![[Op-Ed] The curse of permabulls: Why you need to stop listening to Bitcoin maximalists](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2019/12/bitcoin-bull.jpg&w=70&h=37&q=75) [Op-Ed] The curse of permabulls: Why you need to stop listening to Bitcoin maximalists

[Op-Ed] The curse of permabulls: Why you need to stop listening to Bitcoin maximalists [Op-Ed] The curse of permabulls: Why you need to stop listening to Bitcoin maximalists

![[Op-Ed] The curse of permabulls: Why you need to stop listening to Bitcoin maximalists](https://cryptoslate.com/wp-content/uploads/2019/12/bitcoin-bull-768x403.jpg)

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

Those new to the crypto industry often find themselves torn between two extreme views. With a war going on between those shilling Bitcoin’s supremacy and those rooting for its demise, which party should you listen to?

How Bitcoin divided the world

Envisioned as the ultimate solution to the problem of global currencies, Bitcoin is regarded as one of, if not the most important invention of the past decade. But while the world’s largest decentralized digital asset brought on a revolution both in finance and in technology, it also gave birth to some pretty radical philosophies.

It enabled those whose political ideologies were dangerously close to anarchy to back their arguments with cold, hard data—that the idea that Bitcoin is the ultimate way to separate money from the state was backed with a $127 billion market cap.

As Bitcoin’s value increased, the small niche of pro-crypto anarchists turned into a full-blown Bitcoin maximalist movement, shilling the world’s first cryptocurrency as the end all be all of decentralized finance.

However, as the human condition mandates that one extreme view must be countered by another, equally extreme one, the anti-Bitcoin movement was born.

While Bitcoin attracted a rather diverse following, those advocating against it all seemed to be heavily involved in the financial sector. Economists, Wall Street execs, politicians, and traditional investors found themselves united against the idea of an independent, anonymous, and immutable monetary system set out to challenge both fiat currencies and precious metals such as gold.

Extremist philosophies are a danger to the crypto industry

Both of these philosophies present valid arguments. Both of these philosophies are also inherently wrong.

Any type of extremist ideology is poised to target only a small minority of single-minded individuals who almost always fail to see the bigger picture. It also tends to isolate those with more moderate views, who make up the majority of the market.

Those new to the crypto industry might find themselves drawn to the permabulls with the loudest voices. After all, promises of a 100 trillion-dollar marketplace are hard to resist. With billionaires and die-hard Wall Streeters knee-deep in Bitcoin, missing out on the action seems like the worst move in the history of investment.

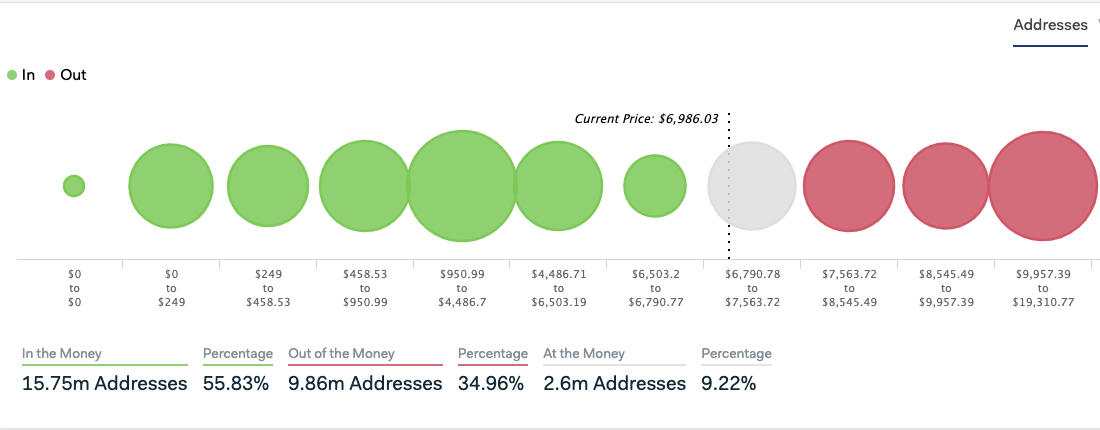

With Bitcoin reported as the best investment of the decade and more than half of all Bitcoin addresses remaining profitable despite the coin’s latest dip, the data really does seem to show saying no to crypto is a bad decision.

However, what bulls fail to see is that the data shows more than a third of all Bitcoin addresses are also at a loss, having bought BTC for more than its current price.

Likewise, the carefully orchestrated media campaign against Bitcoin paints a picture of a volatile market created out of thin air. Some even go as far as calling it a Ponzi scheme and a “glorified spreadsheet.”

What makes both of these views dangerous is the fact that they’re both almost impossible to disprove. Jim Angel, a professor at the Georgetown University School of Business, warned about the dangers of the Bitcoin bubble back in 2017. He explained that because Bitcoin is such a unique phenomenon, the market won’t crash “swiftly and harshly” as it did during the dot-com bubble. If it does crash, it will be a slow and painful deflating rather than a sudden burst.

Therefore, it might take another 50 or more years before the market reaches a low enough point that the permabulls admit defeat. It also might take 50 more years of a volatile market before those fighting against cryptocurrencies admit that Bitcoin does have an intrinsic value.

And that is the curse of the Bitcoin maximalists—listening only to the permabulls or the permabears paints an incomplete picture of the market, even though it might be true.

Choosing which extreme path to take when you enter the crypto industry is a difficult choice.

Good thing the answer is—none.

Deribit

Deribit