Is Aave destined to stay the top DeFi lending platform?

Is Aave destined to stay the top DeFi lending platform? Is Aave destined to stay the top DeFi lending platform?

Crypto lending has become one of DeFi's most promising use applications, ushering in an influx of dozens of platforms, tools, apps and participants all claiming to revolutionize how tokens are loaned and borrowed.

Photo by Fabrice Villard on Unsplash

According to Footprint, the number of platforms in the DeFi lending category grew by 263% to 69 since December 2020, setting a record TVL of $48.44 billion, accounting for 21.04% of all DeFi platforms and networks’ entire TVL.

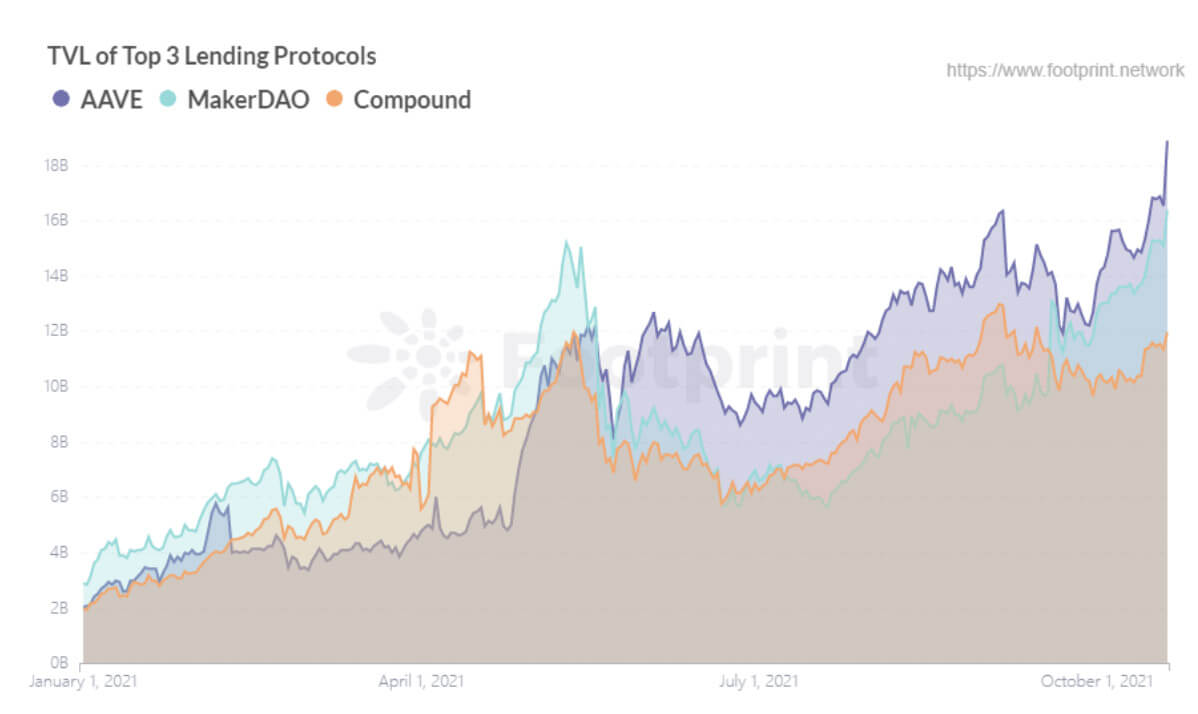

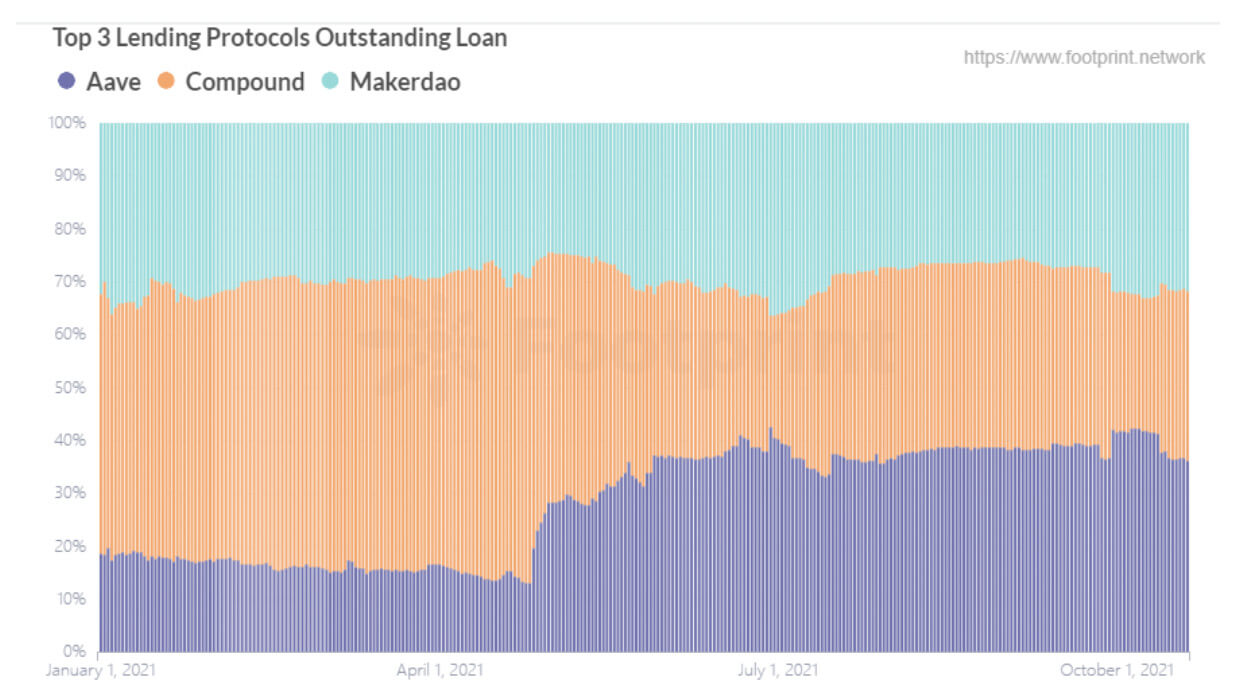

The most important lending platforms to have emerged are Aave, MakerDAO and Compound—they dominate the category in terms of TVL. However, while Compound used to be the strong favorite, the May 19th Crypto Market Crash reshuffled the leaderboard and Aave took the lead.

As indicated in the chart below, MakerDAO and Compound have performed poorly in recent months.

Therefore, many people are wondering whether Aave is on top because it’s a particularly strong platform or because its competitors temporarily fell behind. The answer determines your assessment of Aave locking in your tokens in the long term, and also who to watch for insights about the future of crypto lending.

Data overview

When we look at the data, it becomes clear that Aave has several strong advantages that indicate it will continue to be a market leader in DeFi lending. Namely, it is highly secure, innovative, and has recently launched Aave Pro, which gives it an enormous head start as traditional finance starts to buy into crypto.

Project Background

Aave, formerly known as ETHLend, was launched on Ethereum in November 2017. The platform’s initial mode of operation was similar to that of P2P—with the online platform matching borrowers and lenders through smart contracts in a peer-to-peer fashion. But the development model was soon adjusted aftermarket reaction was subdued.

In 2019, the project completed a brand upgrade and was renamed to Aave (or “ghost” in Finnish), and went live in January 2020. This version provides liquidity by establishing a pool of funds and focuses on solving the problem of inefficient aggregation of lending needs. Users deposit collateral assets and then borrow assets within the collateral rate without a need for matching.

In the succeeding months, the platform achieved the following milestones:

- July 2020: received $4.5 million from ParaFi and $3 million in strategic funding with participation from Framework Ventures and Three Arrows Capital. It also released its economic proposal, Aavenomics, which included the conversion of the original token Lend to AAVE and the issuance of an additional 3 million tokens, a security module, lending incentive, among others.

- October 2020: secured $25 million in funding led by Blockchain Capital and Standard Crypto, in addition to receiving approval from the U.S. SEC to register as an Ether Trust.

- February 2021: completed its V2 upgrade then launched the AMM marketplace the following month, allowing liquidity providers to pledge LP tokens from Uniswap and Balancer for loans

- April 2021: offered token incentives to borrowers and lenders through its liquidity mining program

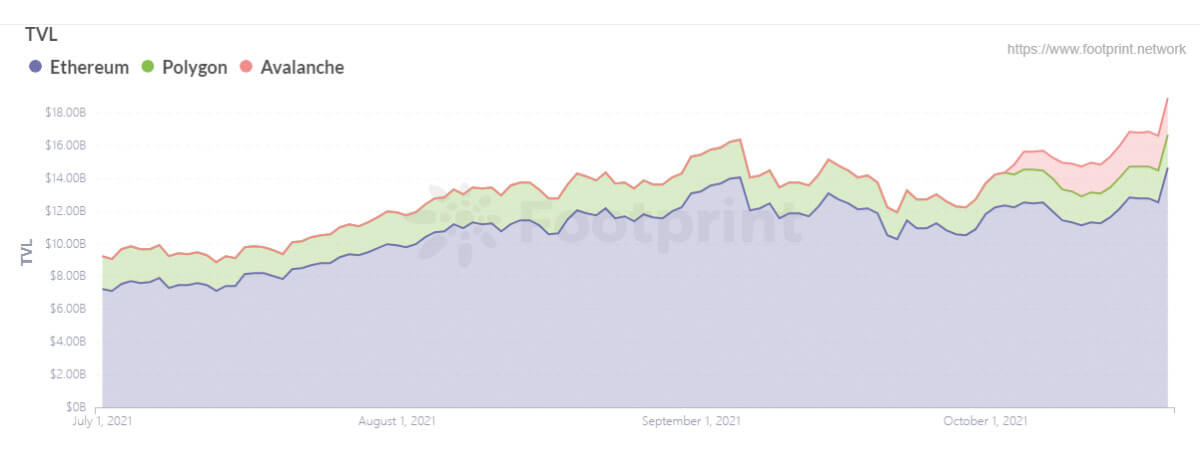

- May 2021: deployed and launched the Polygon chain

- July 2021: launched a new product for institutional clients Aave Pro

- October 2021: deployed and launched Avalanche.

Economic model

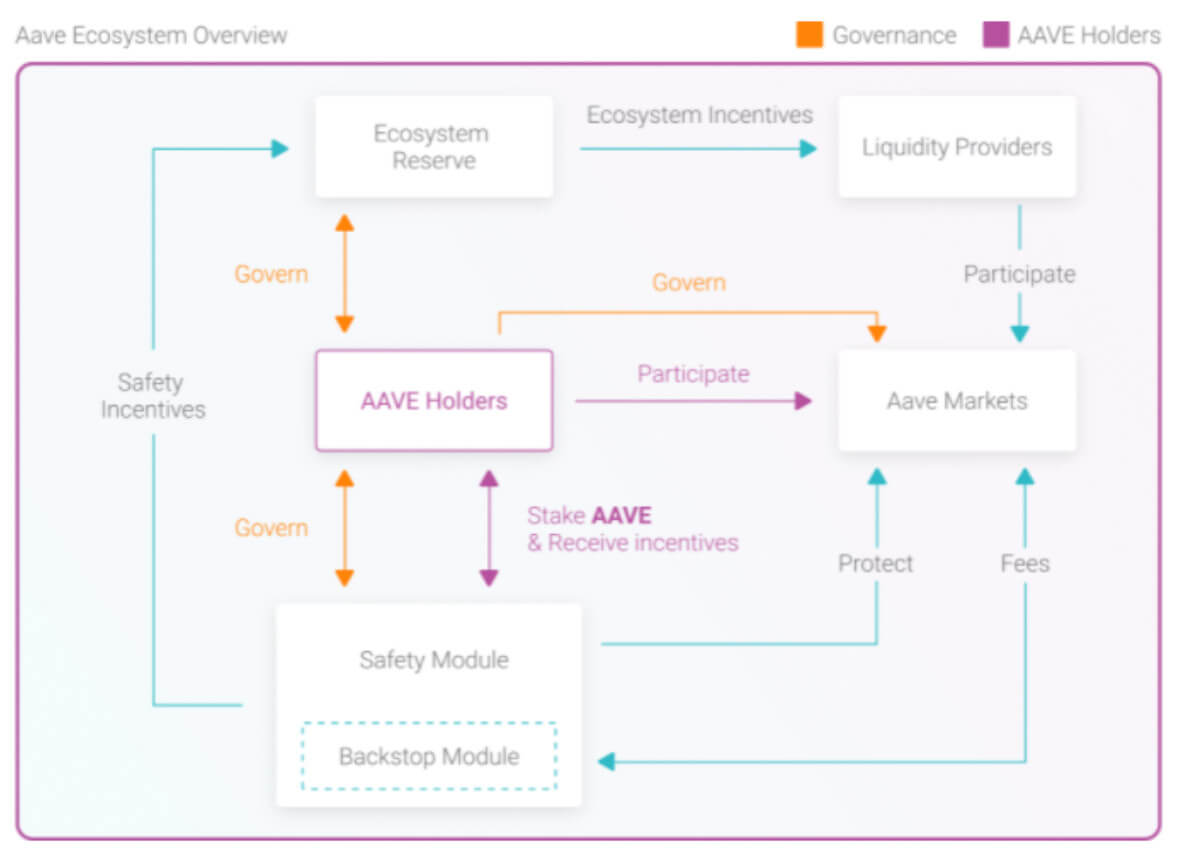

Aave’s economic model, which went live in July 2020, has three main uses for the token AAVE, namely community governance, safety module building and ecosystem rewards.

- Community Governance: Users holding the platform token AAVE can participate in community governance, such as participating in voting on the protection of the platform ecosystem, updates to the safety module mechanism, new feature iterations, etc. One AAVE token is equivalent to one vote.

- Safety Module Construction: Users can pledge their token AAVE holdings into a security pool, which is used to protect against risk events such as contract breach risk, liquidity risk (liquidation risk arising from insufficient collateral coverage), and prophecy machine risk (caused by network congestion or market crash and where the prophecy machine cannot update the price or the price is provided incorrectly).

- Ecosystem Rewards: Token rewards given to borrowers and lenders, equivalent to liquidity mining.

Aave has put a lot of effort and innovation into security, not only by incorporating a safety module as part of the ecology and thus providing a safety cushion for risky events, but also by rewarding those who find security vulnerabilities. These proactive initiatives continue to support Aave’s breakthrough development.

Flash Loan

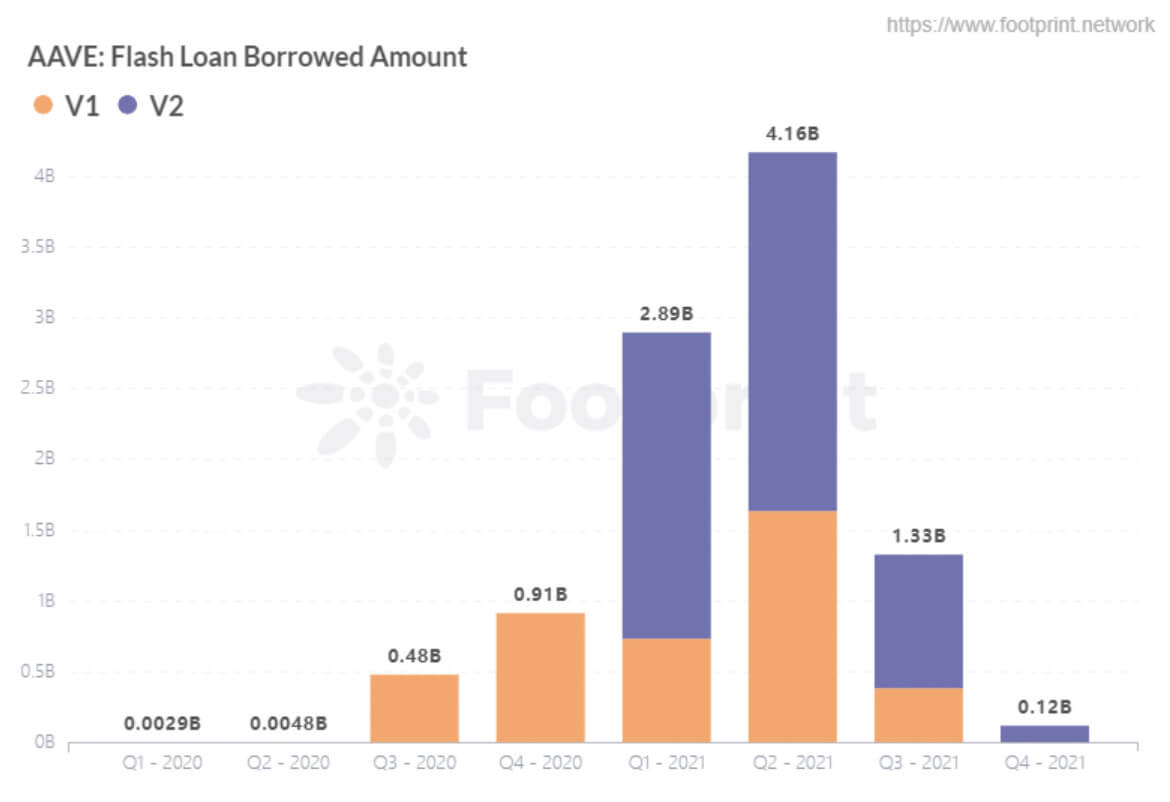

Aave also has a first-of-its-kind advantage over other lending platforms through Flash Loan. The product has a certain threshold for users and is suitable for developers with some programming skills. It is characterized by the ease with which users can obtain loans without the need to pledge any assets. They would have to simply return the borrowed funds within the same block (about 15 seconds). If they are unable to repay the loan in the same block, the transaction is revoked without any impact on the user. But, if the loan is successful, they are charged a 0.09% fee.

As of this writing, Flash Loan has surpassed $9.8 billion in cumulative lending volume and is expected to surpass $10 billion by the end of October. Although the entire crypto industry is in a recovery phase after the 519 Crypto Market Crash and Flash Loan’s transaction volume has declined, there is no denying the explosive growth of the product, building a strong momentum to support Aave to overtake Compound and MakerDAO.

Asset classes and interest rates

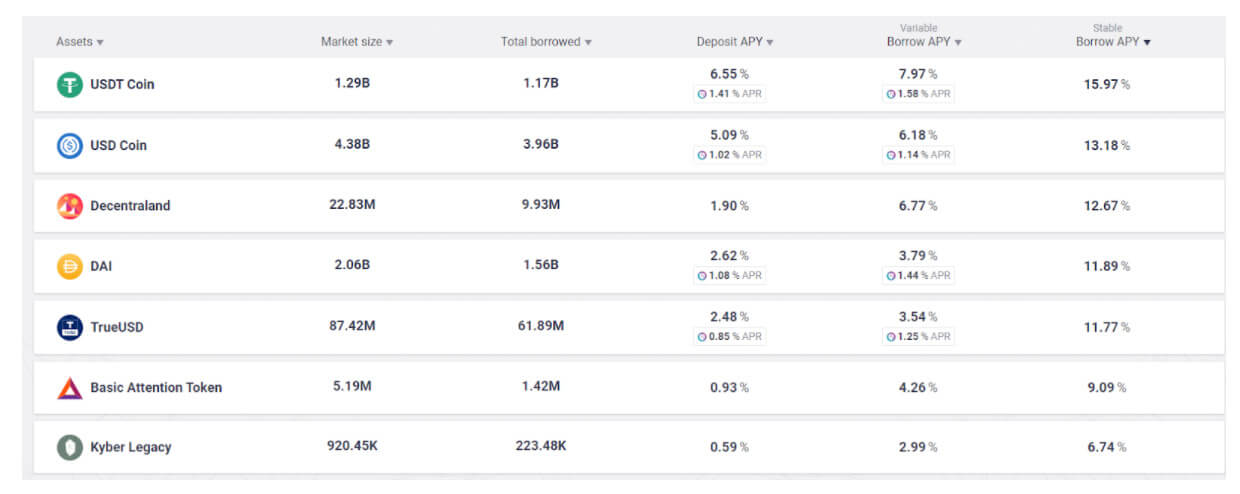

The V1 and V2 versions support 31 types of assets in single token pledges, mainstream cryptocurrencies and emerging cryptocurrencies. On the other hand,the AMM version supports LP token pledges for Uniswap and Balancer, with 16 types of assets. This differentiated strategy satisfies the lending needs of multiple groups, attracts more users to participate and retain, and also accelerates the expansion and influence of the platform, laying the foundation for achieving a bend in the road.

The strength of the asset range has allowed Aave to expand its pool of funds and has given it more scope to create unique interest rate advantages. First, the overall borrow APY is lower than other platforms (capital utilisation in the same dimension), with liquidity subsidy for depositors and borrowers (although this is not an Aave initiative).

Second, it is a pioneering interest rate swap that allows users to choose between a variable borrow APY or stable strategy borrow APY. If they choose a higher rate, they can switch to a lower rate strategy, giving them access to lower-cost funding in a more volatile and decentralised market.

Aave Pro

The success of Aave’s V2 trial of the credit delegation model where loans can be obtained without collateral paved the launch of the Aave Pro project, which integrates DeFi with traditional finance and provides a new gateway to DeFi for offline investment institutions.

It caters to individual investors who have very limited funds compared to institutional investors. In addition to this, DeFi has experienced explosive growth for over a year, but has not lasted as long as before.

The OTC funds are more often pooled in the hands of institutional investors. As an electronic money institution licensed by the FCA in the UK, Aave can ensure the safety of funds in a more compliant and secure dimension to allow institutional investors to participate and promote the good development of the whole ecosystem.

Aave Pro is different from the original V1, V2 and even AMM. For one, Aave Pro is only developed for OTC institutional investors, with only four assets launched – USDC, BTC, ETH and AAVE. Second, Aave Pro is a private pool, which is completely separate from the Aave protocol pool, so that the risks are completed independently.

Third, participating investment institutions need to pass the KYC verification of Fireblocks, assess the credit rating through KYC information, and adopt different collateral rates according to different credit ratings, which greatly reduces the security of funds.

Summary

Aave took the lead in lending because of its team instead of coincidence. Not only processing a tightened control over security and compliance, Aave team also continually sought out breakthroughs and innovation in DeFi lending. With the launch of Aave Pro, in particular, Aave has gradually opened a gap with the top lending platforms and is set to usher in a new round of development for DeFi in a new direction.

What is Footprint

Footprint is an all-in-one analysis platform for blockchain data visualisation and insight discovery. It cleans and integrates on-chain data so users regardless of experience level can immediately start researching tokens, projects and protocols. With over a thousand dashboard templates plus a drag-and-drop interface, anyone can build customized charts in minutes. Uncover blockchain data and invest smarter with Footprint.

Arkham Intelligence

Arkham Intelligence