Bitcoin’s unique correlation profile suggests an emerging pattern in financial landscapes

Bitcoin’s unique correlation profile suggests an emerging pattern in financial landscapes Quick Take

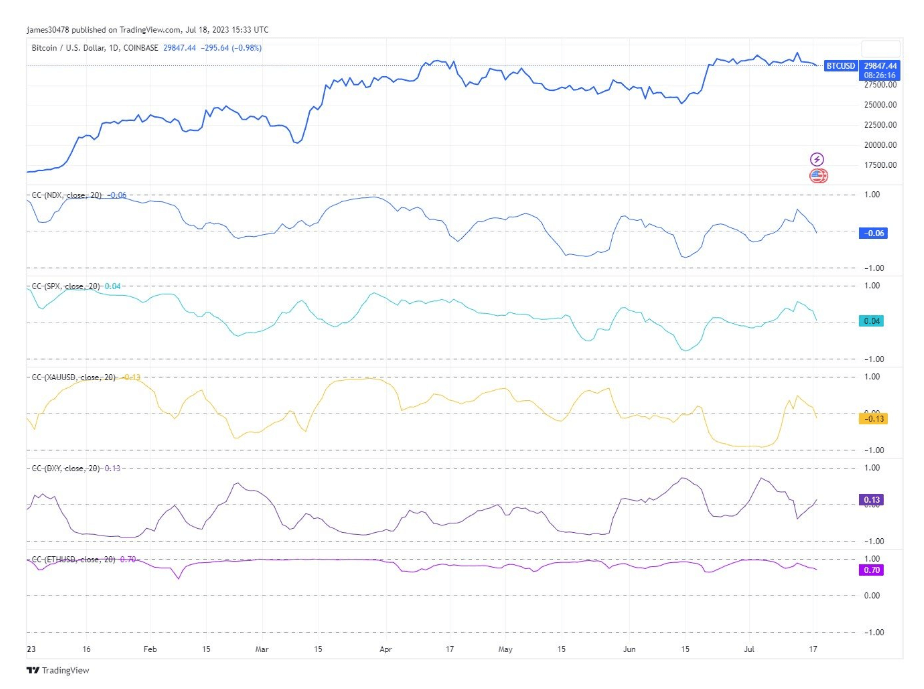

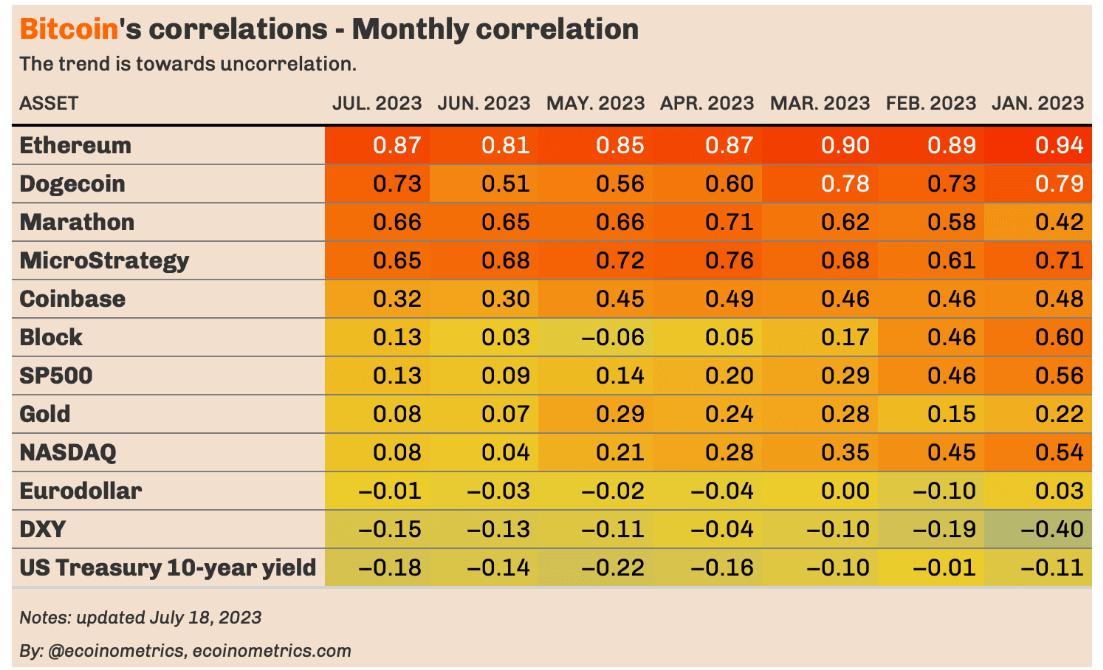

A review of year-to-date data demonstrates a clear trend of decreasing correlation between Bitcoin and major assets. This finding is in accordance with Ecoinometrics‘ analytics, highlighting a sustained monthly trend of Bitcoin diverging from traditional financial assets.

Key examples of this trend include significant assets like the S&P 500, Gold (XAU), Nasdaq, Eurodollar, and the US Treasury 10-year yield, all of which exhibit a decreasing correlation with Bitcoin.

This distinct lack of correlation accentuates Bitcoin’s unique performance traits within the financial ecosystem, further emphasizing its potential as a tool for portfolio diversification.