Bitcoin’s market cap holds strong at 7.4% against gold, marking its status in the ETF market

Bitcoin’s market cap holds strong at 7.4% against gold, marking its status in the ETF market Quick Take

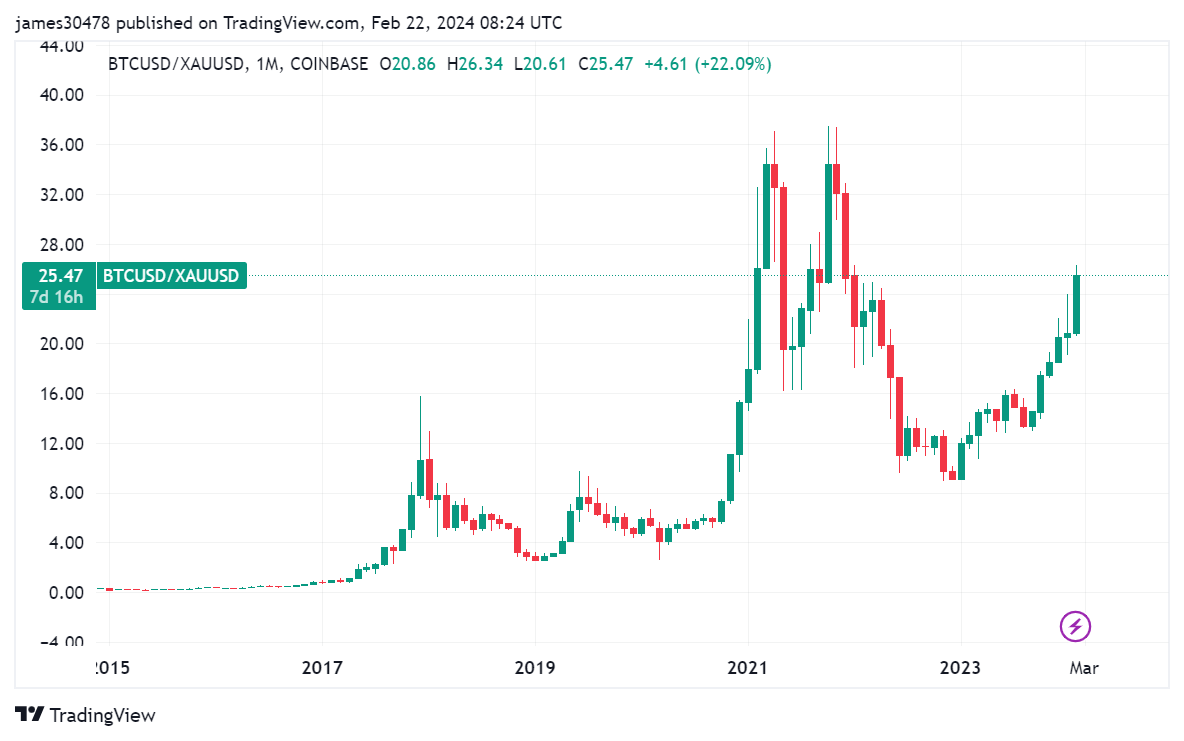

Bitcoin, often called ‘digital gold,’ continues to make significant strides in the Exchange Traded Funds (ETF) market, as highlighted by CryptoSlate analysis. Currently, Bitcoin’s price, pegged against gold, is 25.5 ounces, a decrease from the 2021 high of 37 ounces. Despite this, Bitcoin’s market cap is a significant 7.37% compared to gold’s. At the same time, it marked its ascension as a $1T asset class when it breached $51,020.

Bitcoin ETFs have garnered substantial attention, with approximately $41 billion invested across US-based ETFs as of February, as shown on Bloomberg Terminal shared by Bitcoin Munger.

Comparatively, gold ETFs command a more significant share with $111 billion invested. However, Bitcoin Munger suggests that at the current growth rate, Bitcoin could soon reach parity with investment in ETFs.

Despite outflows in Gold ETFs in 2024, Bitcoin ETFs saw a surge, with net inflows exceeding $5 billion. This data indicates a shifting trend in investor preference and a growing confidence in digital assets.