Liquid staking tokens rally by 15% as Ethereum Shapella upgrade draws near

Liquid staking tokens rally by 15% as Ethereum Shapella upgrade draws near Liquid staking tokens rally by 15% as Ethereum Shapella upgrade draws near

Liquid staking platform tokens have seen their values increase following news that staked Ethereum withdrawals would be enabled on April 12.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

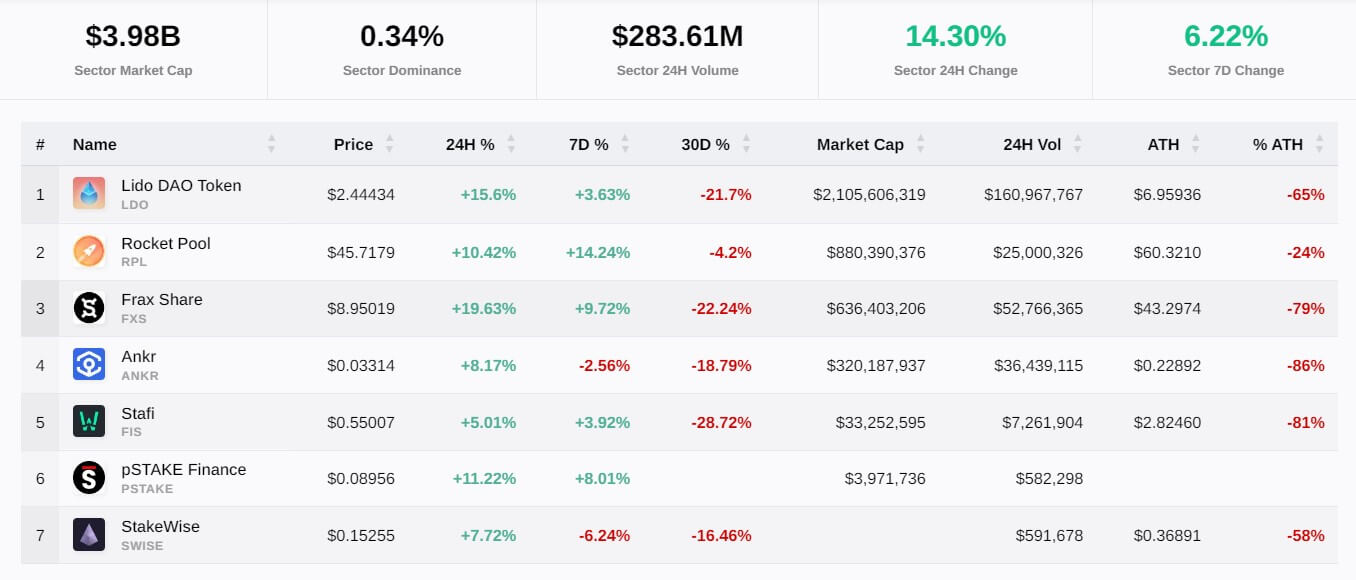

Liquid staking is the best-performing crypto sector in the last 24 hours after rallying by more than 15%, according to CryptoSlate data.

According to the data, all seven projects in the space soared by more than 5%, with two of them — Lido (LDO) and Frax Share (FXS) — among the top five gainers for March 29.

Liquid staking derivatives (LSD) platforms have enjoyed renewed interest following news that the highly anticipated Shapella network upgrade — enabling staked Ethereum withdrawals — will activate on April 12 at epoch 194048, according to an Ethereum Foundation statement.

Frax Share leads peers

According to CryptoSlate data, Frax Share’s FXS is the best-performing liquid staking derivatives token over the reporting period — up 19.63%.

FXS is the governance token of Frax Protocol and has seen its price increase significantly after launching a liquidity staking program late last year.

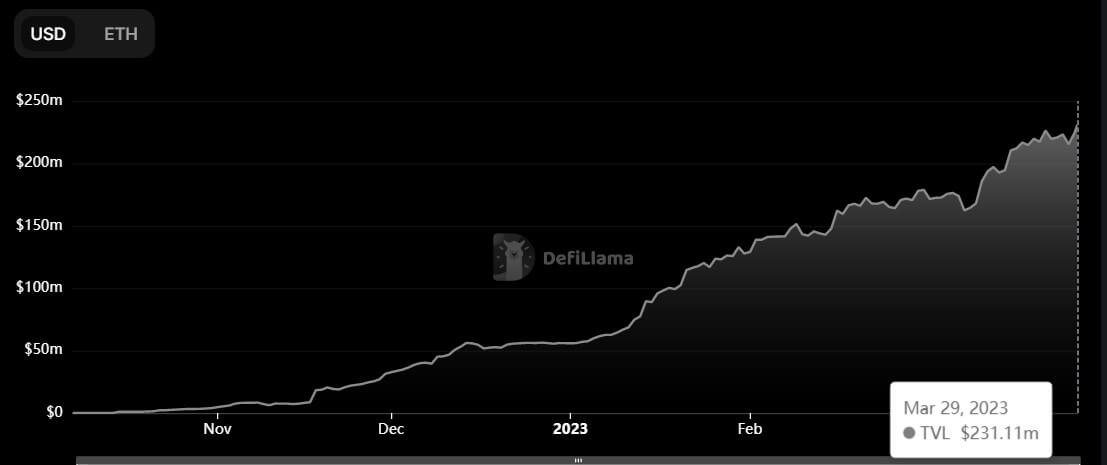

The total value of assets locked (TVL) in Frax Ethereum (frxETH) surged 31.49% in the past 30 days to an all-time high of $231 million — equating to 131,970 ETH tokens, according to DeFillama data.

In February, Blockchain analytical firm Nansen reported that frxETH’s supply grew by 70,000 ETH within three months.

Lido remains dominant LSD

Meanwhile, Lido remains the dominant staking platform in the crypto industry. Its LDO token increased by 15.57% in the past 24 hours to $2.43 at the time of writing.

Despite Lido developer’s decision to sunset its staking services for Polkadot and Kusama, the protocol’s TVL rose 6.51% to $10.89 billion.

According to Dune Analytics data, the protocol accounts for roughly 32% of all staked ETH — translating to around 5.8 million tokens.

Besides that, it is also the most dominant decentralized finance protocol — with a 21.8% market dominance, according to DeFillama data.

Meanwhile, other staking protocols like Rocket Pool (RPL), StakeWise (SWISE), ANKR, and Stafi (FIS) all recorded positive gains in the last 24 hours. Overall, the market cap of the crypto tokens in this sector sits at $3.98 billion as of press time.

In the last 24 hours, DeFillama data shows that the top 10 liquid staking protocols — except Marinade Finance — saw their TVL rise by an average of 5%.