Bitfinex data shows investor trend to cash out on Bitcoin amidst market highs

Bitfinex data shows investor trend to cash out on Bitcoin amidst market highs Quick Take

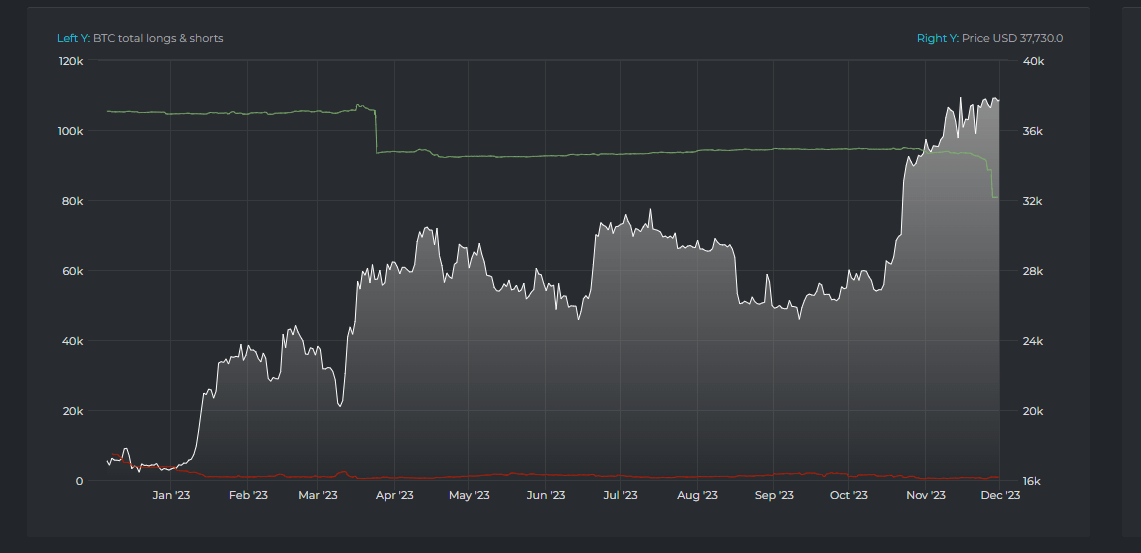

Data from Datamish reveals a Bitcoin market trend on Bitfinex of closing long positions during volatile periods throughout 2023. The start of the year marked the opening of roughly 100,000 BTC long positions. However, following the SVB collapse in March, approximately 12,000 BTC longs were closed.

Recently, a similar number of Bitcoin longs closed in the wake of substantial growth seen in October and November. This leaves approximately 80,000 BTC in longs on Bitfinex. The swift closure of longs post substantial growth is indicative of investors opting to lock in gains amid rising Bitcoin prices.

Conversely, short positions have remained relatively subdued throughout the year, with less than 1,000 BTC. This muted activity in shorts presents a clear market sentiment leaning towards bullish prospects despite the fluctuations and uncertainties the market has endured.