Short-term Bitcoin holders may have cashed in $3B as long-term investors hold steady

Short-term Bitcoin holders may have cashed in $3B as long-term investors hold steady Quick Take

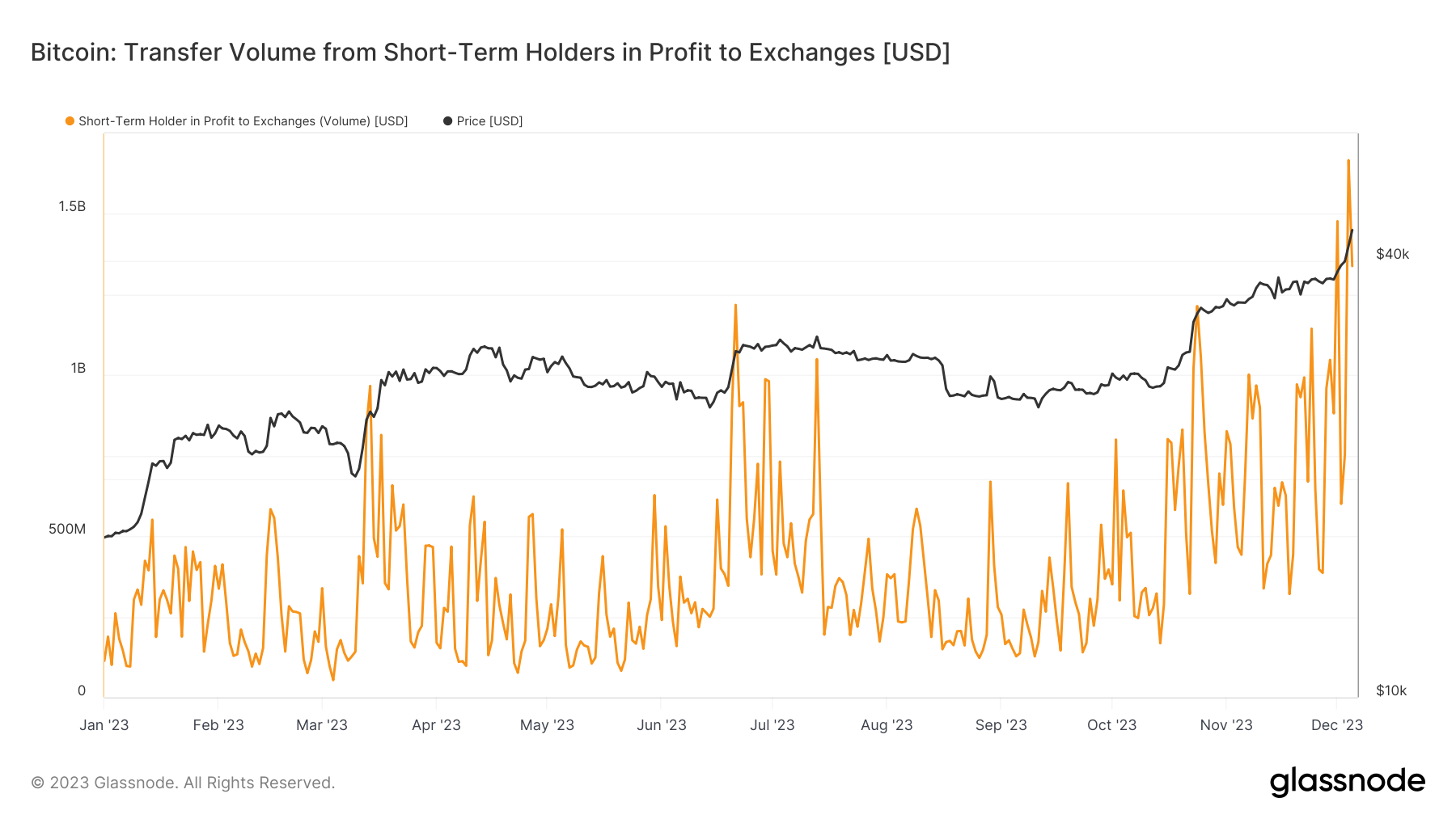

Recent analysis by CryptoSlate reveals a trend among short-term Bitcoin holders. On Dec. 1, amid the unprecedented profit taking of around $1.5 billion, Bitcoin has since increased by 13% since then. This surge coincided with a new record in potential profit-taking by short-term holders – investors who have acquired Bitcoin within the last 155 days. This peak was marked by a total of $1.7 billion worth of BTC on Dec. 4.

The trend persisted as Bitcoin surpassed the $44k mark on Dec. 5, as coins sent to exchanges were in profit by roughly $1.3 billion. These events indicate that Bitcoin’s ecosystem witnessed a staggering $3 billion worth of coins in profit sent to exchanges in just two days.

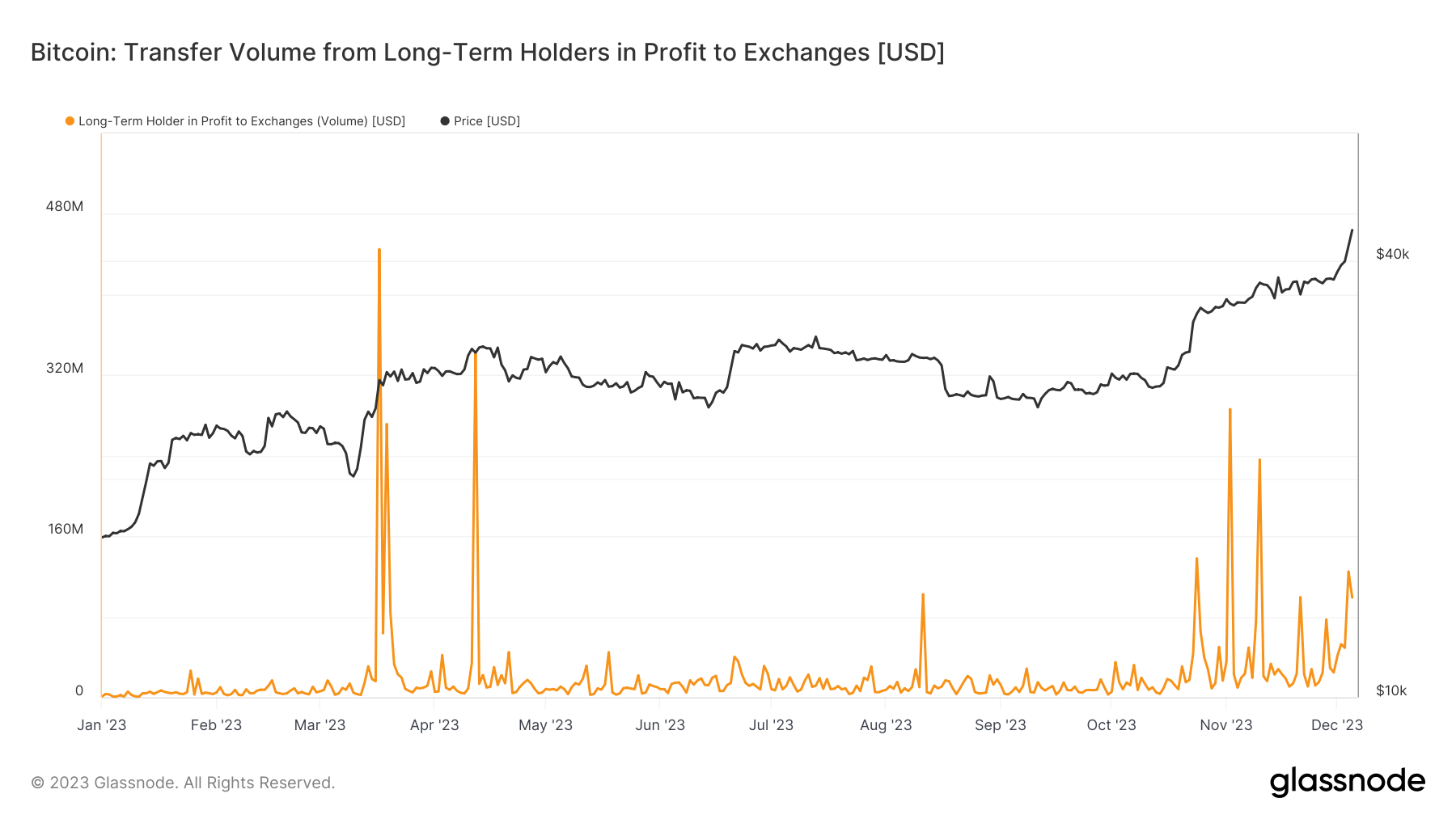

In a noticeable shift, long-term holders who have retained Bitcoin for more than 155 days have likely begun to realize profits. Over the past two days, the profit-taking actions by this group have approached roughly $225 million. While this figure appears significant compared to the trend observed in 2023, it’s important to note that long-term holders continue to hodl their Bitcoin positions, suggesting a sustained confidence in the long-term value of the digital asset.