Bitcoin options worth $3.7 billion approaching expiration – Deribit

Bitcoin options worth $3.7 billion approaching expiration – Deribit Quick Take

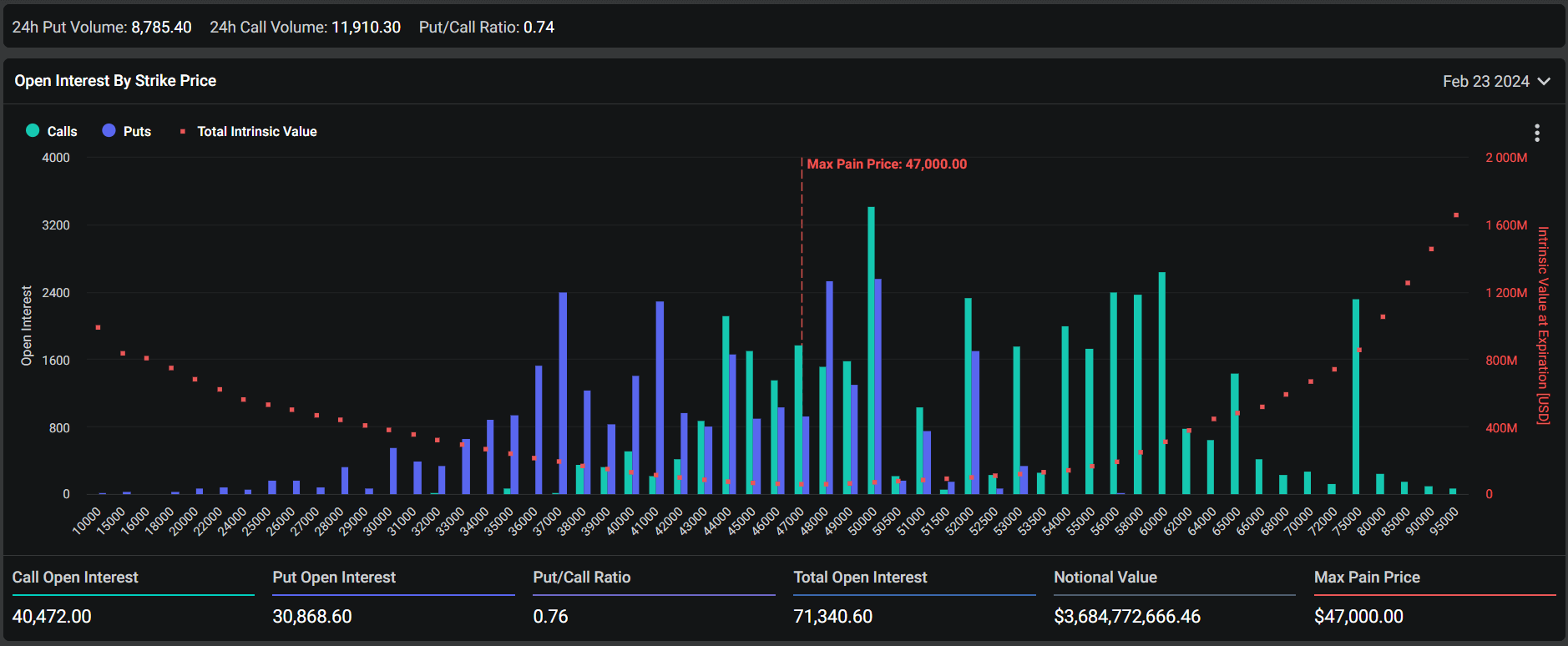

Feb. 23, the last Friday of the month, marks the expiration of an impressive $3.7 billion in Bitcoin (BTC) options, a situation that could notably influence the Bitcoin market, according to Deribit data.

Deribit data shows that the options, totaling $3.7 billion for BTC, feature a significant open interest – a total of 71,340 contracts for both calls and puts combined. The put/call ratio for BTC stands at 0.76, reflecting 76 put options for every 100 call options. This ratio leans towards a bullish sentiment, a tendency reinforced by the ‘max pain point’ at $47,000. Beyond this, a meaningful open interest in call options lies between the strike prices of $53,000 to $60,000.

The current higher price leans towards bullish sentiment, a trend not wholly predicted by the options market setup. Should the price remain above $51,000, a decrease in the put/call ratio could occur, as traders may opt for more calls, anticipating further bullish trends.