The shrinking giant: Fed’s balance sheet down by $1T

The shrinking giant: Fed’s balance sheet down by $1T Quick Take

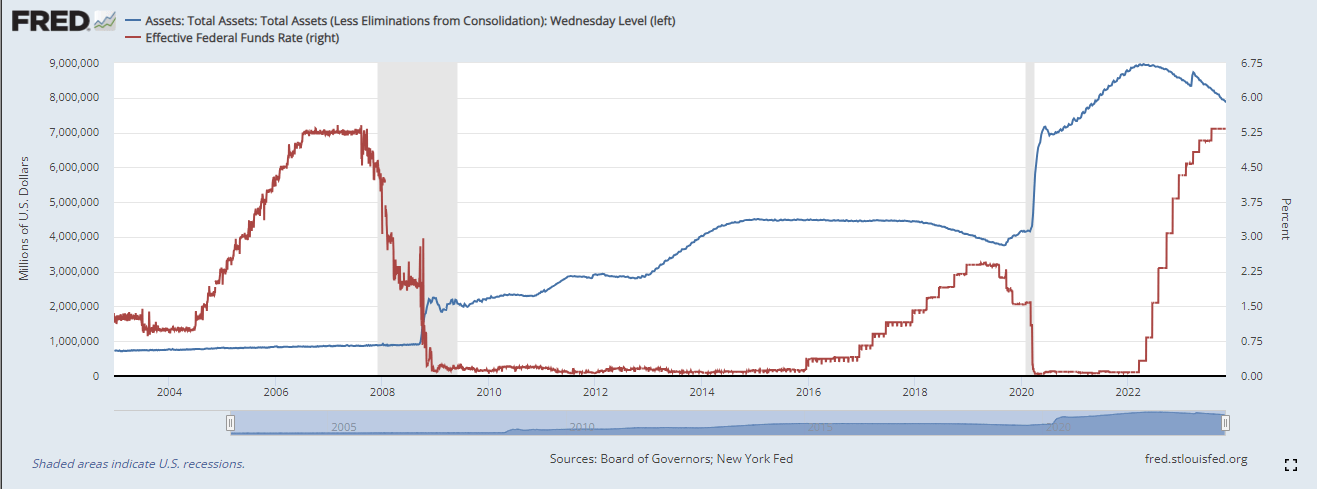

The Federal Reserve’s balance sheet has seen another sizeable reduction this past week, shedding approximately $40 billion. This now brings the balance sheet’s cumulative contraction to around $1 trillion from its peak. At its zenith, the balance sheet surged to an unprecedented $8.96 trillion.

Currently, it stands at a slightly more modest $7.86 trillion, indicating a reduction of approximately $1.1 trillion. However, it’s important to contextualize this contraction within the broader economic landscape. Even with this reduction, the balance sheet remains $3.5 trillion larger than before the COVID-19-induced expansion.

A recession has followed instances of interest rate hikes by the system since 2006. We observed this pattern when the Fed increased rates to 5.25; as the recession ensued, the rates dropped, and the balance sheet inflated. A similar circumstance unfolded on the verge of the COVID-19 pandemic in 2019. This poses the critical question: Are we poised to witness a recurrence of this cycle?