These on-chain fundamentals will prevent you from investing in a scam token

These on-chain fundamentals will prevent you from investing in a scam token These on-chain fundamentals will prevent you from investing in a scam token

Photo by Tom Roberts on Unsplash

Bitcoin was born to disrupt the global financial system at its core. With the idea of a decentralized, borderless, censorship-resistant, and peer-to-peer version of cash, the flagship cryptocurrency is taking power from governments around the world and giving it to the people. Long gone are the days when trust needs to be deposited on third parties for any given transaction.

These fundamentals have paved the way for Bitcoin’s success over the years leading to the formation of a new industry. Many projects have been brought to life empowered by the use of blockchain technology.

One of them is Ethereum, which targeted the way agreements are made between parties. With its smart contracts protocol, Ether digitally facilitates and verifies the enforcement of agreements.

A significant number of brilliant minds around the world have opted to use blockchain technology to make their innovative ideas come true. But, others have relied on the novelty of the industry to commit fraud.

BitConnect, for instance, was able to capture the attention of unaware investors under the disguise of a decentralized and autonomous way to earn cryptocurrencies. The company promised high returns on investments through its lending program. However, the firm was forced to shut down in early 2018 following warnings from Texas and North Carolina regulators, which led to the collapse of BCC.

Even though there are still many obscure projects within the cryptocurrency industry, on-chain data can help determine their legitimacy.

On-chain metrics to the rescue

Santiment, a behavior analytics platform, affirmed that it is easy to investigate potential exit scams throughout the crypto sphere by diving into the fundamentals. A look at the network activity and development growth can provide an idea of what is happening behind closed doors.

The on-chain insights provider said:

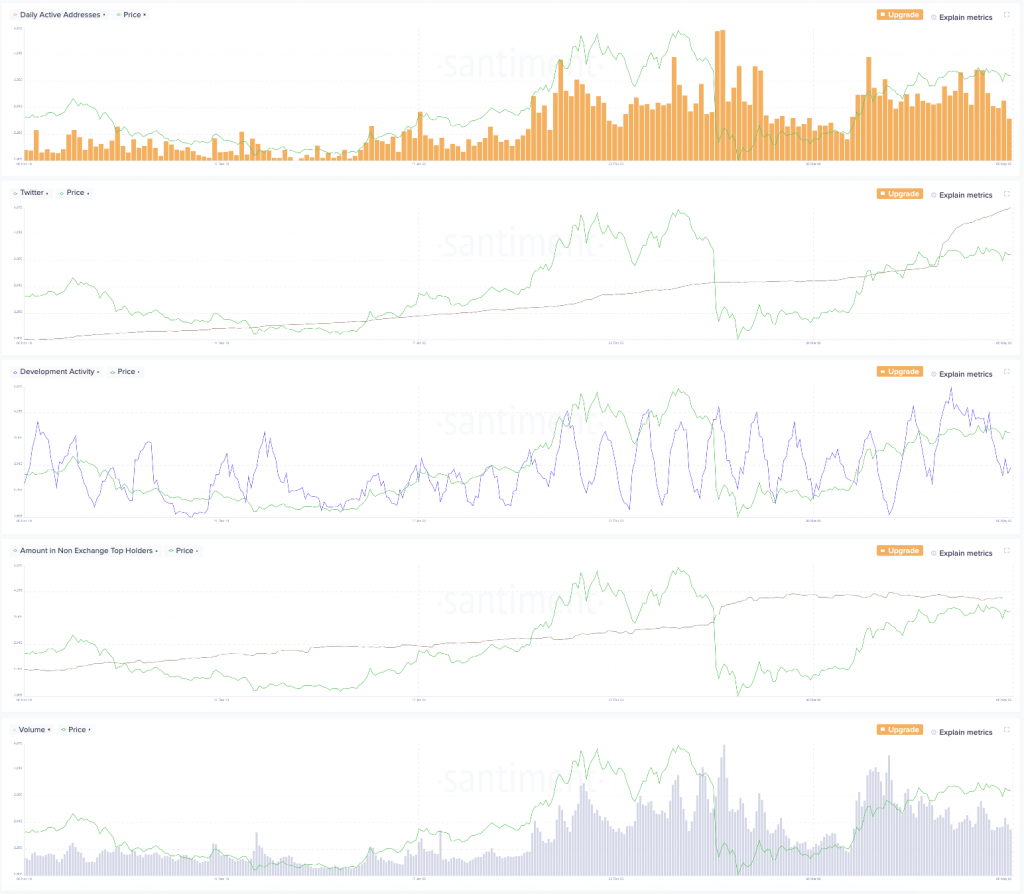

“To accurately look into a project’s health as a true contender [you must] ensure that [it] is showing steadily stable (or preferably increasing) levels of daily active addresses, Twitter growth, development activity rates, amount of top holder funds off exchanges, and trading volume. If all are moving upward, it is a great sign you are in an asset with some serious staying power.”

A glimpse at Chainlink, which is a startup that is trying to close the gap between smart contracts and real-world applications, shows that all the aforementioned on-chain metrics are trending up. This can be considered as a clear sign of its stability and legitimacy.

BitCoin One (BTCONE), on the other hand, does not show the same levels of strength. This altcoin has very sporadic daily active addresses, the amount of top holder funds off exchanges has remained flat over the past six months, and on-chain volume has been on a steady decline.

While this data does not necessarily condemn it a scam, it certainly sets off the alerts.

As the cryptocurrency industry continues to mature, more transparency will be brought to investors through the use of distributed ledger technology. Now, it is in the hands of crypto enthusiasts to do their due diligence in a market that lacks regulatory oversight.

Farside Investors

Farside Investors