Investors closely monitor the MOVE index amidst surge in US yields

Investors closely monitor the MOVE index amidst surge in US yields Definition

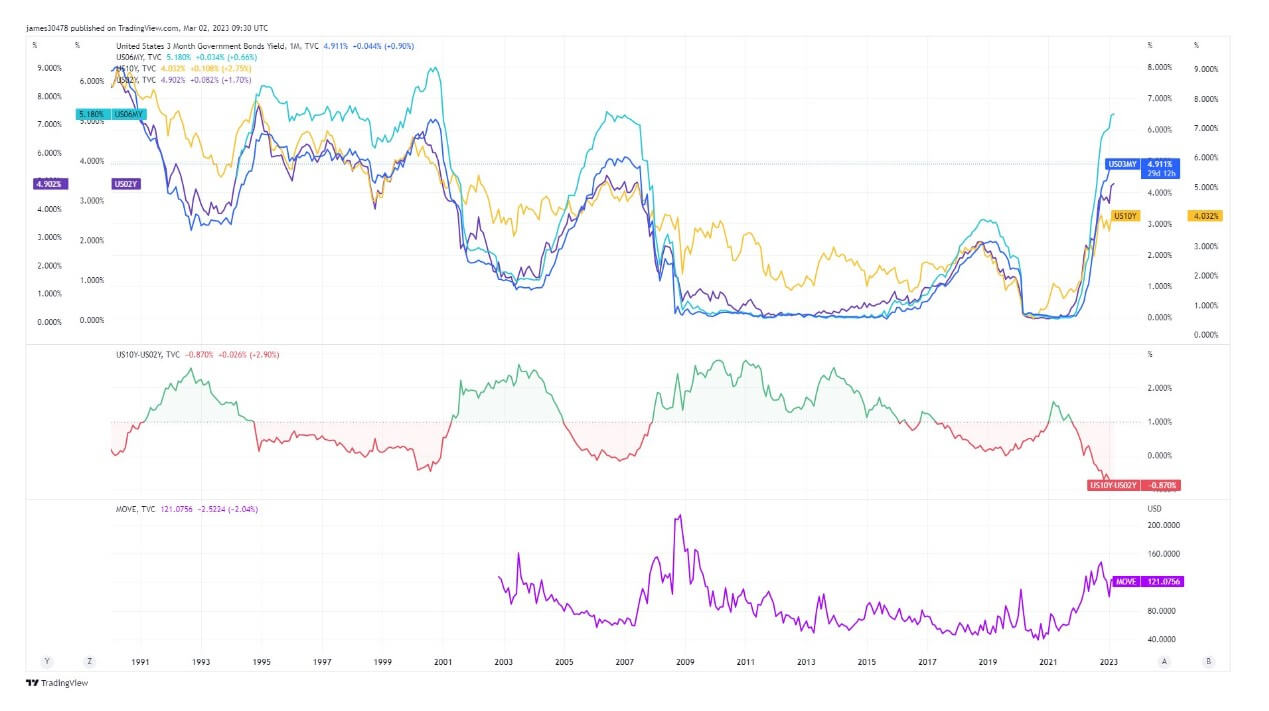

The MOVE index tracks the movement in U.S. Treasury yield volatility.

Quick Take

- As yields continue to rise and approach 2022 highs, eyes will be on the Move Index to understand how the bond market functions.

- The Move Index is currently at 121, while the 2022 high was roughly 158 in September 2022, during the same period as the Liability Driven Investment fiasco in the UK.

- The 10-year treasury constant maturity minus the 2-year treasury constant maturity (T10Y2Y) is currently inverted at -0.86%, further than the three previous recessions; 2020, 2008, and 2000.

- Many investors take that as a sign that a recession is heading, roughly 12-18 months after the first inversion.

- While according to BofA Global Research, the fed might raise policy rates to 6%.