Powell suggests slower Fed balance sheet reduction, boosting Bitcoin and Gold

Powell suggests slower Fed balance sheet reduction, boosting Bitcoin and Gold Quick Take

The US Federal Reserve’s recent policy stance has had noticeable effects on various financial assets. The Fed maintained the fed funds rate at 5.25 – 5.50% on March 20 and signaled a slowed pace of balance sheet reduction.

According to Zerohedge, Jerome Powell said, “We did not make any decisions today. The general sense of the committee is that it’ll be appropriate to slow the pace of runoff fairly soon, consistent with the plans we previously issued.”

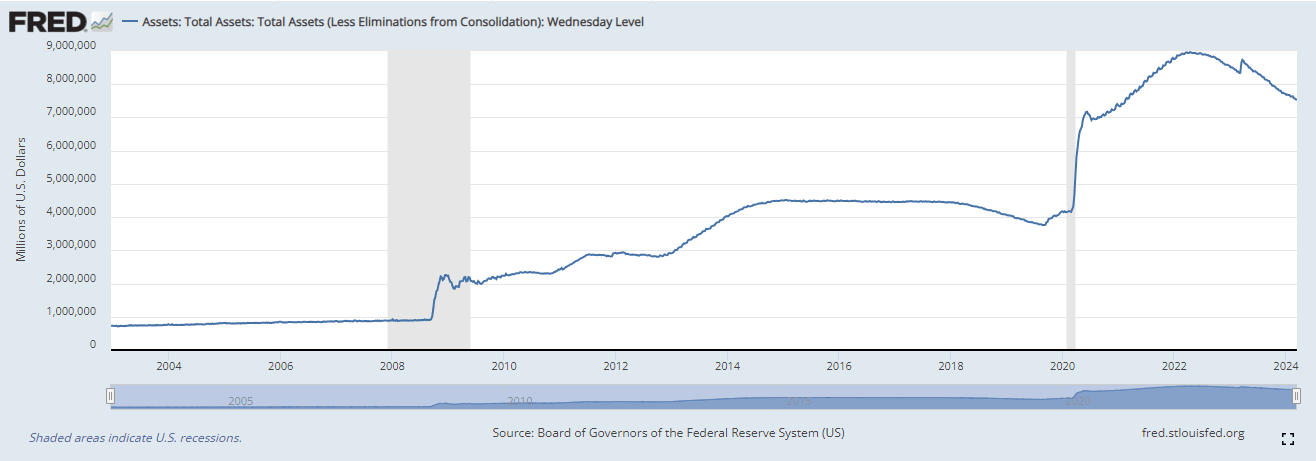

According to FRED data, the total assets on the Federal Reserve’s balance sheet have reached $7.542 trillion, marking a slight increase from $7.538 trillion in the previous week. The Federal Reserve’s balance sheet has expanded by approximately 59% compared to its size in January 2020.

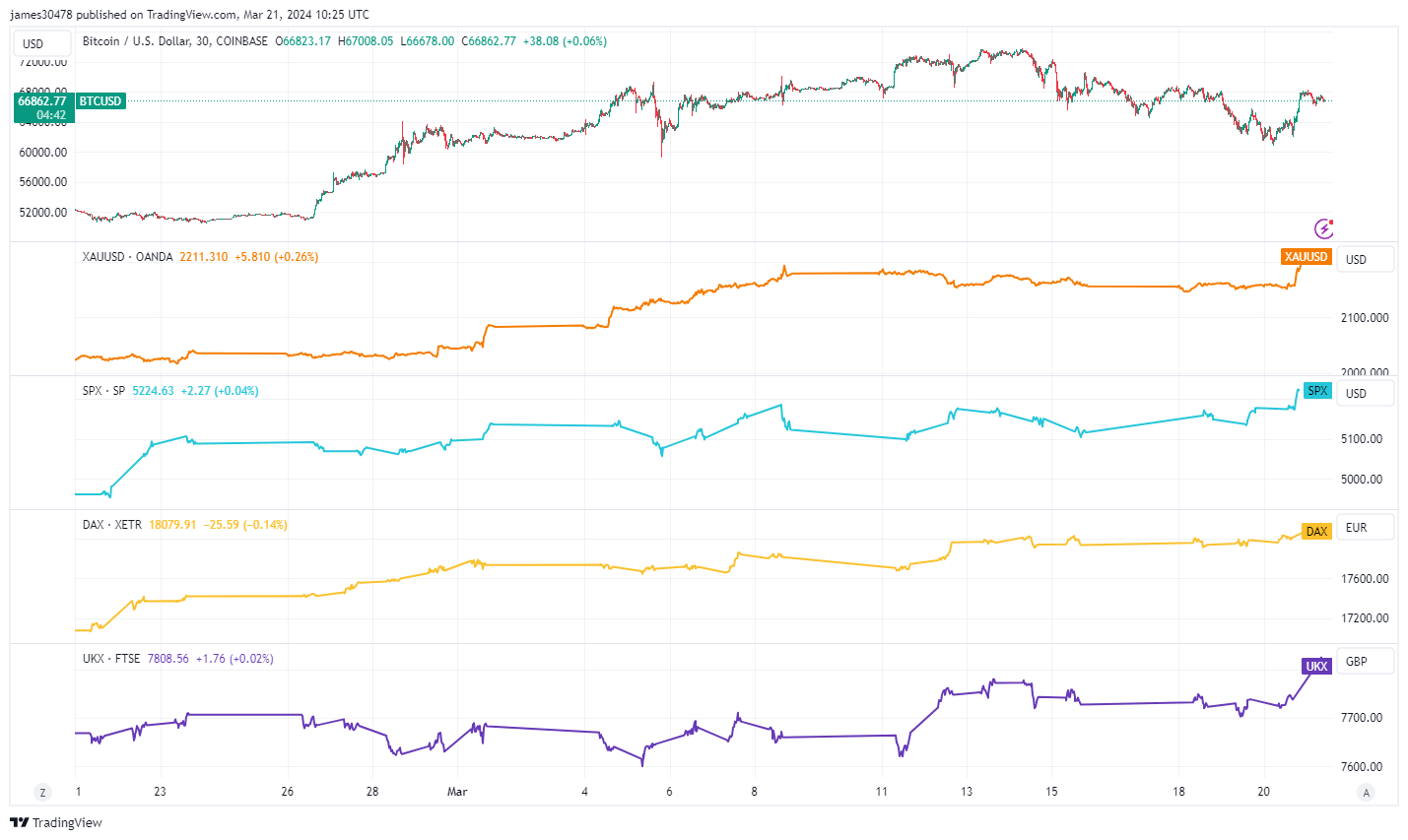

CryptoSlate reported Bitcoin’s significant volatility on the day of the announcement, with prices oscillating between $60,800 and just over $68,000. The impact extended beyond digital assets, with Gold reaching fresh peaks now trading at $2,210 and the S&P 500 also hitting a record high at 5,224. In addition, European equities such as DAX and the UK’s FTSE 100 continued their steady upward trend.

According to the CME Fed watch tool, this reaction by the markets was reflected by the 65% prediction of a Fed rate cut in June.

However, it’s pertinent to note that these market movements occur amidst persistent inflationary pressures, with US CPI remaining above the 2% target since March 2021 and unemployment maintaining near secular lows at 3.9%, according to Trading Economics. The Fed’s dual mandate to promote maximum employment and price stability will remain a key point of focus in the coming months.

CryptoSlate has previously explored the potential for sustained inflation in the 2020s, drawing parallels to the inflationary pressures of the 1970s. Additionally, how Gold and Bitcoin may react favorably to such economic conditions has been discussed.