Ranging weekend for Bitcoin and Ethereum as ‘bearish’ inflows threaten market recovery

Ranging weekend for Bitcoin and Ethereum as ‘bearish’ inflows threaten market recovery Ranging weekend for Bitcoin and Ethereum as ‘bearish’ inflows threaten market recovery

Bitcoin and Ethereum fell back down to lower supports followed by weekend volatility.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Bitcoin and Ethereum prices fell by almost 15% going into the weekend as BTC faced rejection at the $35,000 region once again.

CryptoQuant, a popular on-chain data analysis tool for cryptocurrencies, pointed out a concerning number of inflows of Bitcoin into exchanges during the weekends.

Large numbers of inflows are often seen as a bearish sign and ‘bears’ take advantage of such movements and drive the price lower.

Concerning Flows into the Weekend

Read More ? https://t.co/9VkQqze3zo pic.twitter.com/kWtFbowq3y

— CryptoQuant.com (@cryptoquant_com) June 25, 2021

Analysts predict further downside in the coming days as Bitcoin has failed to break the $35,000 resistance multiple times. Weak volume along with negative news surrounding Bitcoin might fuel the further downside in the coming days.

JPMorgan, one of the biggest banks in America, also stated that the Bitcoin bull run might be over and further downside is very likely.

There are also big concerns about the decline in hashrate for Bitcoin as China continues to crack down mining operations in its territory.

So what’s next for Bitcoin?

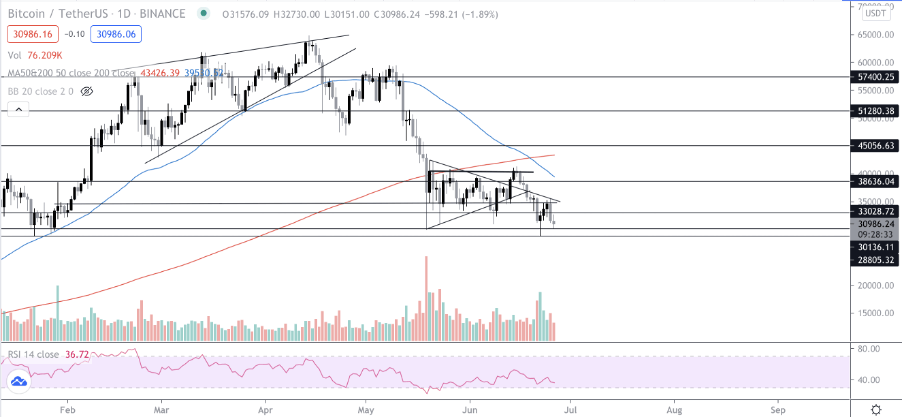

BTC price fell down to lower support of $30,500 once again after a bearish close yesterday, This support has held well in the past but a close below it will surely lead to sub $30,000 levels.

There has been an increase In the volume over the past couple of days but the price has not been affected by it. Bitcoin is currently at the weekly 50MA and it also has weekly support at $32,500.

It is likely that the price might climb back above $32,500 before the week closes. The RSI (relative strength index) looks to be going into the oversold zone once again.

What’s next for ETH?

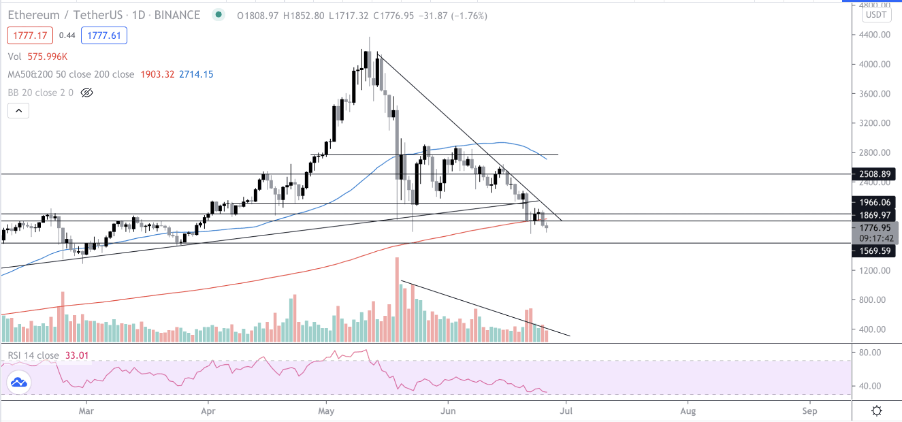

Ethereum (ETH) looks bearish on several time frames now, The price has continued to dip over the last several days and the RSI looks oversold at the same time.

As the below image shows, the daily candle yesterday closed below the 200MA which had been a support region over the last few drops.

This indicates further downside in the coming days however, $1,710 is a weekly support and in case the weekly candle closes below the support the next big support is in the $1,569 area.

The $2,000 price point is important for ETH as it has faced rejection from that area several times.