US spot Bitcoin ETF could dwarf Canada’s $370 million market cap ETF success

US spot Bitcoin ETF could dwarf Canada’s $370 million market cap ETF success Quick Take

As anticipation builds around introducing a spot Bitcoin ETF in the United States, the world’s largest financial capital market, a comparative analysis with the Canadian market provides intriguing insights.

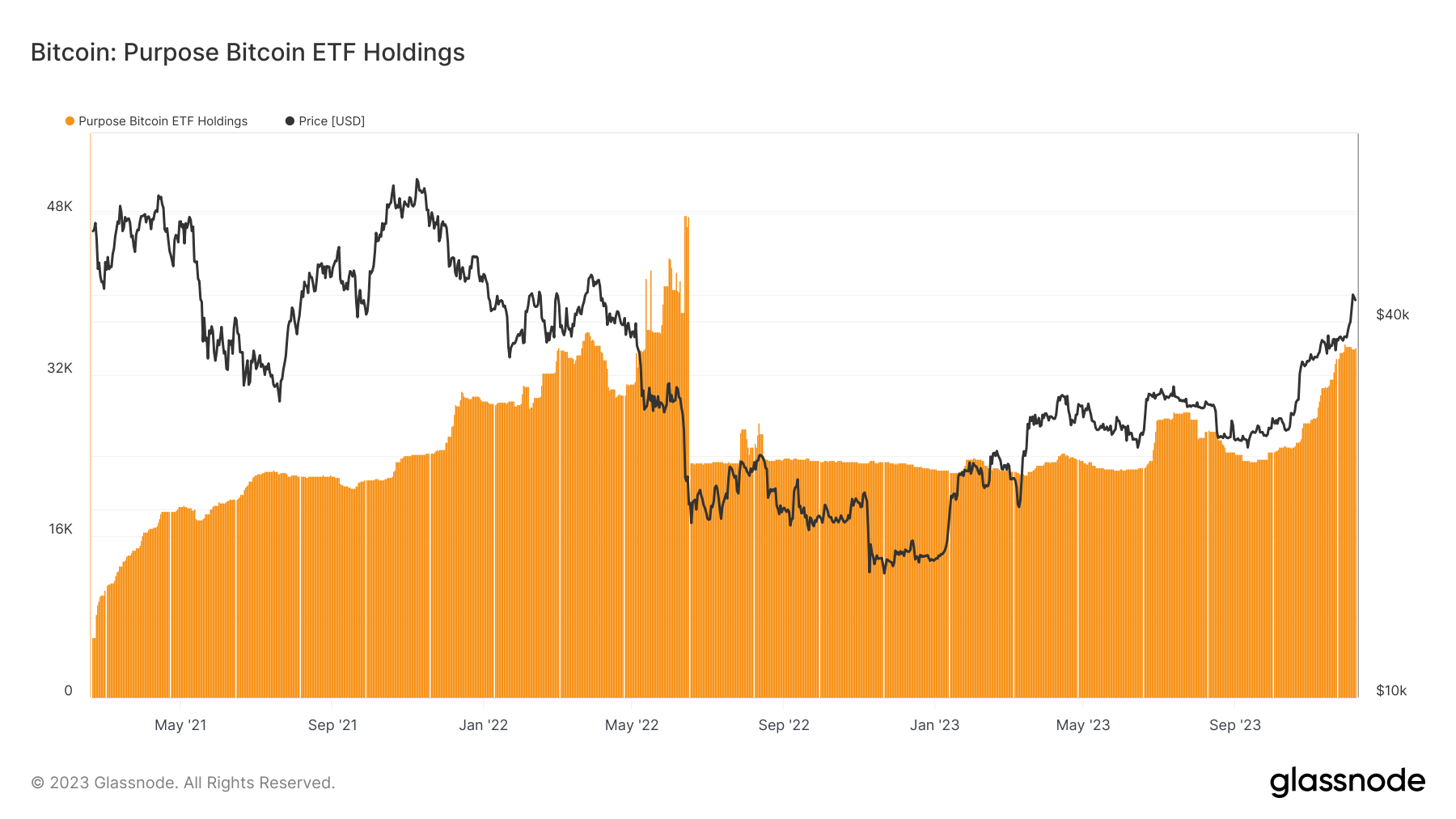

Canada is already home to a spot Bitcoin ETF, Purpose, possessing a market cap of roughly USD$370 million, with holdings of about 34,000 Bitcoin. The year-to-date performance of Purpose is up approximately 156%.

The enormity of the US market becomes pertinent when we compare it to Canada’s stock and bond market, pegged at approximately $6 trillion. In contrast, the US bond and stock markets hover at around $180 trillion – about 30 times larger.

Should a Bitcoin ETF be launched in the US and align with the market proportion seen in Canada, it could register a significant presence. Global investment management firm VanEck predicts a spot Bitcoin ETF listed in the US could reach $40.4B within 2 years, which would place it just outside the top 30 places in the list of total ETFs.