MicroStrategy records $918M impairment loss in Q2, Saylor moves to new Chairman role

MicroStrategy records $918M impairment loss in Q2, Saylor moves to new Chairman role MicroStrategy records $918M impairment loss in Q2, Saylor moves to new Chairman role

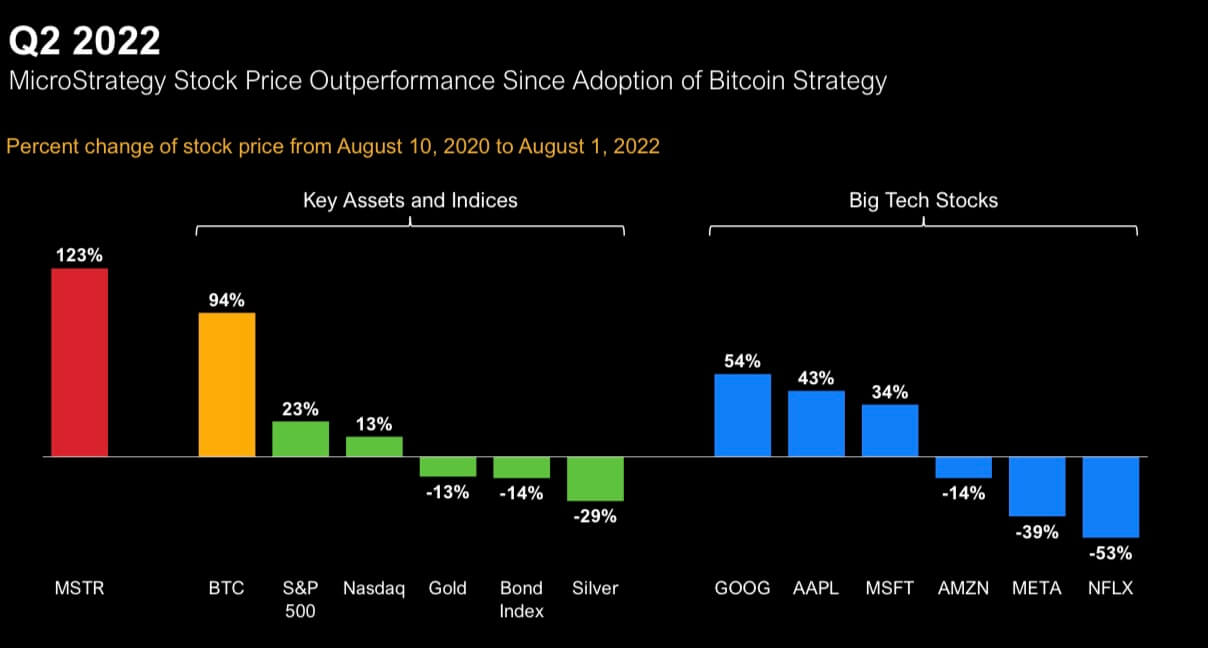

Despite the losses, MicroStrategy stock has outperformed Nasdaq, Gold, Silver, and even some of the biggest tech companies after its Bitcoin adoption.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

MicroStrategy recorded an impairment charge of $918 million on its Bitcoin (BTC) holdings in the second quarter, according to its earnings report released on August 2.

The report also revealed that the company will create a new role of executive chairman, which Michael Saylor will fill.

Meanwhile, Phong Le, the company’s president and chief financial officer, will become the new CEO taking over from Saylor, while remaining president Andrew Kang will become the new Chief Financial Officer.

MicroStrategy’s Bitcoin holding

The business intelligence firm holds 129,699 Bitcoins and is valued at $1.988 billion as of June 30.

According to the firm, this reflects a cumulative impairment loss of $1.989 billion since it began its Bitcoin acquisitions in 2020. The firm stated that its average cost per bitcoin is approximately $30,664.

Meanwhile, the company has maintained that it would continue to hodl its Bitcoins despite the losses incurred.

Since MicroStrategy’s Bitcoin adoption, its stock has outperformed Nasdaq, Gold, Silver, and even the stock performance of some of the biggest tech companies like Google, Meta, Netflix, Microsoft, etc.

Michael Saylor to become new executive chairman

Michael Saylor revealed that he would be stepping down as MicroStrategy’s CEO during the earnings call.

Saylor added that he will now be able to focus on accumulating more cryptocurrency for the company in his new role. Saylor said:

“As Executive Chairman I will be able to focus more on our bitcoin acquisition strategy and related bitcoin advocacy initiatives, while Phong will be empowered as CEO to manage overall corporate operations.”

Short positions on MicroStrategy’s shares

Bloomberg News reported that short positions on Microstrategy stock had grown recently.

According to the report, 51% of MicroStrategy’s available shares are sold short and are worth approximately $1.4 billion.

The report continued that the short positions rose by 680,000 shares in the last seven days and by 1.2 million shares over the last 30 days.

CryptoQuant

CryptoQuant