This key resistance level could spark a massive Bitcoin selloff

This key resistance level could spark a massive Bitcoin selloff This key resistance level could spark a massive Bitcoin selloff

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

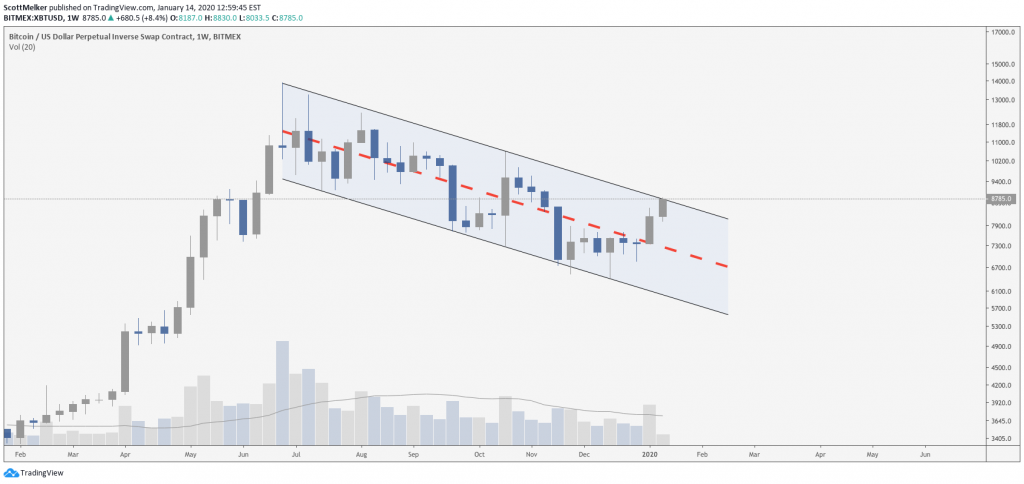

Bitcoin’s bulls have now propelled the cryptocurrency to the upper boundary of a strong multi-month channel, and they appear to be showing some signs of faltering as BTC struggles to break past this level.

It is important to note that the recent uptrend has significantly enhanced the cryptocurrency’s bullishness and has led some analysts to note that it could be on the cusp of another major rally to highs of $9,100.

Bitcoin rallies as bulls attempt to hold price above $8,750

Currently, Bitcoin is trading up over 7 percent at its current price of $8,740, which marks a massive climb from its daily lows of $8,100, around where the cryptocurrency consolidated at for several days following its rally to highs of $8,400.

It is important to note that this recent BTC rally has come about in tandem with massive gains seen by major altcoins, signaling that fresh capital is entering the markets, rather than funds being shifted from altcoins to Bitcoin.

A few of the biggest winners within the crypto markets today are Bitcoin SV, Bitcoin Cash, and EOS, which are trading up 90 percent, 23 percent, and 22 percent respectively.

In order for the momentum seen across the aggregated crypto market to extend significantly further, it is imperative that Bitcoin closes the day above $8,750, as Josh Rager – a well-respected cryptocurrency analyst – explained in a tweet that a daily close above this level could mean a visit to $9,100 is imminent.

“If $BTC can hold above $8750, we should see it push up to $9000 – $9100,” he concisely noted.

Will this key trendline halt the ongoing BTC rally?

Part of the reason why a move to $9,100 would be so significant is because it would mark a decisive climb above the upper boundary of a long held descending channel BTC has been caught within.

Scott Melker, a popular cryptocurrency analyst on Twitter, spoke about this trendline in a recent tweet, noting that he is taking some profits off the table due to the strong resistance at this level.

“I am taking some money off the table on my $BTC long from $7,700. I think it’s likely to consolidate and continue up, but this has been another epic trade and price is at a key resistance on multiple time frames. Never a bad idea to pay yourself,” he noted.

If bulls are able to sustain this momentum, the recent lows experienced by Bitcoin and the aggregated crypto markets could mark a long-term bottom, but a failure to close above $8,750 could mean significant losses are imminent.

Bitcoin Market Data

At the time of press 6:19 am UTC on Jan. 15, 2020, Bitcoin is ranked #1 by market cap and the price is up 2.01% over the past 24 hours. Bitcoin has a market capitalization of $157.66 billion with a 24-hour trading volume of $44.53 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:19 am UTC on Jan. 15, 2020, the total crypto market is valued at at $238.07 billion with a 24-hour volume of $166.85 billion. Bitcoin dominance is currently at 66.27%. Learn more about the crypto market ›

Deribit

Deribit