These three crypto “ghost chains” could help fuel a 78%+ rise in DeFi tokens

These three crypto “ghost chains” could help fuel a 78%+ rise in DeFi tokens These three crypto “ghost chains” could help fuel a 78%+ rise in DeFi tokens

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The DeFi sector has seen growth throughout the past several months that has mirrored that seen by the aggregated crypto market in 2017.

Many tokens related to the rapidly growing ecosystem have posted year-to-date gains of more than 100 percent. A select few have even climbed by as much as 900 percent over a YTD period.

This boom has come about due to an influx of new investors into this fragment of the crypto market.

On the other end of this, the ecosystem is also seeing an influx of users who are utilizing DeFi to take out collateralized loans using crypto.

Although some are calling the meteoric rise seen by this sector a “bubble,” DeFi assets remain an incredibly small part of the aggregated market.

One prominent crypto investor is noting that a potentially imminent exodus of investors out of so-called “ghost chains” could help fuel a further rise in the price of top DeFi assets.

DeFi sector remains a small sliver of the aggregated crypto market

The decentralized finance sector still makes up for a small portion of the entire crypto market, despite its recent growth.

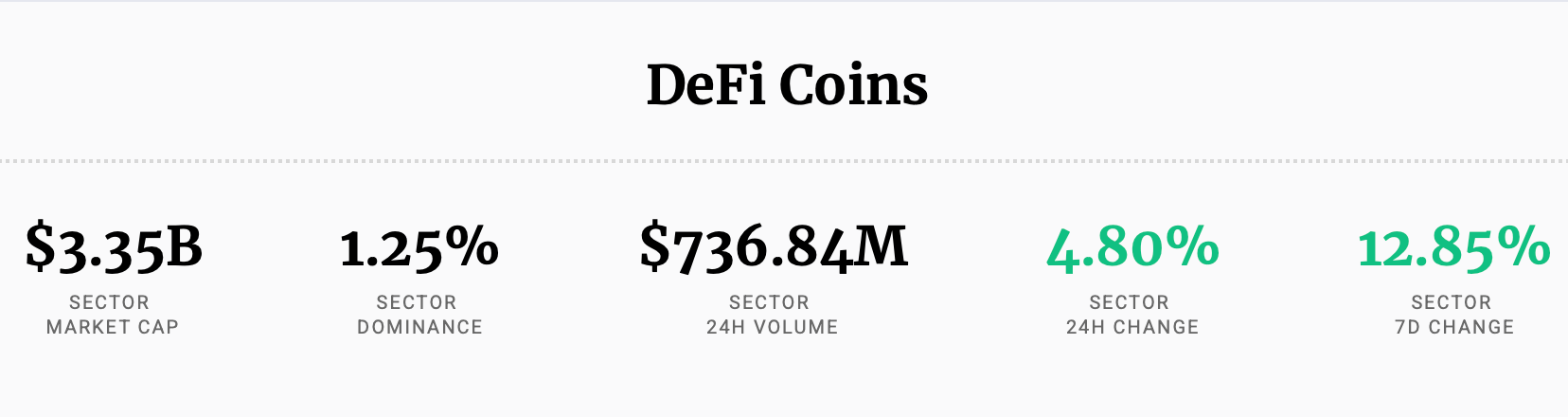

According to proprietary data from CryptoSlate, the aggregated market capitalization of all DeFi-related tokens currently sits at $3.35 billion.

While compared to the total market’s size of roughly $270 billion – $170 billion of which is accounted for by Bitcoin – this sector remains incredibly small, having a mere 1.25 percent dominance.

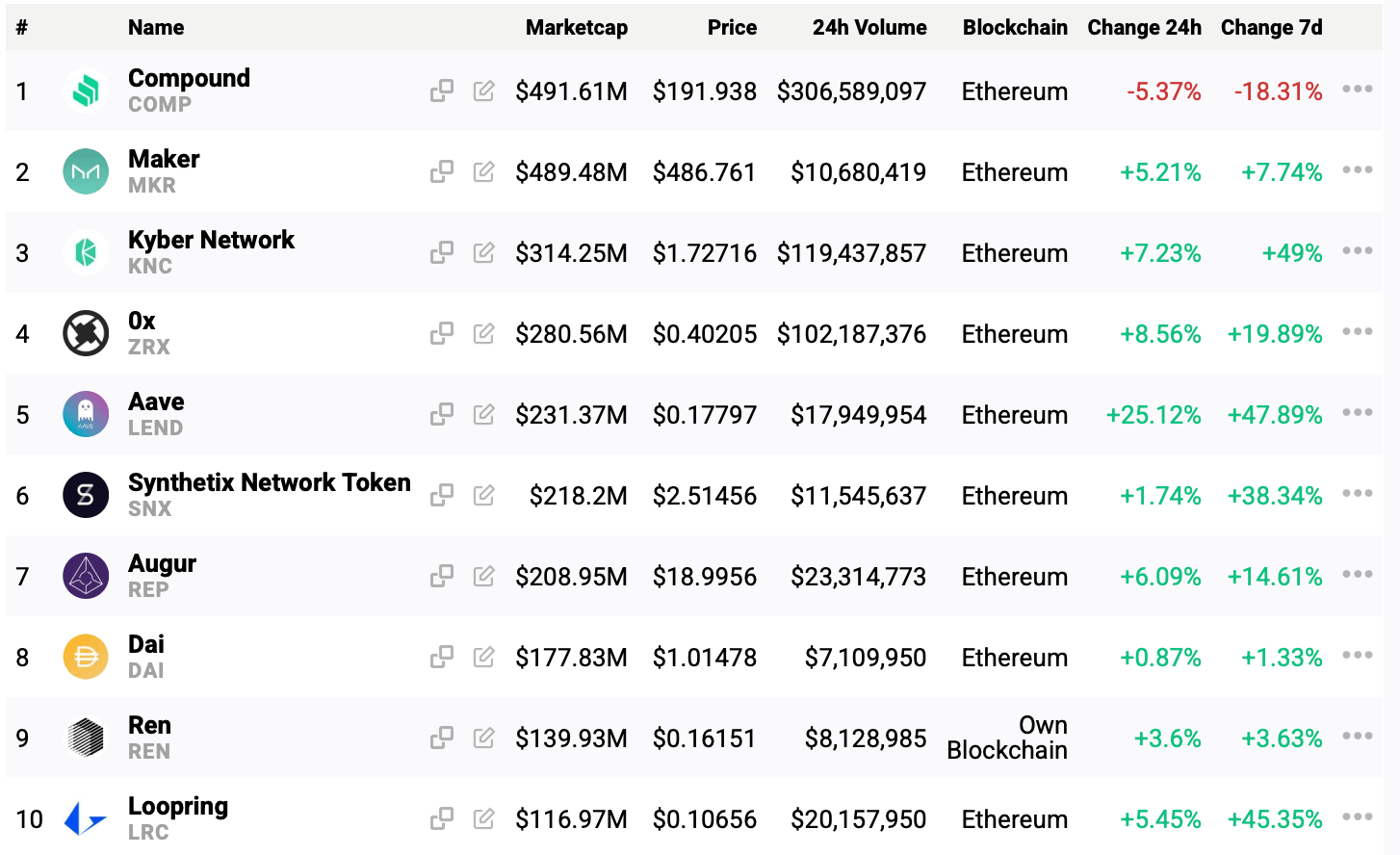

This number is likely to shift in the days and weeks ahead, as DeFi tokens are showing no signs of slowing their ascent. Of the top ten, only one has posted losses over the past seven days.

Investor exodus away from “ghost chains” could help fuel the rise of DeFi

Because there have not been any notable capital inflows into the crypto market, the growth of individual sectors typically comes about at the expense of others.

One group of assets that could soon see outflows that are directed into tokens within the decentralized finance ecosystem are so-called “ghost chains.”

This is a term used to describe blockchains with multi-billion market caps but minimal utilization rates.

An academic research paper from June found that XRP, Tezos, and EOS all have nearly no on-chain activity from actual users.

Spartan Black – a pseudonymous fund manager and former partner at Goldman Sachs – explained that a redirection of 10 percent of these three tokens’ market caps would fuel a 78 percent rise in the value of the top five DeFi crypto assets.

“If 10% of the value (circ mkt cap) of these 3 ghost chains is reallocated to the top 5 DeFi projects, the collective value of the 5 DeFi assets will go up 78%. If I add ADA and XLM into the mix of ghost chains, the latter group’s value will more than double. Think about that.”

It is a strong possibility that the hype surrounding DeFi will cause a departure away from assets with less proven utility.