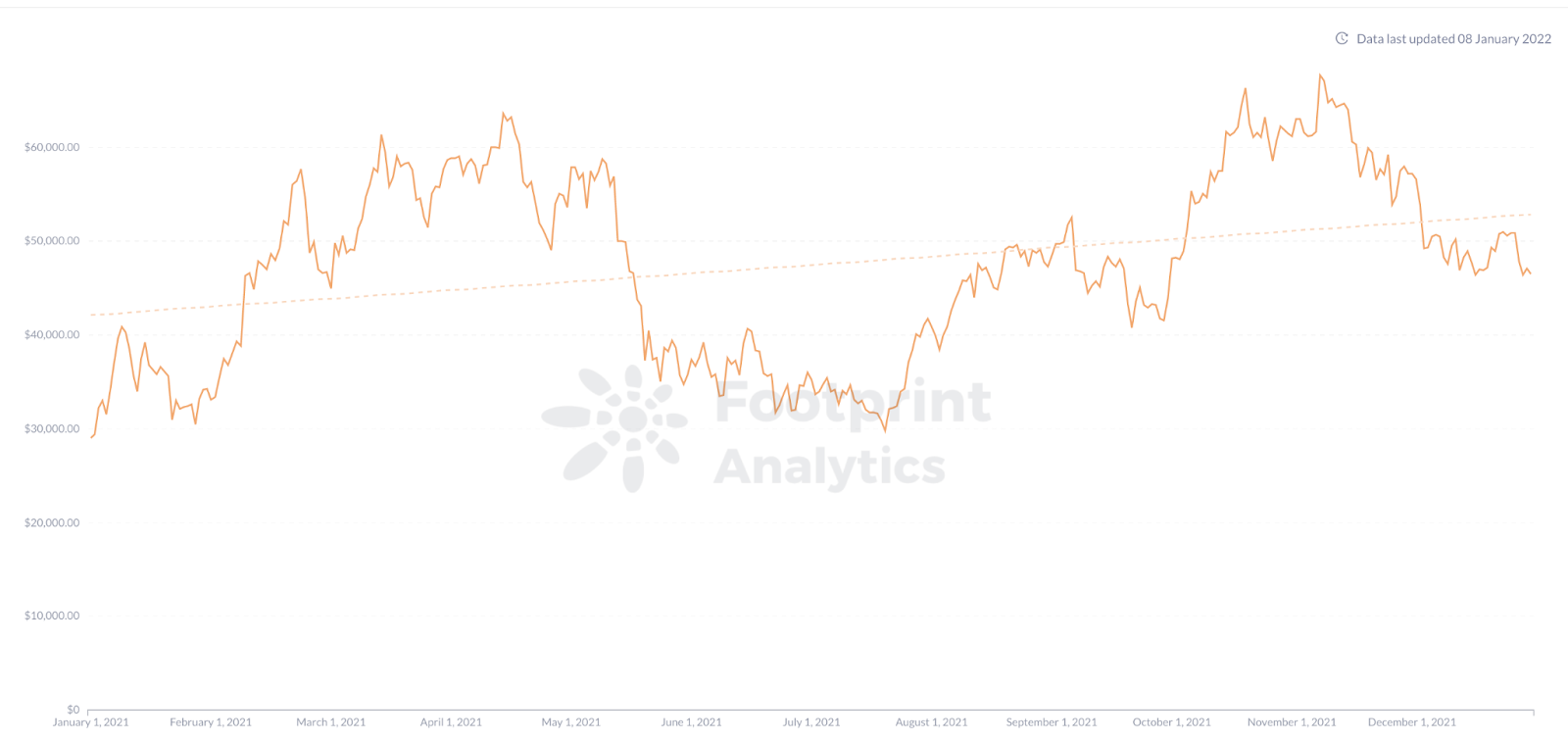

BTC, which has existed for the past ten years, mainly traded among small investors and crypto believers, underwent a significant change in 2021. Tesla announced acceptance in BTC payments for its products temporarily, causing a substantial surge in price and bringing BTC into the public eye. The entry of institutional investors, the inclusion of BTC as legal tender in El Salvador, and the first approval of a Bitcoin futures ETF in the US drove BTC to a new high of $67,674.

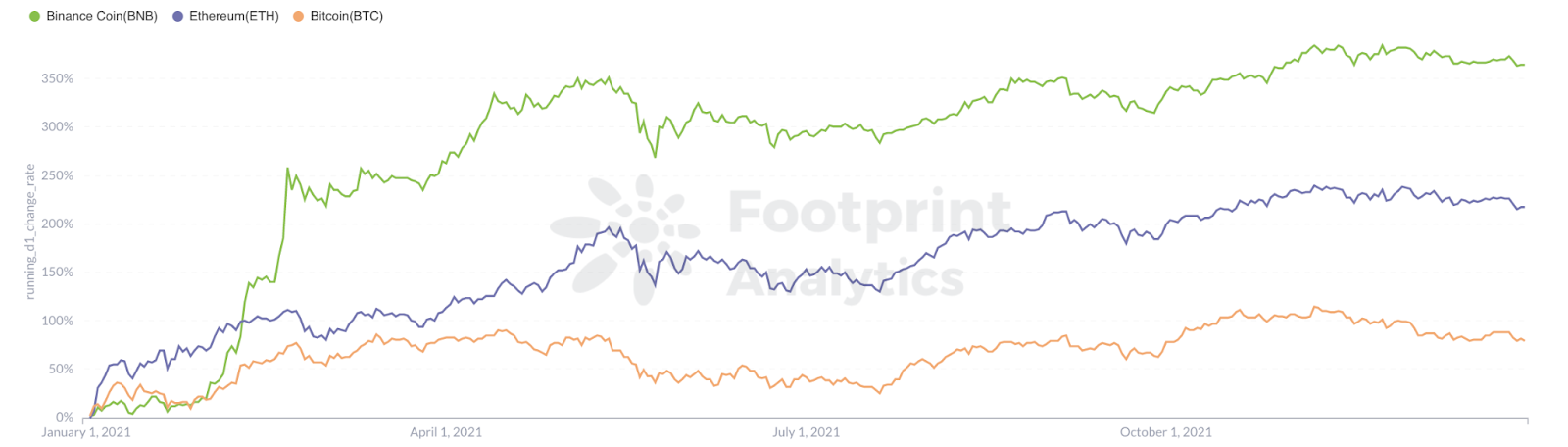

Having experienced four hard forks in 2021, Ether laid the foundation for its transition to PoS in 2022. The London upgrade reaffirms to the crypto world that Ethereum is a sound, dynamic economic system—with ETH prices growing more than 4x in the last 12 months.

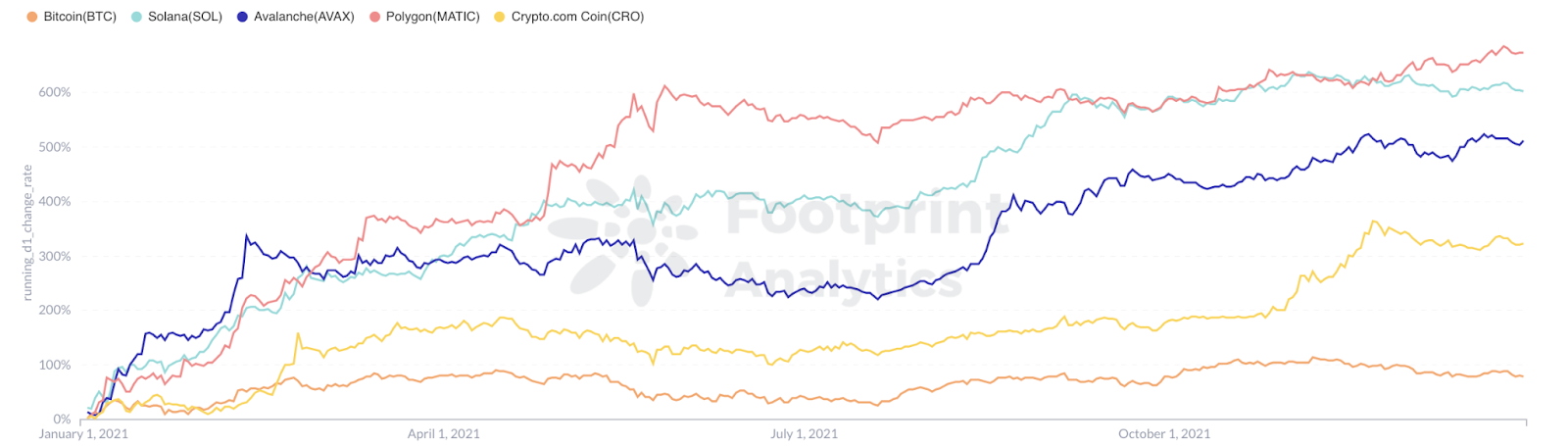

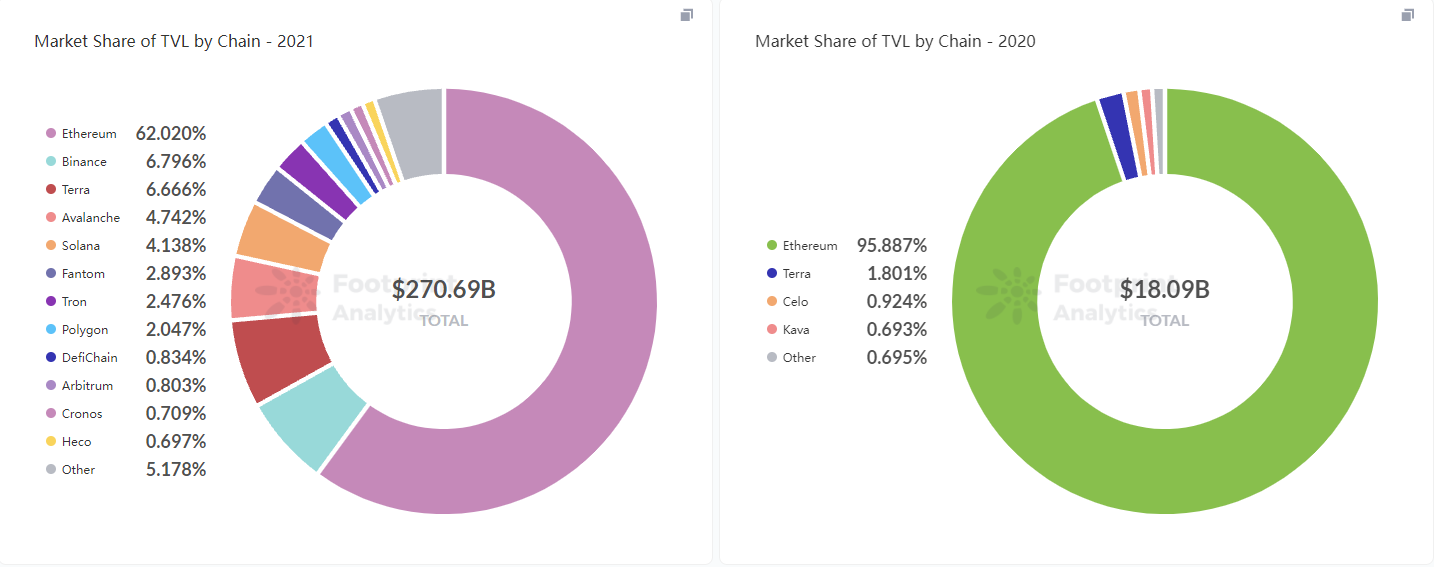

Ether’s ambitious London upgrade and development plans for 2.0 have not deterred the crypto world from exploring more diverse public chain solutions. By 2021, 86 public chains were geared towards blockchain developers and users.

With Ether’s market share declining from 96% market dominance to 62% by the end of the year, these new chains—both competing and collaborating with the Ether ecosystem—have become the big story heading into 2022.

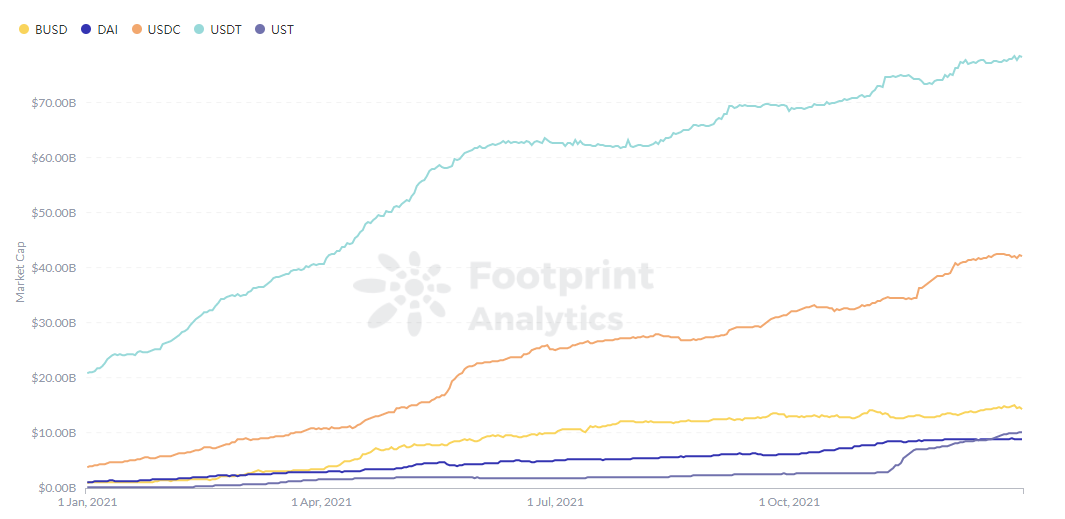

As a bridge between the real world and Web 3.0, stablecoins play a vital role in the operation of the blockchain. 2021 saw the total issuance of over 100 billion stablecoins on Ethereum, and the regulation of stablecoins is also officially on the agenda.

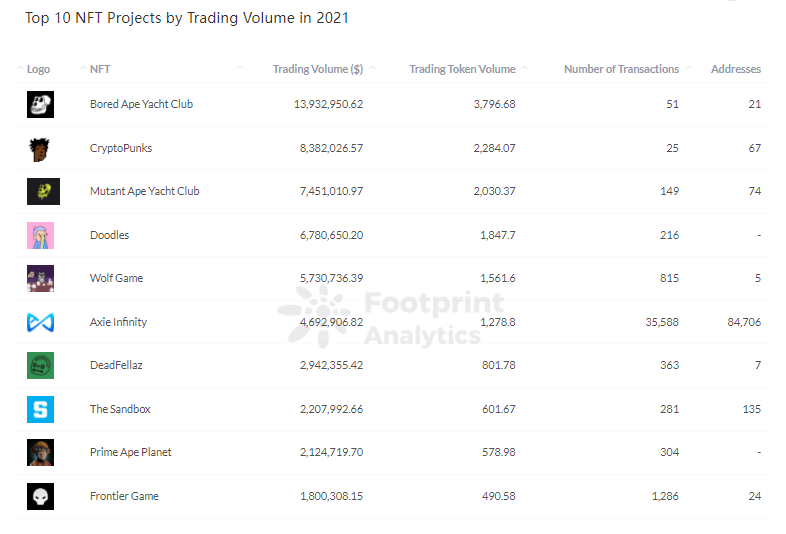

Just as DeFi brought capital into the cryptocurrency market, NFTs are bringing people into it with puzzling artwork, lucrative games, and even some actual use cases.

The metaverse is also a huge unknown with nearly unlimited potential.

During the second half of 2021, GameFi took over the DeFi ecosystem as the hottest area of the crypto market. With Facebook changing its name to Meta and the concept of metaverse reemerging again, virtual games are showing unprecedented appeal.

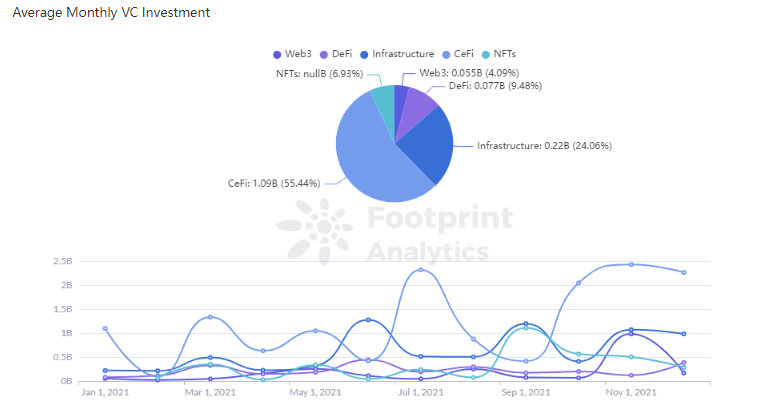

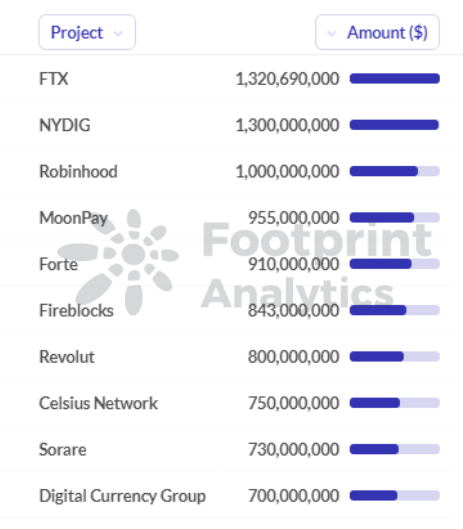

The overall investment industry is currently experiencing a capital winter, and however, fundraising in the blockchain continues unabated. In 2021, overall funding throughout the year generated $30.27 billion, up 790% from $3.4 billion in 2020.

In 2021, investors still favored the CeFi industry, which has mature architecture and development, followed by the NFT and infrastructure sectors.

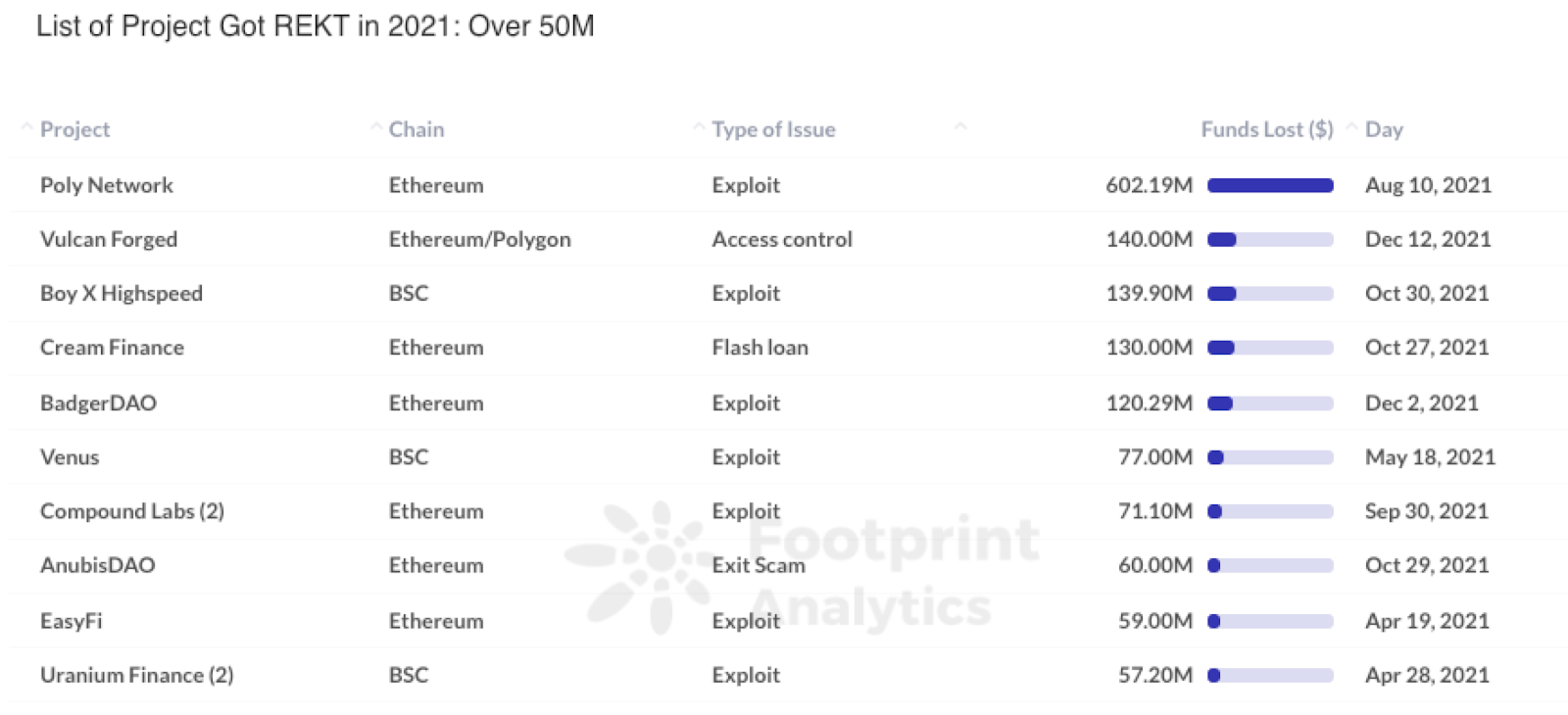

More than 600 programs were REKT (attacked) in 2021, with one-third of them suffering financial losses of $2.2 billion cumulatively. The Poly network was the biggest victim of hacking in 2021, with a breach attack in August resulting in $602 million in losses. The most well-known flash loan attack was on Cream Finance; it generated a cumulative loss of $130 million.

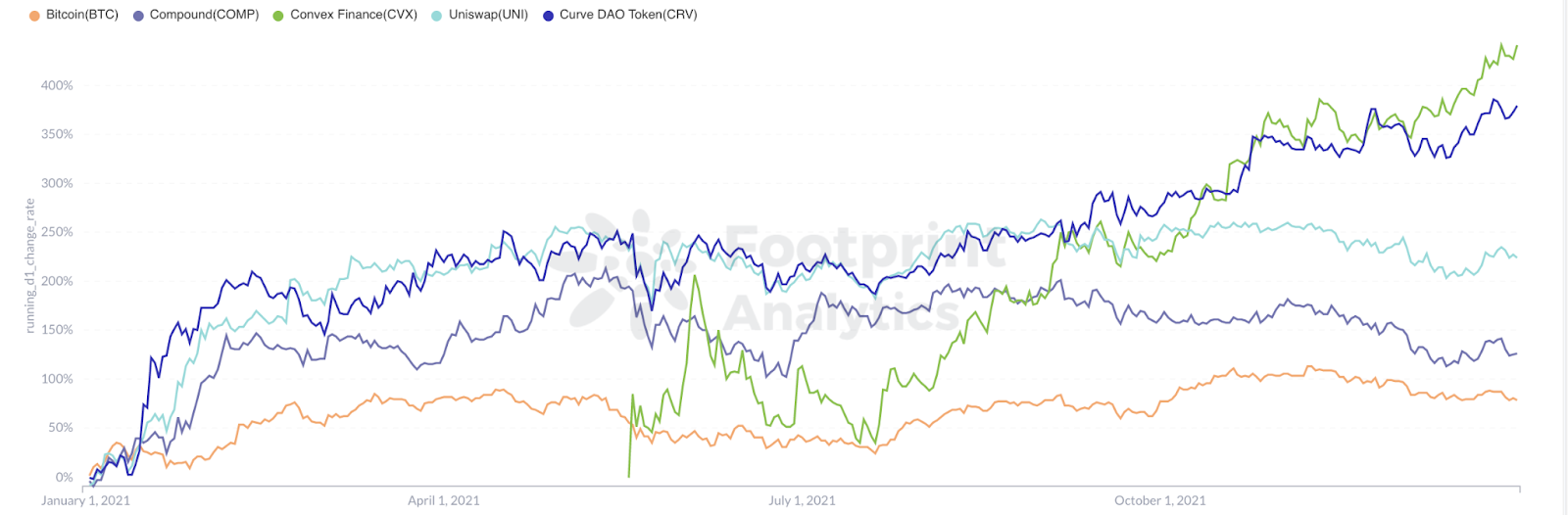

In 2021, dozens of promising projects from DeFi, NFT, and GameFi brought more tokens to the market than anyone could notice. While most people tracked the price of BTC and ETH, we saw some new tokens deviate from this trend for the first time, and while many tokens saw astronomical gains, other projects were hacked and went to zero.

Looking ahead to 2022

With the development of a multi-chain ecosystem, interoperability between chains and projects has become necessary. 2022 will see more projects providing common infrastructure for blockchain interoperability.

In conjunction with innovations in DeFi development, more DeFi lending platforms will also support metaverse land as collateral for loans. NFTs, with more application scenarios, also gain access to more influential communities as big gaming companies jump on the GameFi bandwagon. We also expect the DAOs to get incorporated into NFTs and GameFi.

Summing up

With the growing maturity of the blockchain industry, investors are beginning to shift from the FOMO mentality of coin speculation to a more rational assessment of the intrinsic business value of projects. Along with the entry of more institutional investors, value investment will become the new trend of the crypto world in 2022.

Date & Author: Jan 14th, 2020, [email protected]

Data Source: Footprint Analytics

What is Footprint?

Footprint Analytics is an all-in-one analysis platform to visualize blockchain data and discover insights. It cleans and integrates on-chain data so users of any experience level can quickly start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build their own customized charts in minutes. Uncover blockchain data and discover the value trend behind the project.

Farside Investors

Farside Investors