These three entities now control over 60 percent of Bitcoin hash rate post-halving

These three entities now control over 60 percent of Bitcoin hash rate post-halving These three entities now control over 60 percent of Bitcoin hash rate post-halving

Photo by Dmitry Demidko on Unsplash

The now-concluded Bitcoin halving marked a significant step in the pioneer cryptocurrency’s evolution, that of reducing block rewards to miners to maintain its premise as a deflationary currency.

But critics voiced certain concerns ahead of the event. Some focussed on the effects on BTC prices, while some, more importantly, worried about the eventual centralization of hash power, as smaller players scale down operations and the larger ones thrive.

Larger pools increase dominance

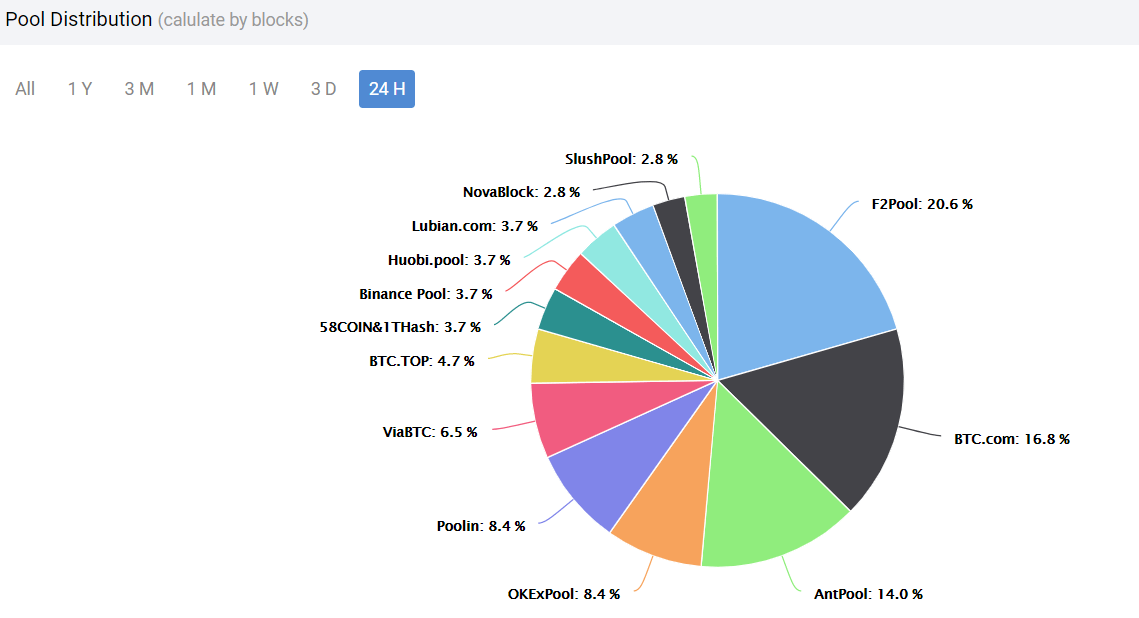

Data from BTC.com, a mining pool and mining data tracker, shows three firms have dominated hash power generation on Bitcoin in the past three days. F2Pool, which mined the iconic 630,000th block, remains at the top with 21 percent of provided hash power.

BTC.com and AntPool are next on the list with 14 and 13 percent hash generation respectively. Both firms are owned by mining giant Bitmain, which posted $300 million in revenues in 2020 and remains a profitable, dominant player in the Bitcoin mining ecosystem.

OKEx Pool contributed over 8 percent in the past 24 hours, a period when Bitmain-owned and F2Pool had over 50 percent hash power generated from their systems.

Lubian, which emerged as a surprise miner earlier last week, dropped to eighth on the hash power charts.

A thread on Reddit referenced the so-called “Nakamoto Coefficient” on the matter, with one user explaining the term:

The minimum number of entities that would have to collaborate to attempt a 51% attack. You want your Nakamoto Coefficient to be as high as possible, to reduce the chance of an attack

As the thread noted, the coefficient has dropped to two on Bitcoin, meaning two dominant entities could, in theory, collide and attempt to launch a 51 percent attack on Bitcoin.

Despite the hashpower increase, it’s important to note that mining pools are not strictly independent organizations—they “pool” user funds to build extensive mining infrastructure for Bitcoin, paying out profits and using revenues to further strengthen their mining rigs.

In a theoretical case of miner collusion, good actors can simply shut down their pool contribution, move to another pool, thus vastly reducing hash power shares for “bad” pools.

Besides, miners have no logical incentive to create a cartel, launch an attack, create long-lasting reputational impact, and damage the burgeoning Bitcoin network.

The entire business model of miners is dependent on mining rewards and transaction fees, and while a 51 percent attack is an outside possibility, no such risk exists currently.