These poll results may spell serious trouble for Bitcoin in 2020

These poll results may spell serious trouble for Bitcoin in 2020 These poll results may spell serious trouble for Bitcoin in 2020

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

2020 has been a great year for Bitcoin (BTC) so far, with the cryptocurrency incurring massive momentum that has allowed it to rally from lows of $6,800 to highs of $8,900 before hitting any meaningful resistance.

This rally has drastically altered the overall sentiment amongst cryptocurrency investors and has led many investors to anticipate that the markets will see a significant further near-term upside.

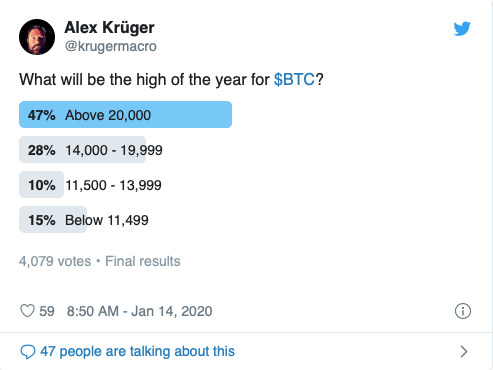

This positivity amongst cryptocurrency market participants is highlighted in a recent poll conducted by a crypto-focused economist, and it may spell trouble for what’s to come next for BTC in the rest of 2020.

Bitcoin’s rally shows signs of faltering as investors grow ultra bullish

Markets have a tendency to trade in a way that causes the maximum amount of pain for traders.

When investors grow ultra-bullish on an asset, bears can use the overleveraged long positions as fuel to perpetuate a downward movement and vice versa.

Because of this, many savvy traders harken back to the classic Warren Buffett quote regarding being fearful when others are greedy, and greedy when others are fearful.

The rally seen by Bitcoin over the past couple of weeks have sparked greed amongst many investors, with astronomical price targets surfacing as many market participants believe that a movement to the five-figure price region is imminent.

This sentiment, however, may be unwarranted, as Bitcoin recently hit insurmountable resistance at $8,900 that has since led it to retrace down to its current price levels around $8,600.

Majority of investors anticipate BTC to close the year above $20k; here’s why that’s a problem

In a recent Twitter poll conducted by crypto-focused economist Alex Krüger, over 47 percent of the 4,079 participants claimed that they believe BTC will end the year over $20,000, while only a mere 14.8 percent voted that it could end the year below $11,499.

If Bitcoin hadn’t gone on a major rally throughout the first few weeks of 2020 and was still trading within the lower-$7,000 region, it is highly likely that these results would differ drastically.

Because there is a sense of overwhelming bullishness amongst investors, it is very possible that the markets will see further downside, with bulls stepping in to reverse the macro Bitcoin downtrend when investors least expect it.

Bitcoin Market Data

At the time of press 6:31 pm UTC on Jan. 17, 2020, Bitcoin is ranked #1 by market cap and the price is up 2.42% over the past 24 hours. Bitcoin has a market capitalization of $161.51 billion with a 24-hour trading volume of $35.32 billion. Learn more about Bitcoin ›

Crypto Market Summary

At the time of press 6:31 pm UTC on Jan. 17, 2020, the total crypto market is valued at at $245.48 billion with a 24-hour volume of $133.01 billion. Bitcoin dominance is currently at 65.76%. Learn more about the crypto market ›

Deribit

Deribit