Ripple signs-on third largest money transfer service to RippleNet

Ripple signs-on third largest money transfer service to RippleNet Ripple signs-on third largest money transfer service to RippleNet

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

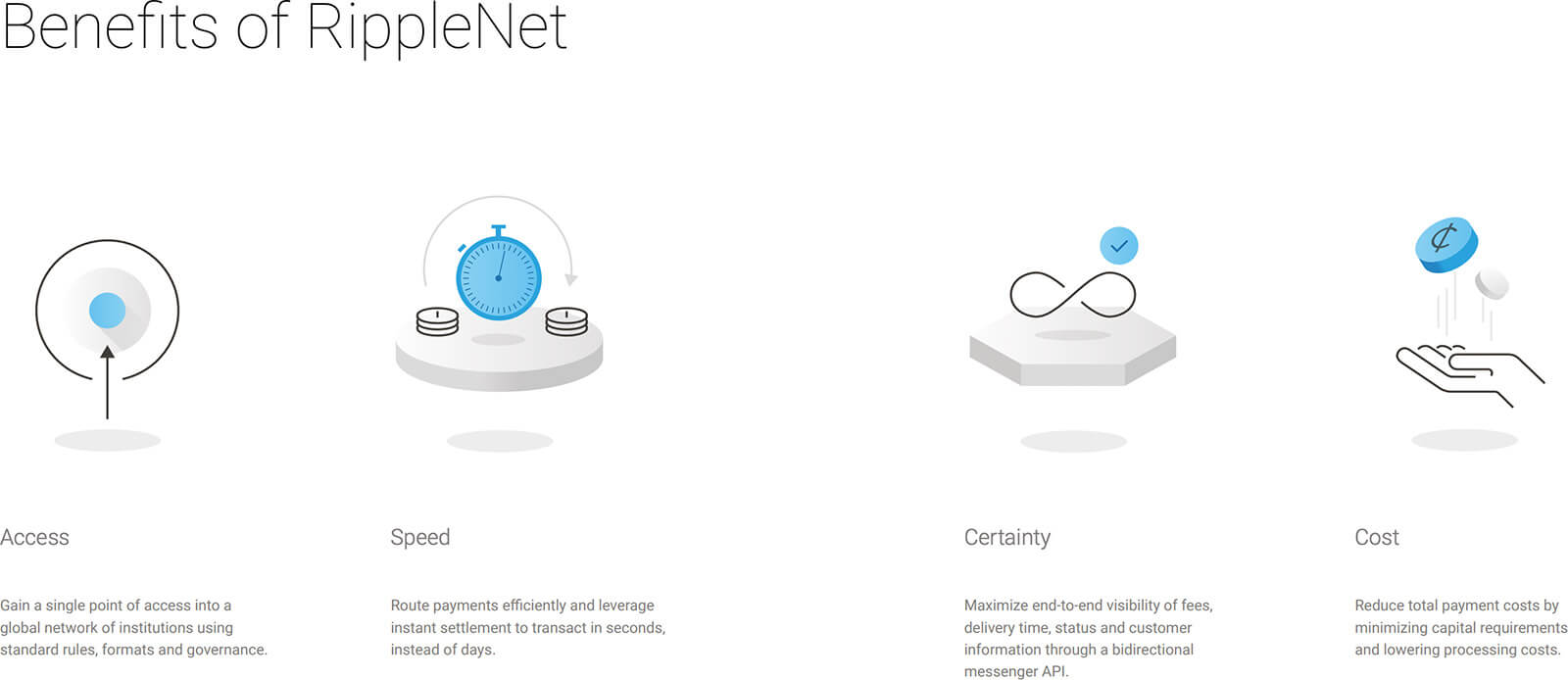

Ria Money Transfer, the third largest money transfer service in the world, joined RippleNet—a settlement layer facilitated by Ripple which streamlines payments through improved technical and operational standardization between participating institutions.

Ria Money Transfer, a subsidiary of Euronet Worldwide (a multi-billion dollar payments conglomerate), operates in 155 countries with over 377,000 locations and facilitates $40 billion in money transfer volume per year.

Ripple announced May 2nd that Ria Money Transfer had joined RippleNet. RippleNet is a competitor to the incumbent SWIFT Network. Established in 1977, SWIFT is used by the majority of international banks for interbank messaging and links more than 11,000 financial institutions. In comparison, RippleNet has a little over 200 financial institutions as part of the network.

Addressing the new partnership, Juan Bianchi, the CEO of Euronet’s money transfer segment, stated:

“Ria’s integration with Ripple serves to build rails for an innovative payment infrastructure that seeks to provide easier access to potential partners while delivering faster and cleaner payments to its users. Time is a vital currency for our customers and partners, so we always keep it at the center of our innovation efforts.”

Those using RippleNet also have the choice to use XRP for “on-demand liquidity” to eliminate the need to pre-fund foreign Nostro accounts, potentially freeing up cash for banks. Transfers involving different currencies can use the XRP Ledger as an intermediary to reduce trading friction between low-volume currency pairs.

Meanwhile, Marcus Treacher, SVP of customer success at Ripple, said:

“This partnership will enable Ripple to expand the reach and solutions for our partners and the overall banking ecosystem. Ria is one of the top money transfer players in the industry, with the second largest network in the world and is known for its world-class service. By joining RippleNet, Ria not only enhances our value chain for our partners but will continue to improve remittance times and costs for both their customer and enterprise clients.”

The new partnership with Ria Money Transfer adds to Ripple’s track record of traction with institutional clients.

XRP Market Data

At the time of press 6:49 am UTC on Mar. 24, 2020, XRP is ranked #3 by market cap and the price is up 0.92% over the past 24 hours. XRP has a market capitalization of $12.95 billion with a 24-hour trading volume of $1.35 billion. Learn more about XRP ›

Crypto Market Summary

At the time of press 6:49 am UTC on Mar. 24, 2020, the total crypto market is valued at at $184.32 billion with a 24-hour volume of $60.12 billion. Bitcoin dominance is currently at 55.49%. Learn more about the crypto market ›

CryptoQuant

CryptoQuant