Potential Bitcoin bull run predicted by closing gap between realized and long-term holder prices

Potential Bitcoin bull run predicted by closing gap between realized and long-term holder prices Quick Take

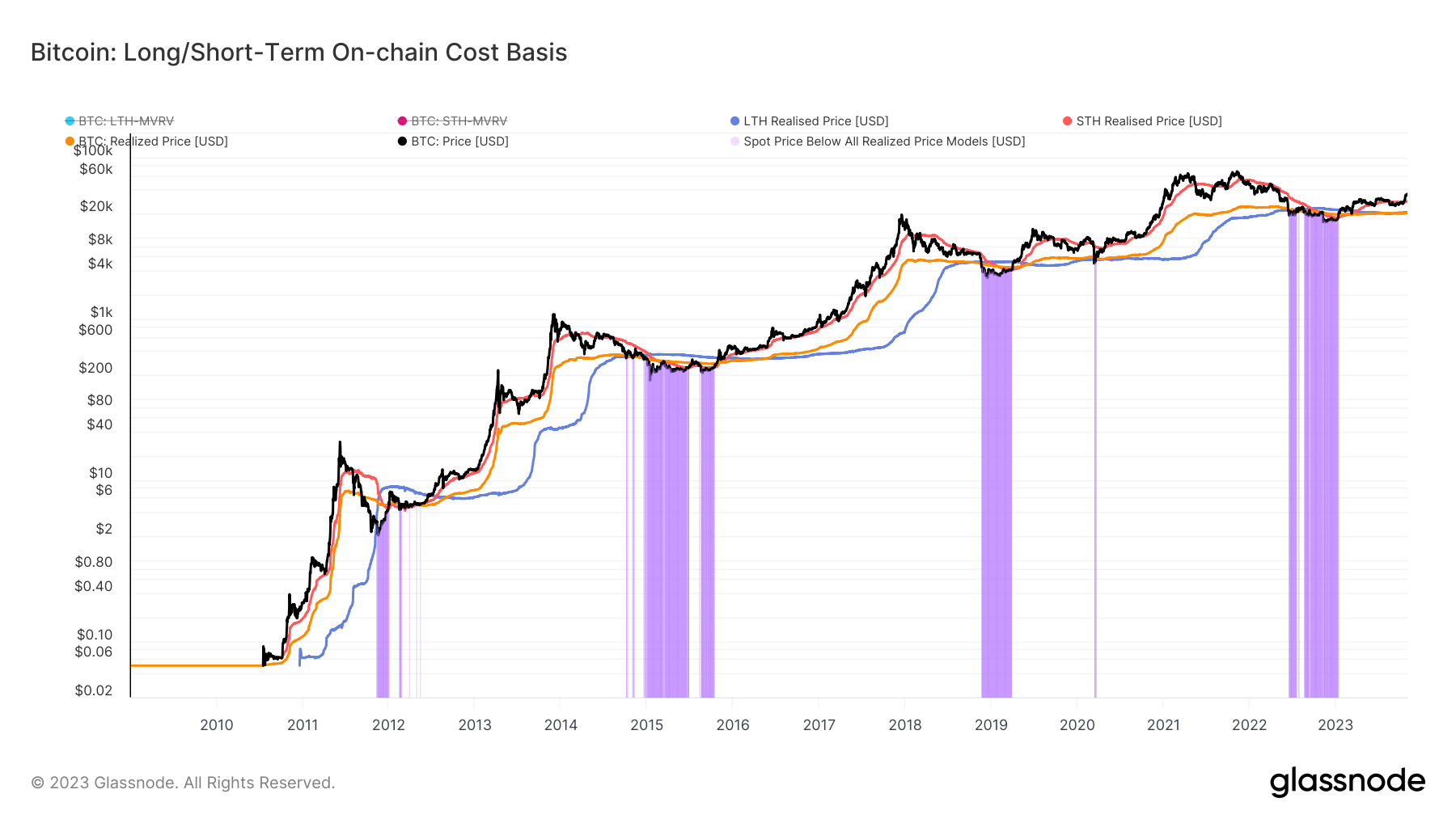

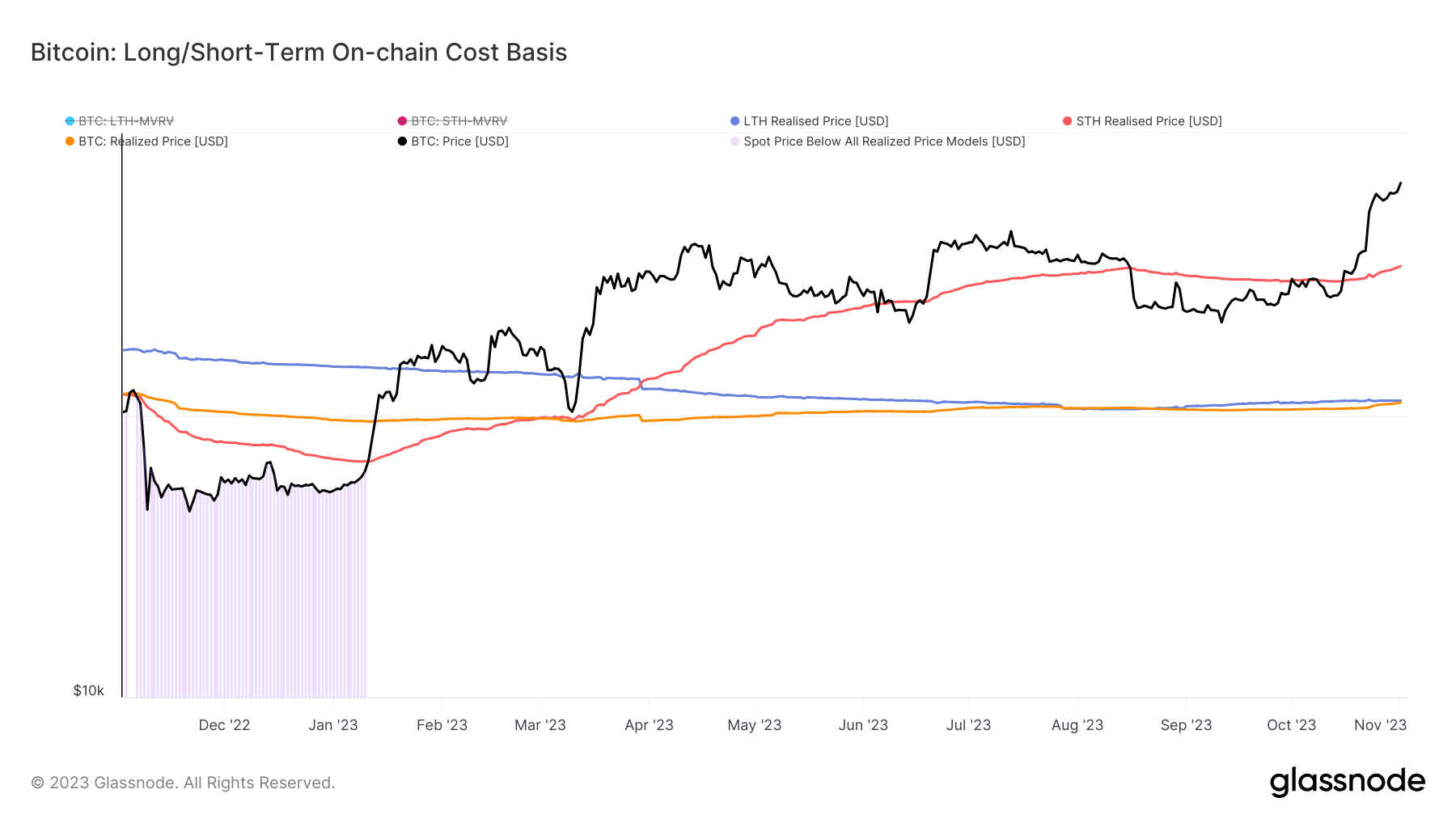

The Bitcoin market is currently exhibiting signs of a potential bull run, as evidenced by the dynamics of the realized prices among different investor cohorts.

The realized price, reflecting the aggregate price at which each Bitcoin was last spent on-chain, currently stands at $20,638. This is only $100 shy of the Long-Term Holder (LTH) realized price – the average on-chain acquisition price for coins that have not moved within the last 155 days, which is $20,744.

| Price Type | Amount |

|---|---|

| Realized Price | $20,638 |

| Short-Term Holder Realized Price | $28,870 |

| Long-Term Holder Realized Price | $20,744 |

Source: Glassnode

Historical trends suggest that a surpassing of the LTH realized price by the realized price has been a consistent marker for the commencement of a new bull market.

In March 2023, a similar scenario unfolded when the Short-Term Holder (STH) realized price – the average on-chain acquisition price for coins moved within the last 155 days – rose above both the realized price and LTH realized price. This led to a marked spike in Bitcoin’s price following the SVB collapse.

However, it’s important to note that during deep bear markets, spot prices often fall below all cost-basis models, meaning that no matter the holding duration, the average investor incurs an unrealized loss.