Grayscale’s Bitcoin Trust marks lowest outflow since trading inception

Grayscale’s Bitcoin Trust marks lowest outflow since trading inception Grayscale’s Bitcoin Trust marks lowest outflow since trading inception

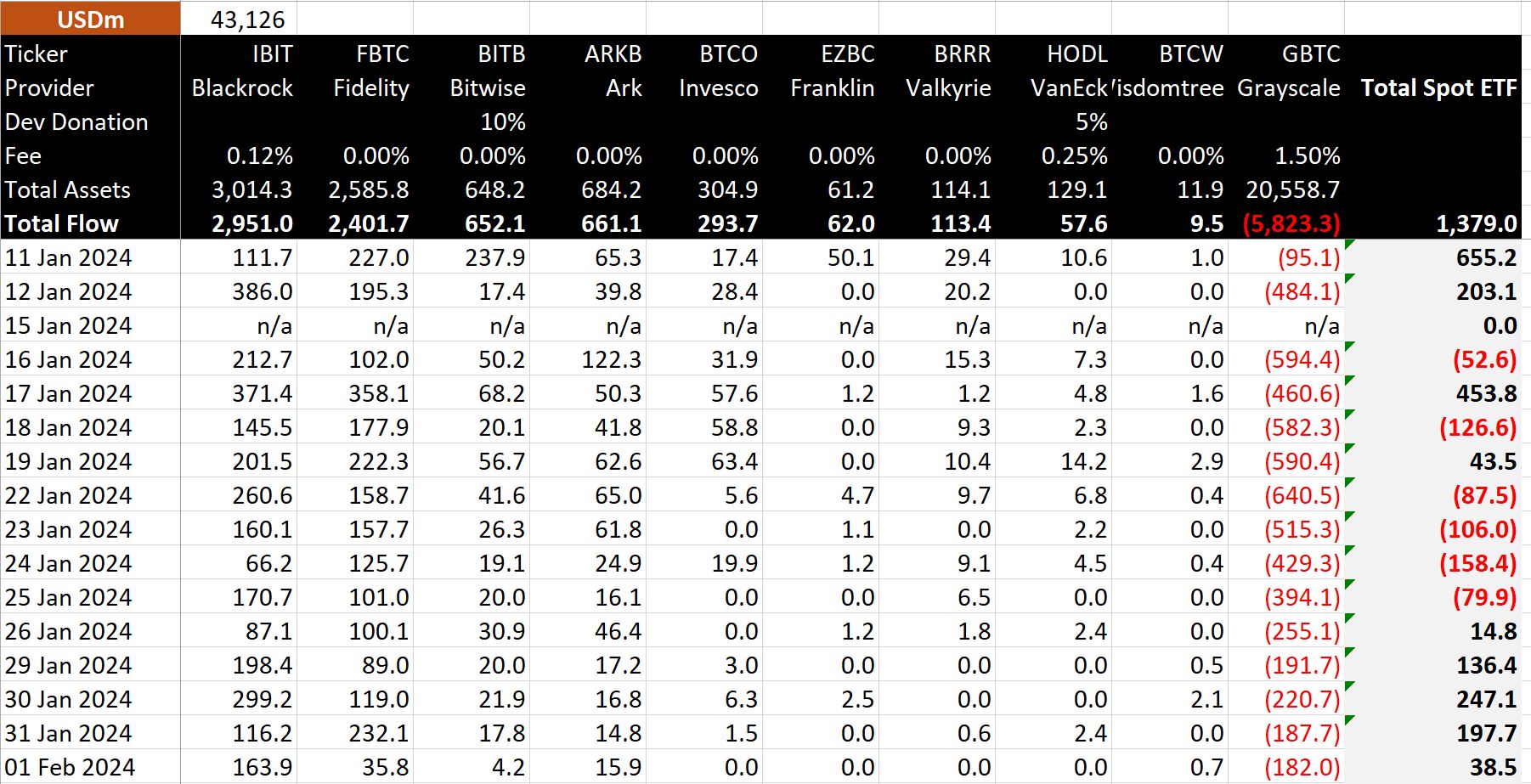

Bitcoin ETF landscape: BlackRock leads with $3B in net inflows.

Quick Take

The 15th day in the evolving landscape of Bitcoin ETFs displayed a rather moderate pace with only $38.5 million in net inflows, according to BitMEXResearch.

The Grayscale Bitcoin Trust (GBTC) observed its lowest amount of outflows since day one of the trading period, recording a drop to $182 million.

Despite reduced net inflows, BlackRock’s IBIT ETF steadied its position with $164 million in net inflows. Fidelity’s FBTC, however, experienced its most minimal influx since trading began, tallying at $36 million.

In a broader context, BlackRock’s IBIT has accumulated a substantial $3 billion in net inflows, while Fidelity’s FBTC stands at a modest $2.4 billion in net inflows. In contrast, GBTC experiences continued to decline with $5.8 billion in net outflows.

The collective movement across these platforms resulted in a total net inflow standing at $1.379 billion.