Net ETF inflows of $132 million on volatile day for Bitcoin as market prepare to gap down

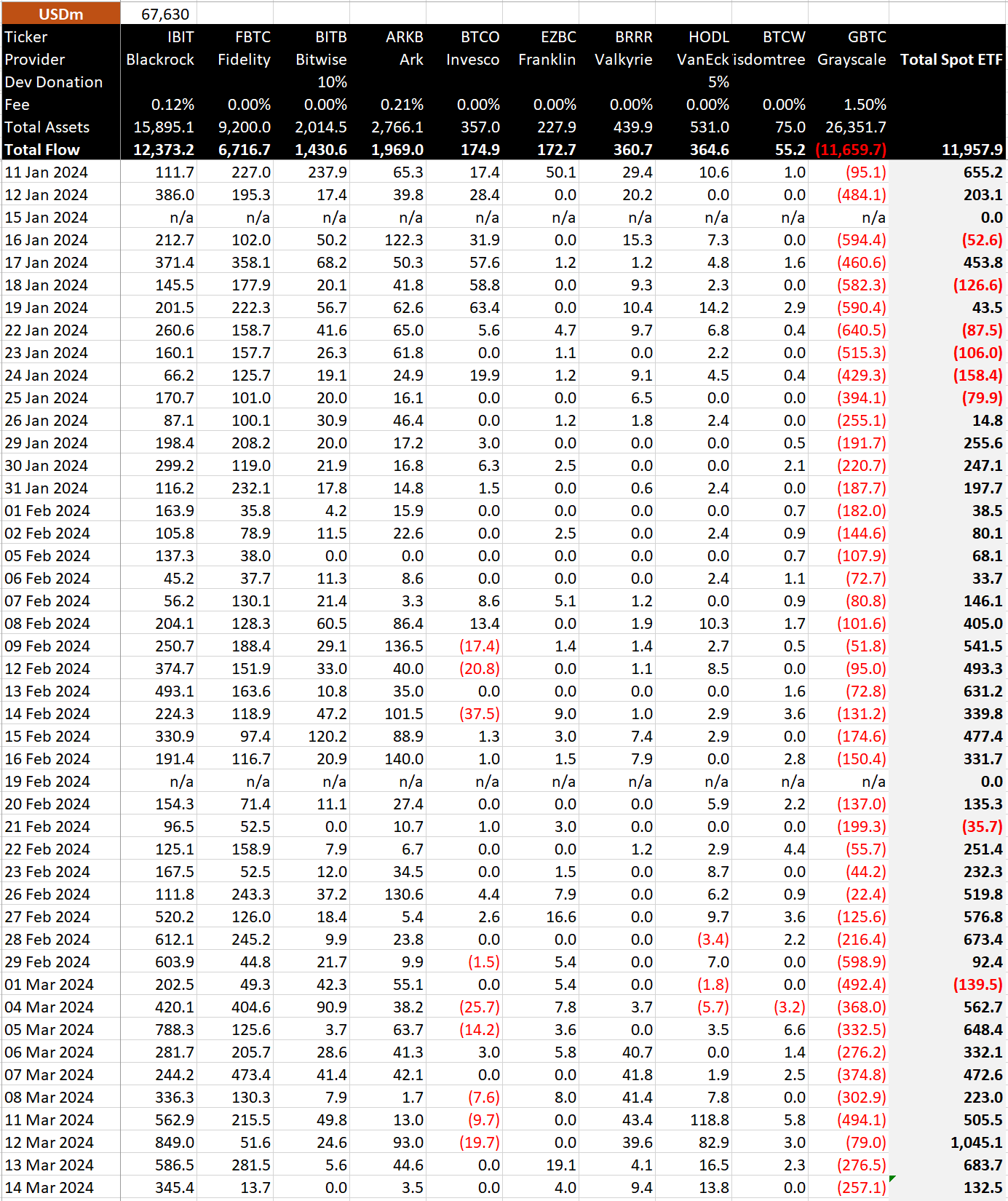

Net ETF inflows of $132 million on volatile day for Bitcoin as market prepare to gap down Bitcoin ETF inflows totaled $132 million on March 14, per data from Bitmex Research. The result, while strong, marks a slowdown from earlier in the week. BlackRock’s Bitcoin ETF saw $345.4 million in inflows, the highest among providers. However, Grayscale’s Bitcoin Trust (GBTC) experienced outflows of $257.1 million, down slightly from the day before.

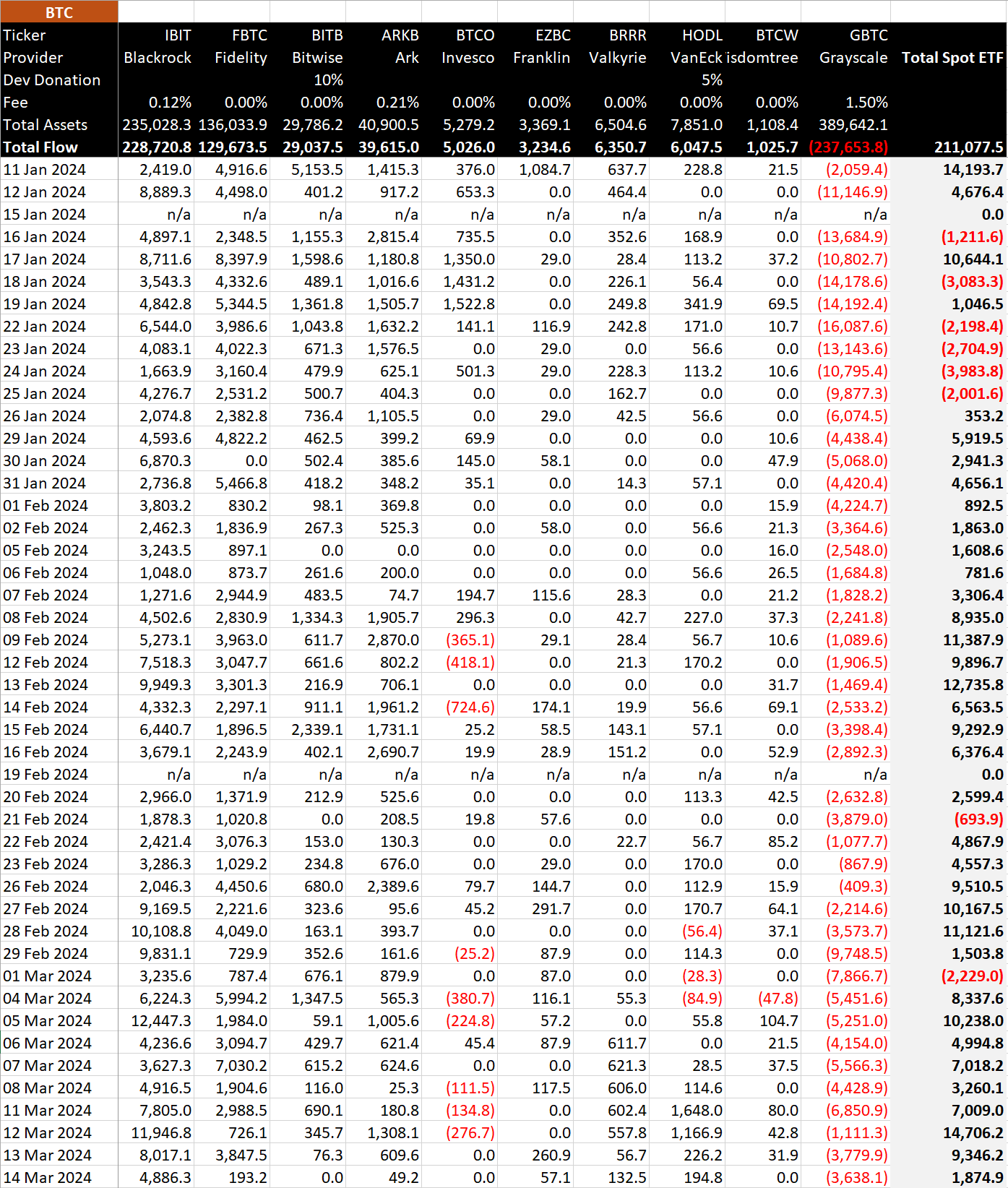

In BTC terms, the net inflow for the day was 1,874 BTC. BlackRock’s ETF gained 4886 BTC and Fidelity, while GBTC lost 3,638 BTC. The mixed results show the rest of the Newborn Nine seeing less than 200 BTC (~$14 million) in inflows. However, without Grayscale, the Newborn Nine saw inflows of $389 million in total.

The data highlights that the landscape of Bitcoin investment products cooled off slightly yesterday while net inflows continued, even with a considerable drawdown in Bitcoin price.