Record surge in Bank Term Funding Program hints at underlying instability in U.S. Treasuries

Record surge in Bank Term Funding Program hints at underlying instability in U.S. Treasuries Quick Take

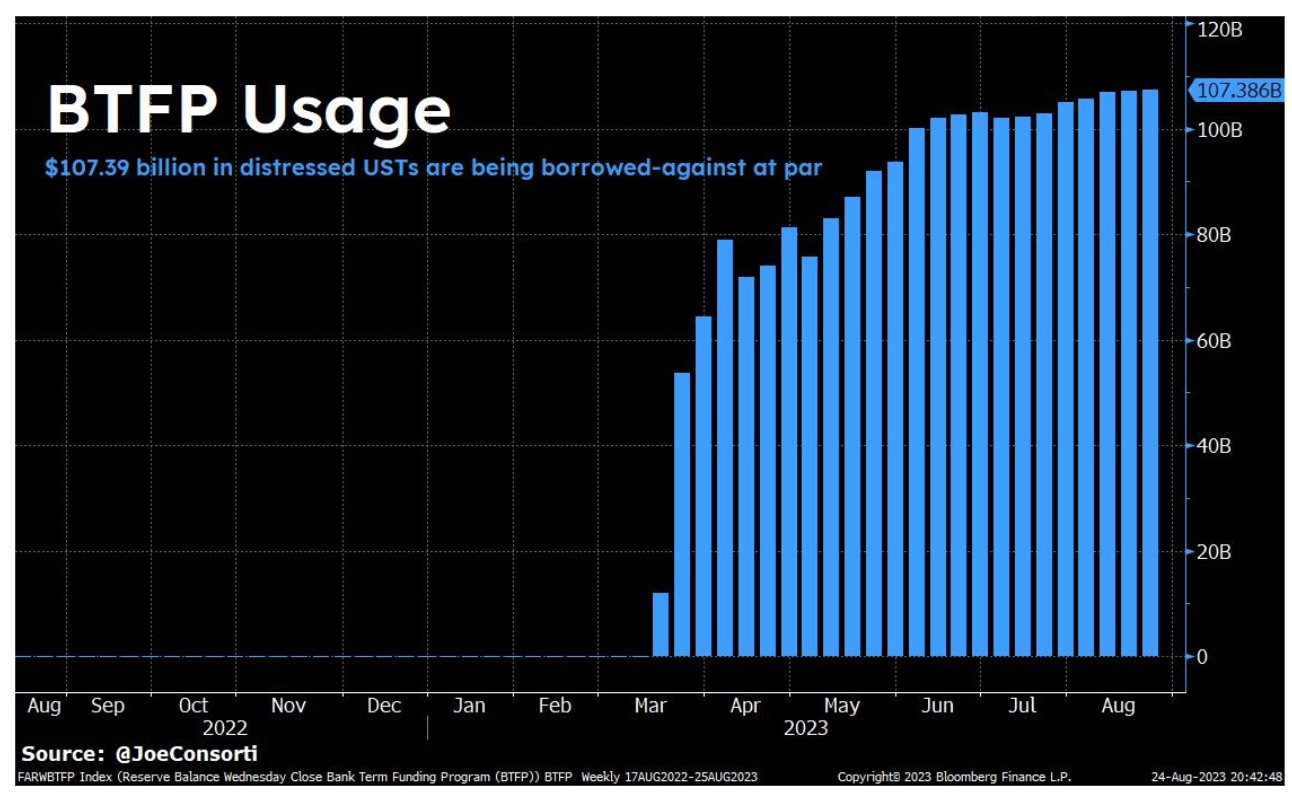

Based on the data analysis from analyst Joe Consorti, the Bank Term Funding Program (BTFP) has surged to a record $107.39 billion. This significant increase in the BTFP, a program instituted following the collapse of Silicon Valley Bank in March 2023, underscores the critical financial environment that led to the creation of this emergency funding strategy in the first place.

However, Consorti warns that this surge could be a veneer over the troubling losses on impaired U.S. Treasuries, suggesting a potential underlying instability. The broader implication of growing BTFP and its correlation with impaired Treasuries warrants careful attention, as these indicators may signal future trends in the financial sector.