Bitcoin options point to $40,000 as likely ‘fair value’ for Bitcoin

Bitcoin options point to $40,000 as likely ‘fair value’ for Bitcoin Quick Take

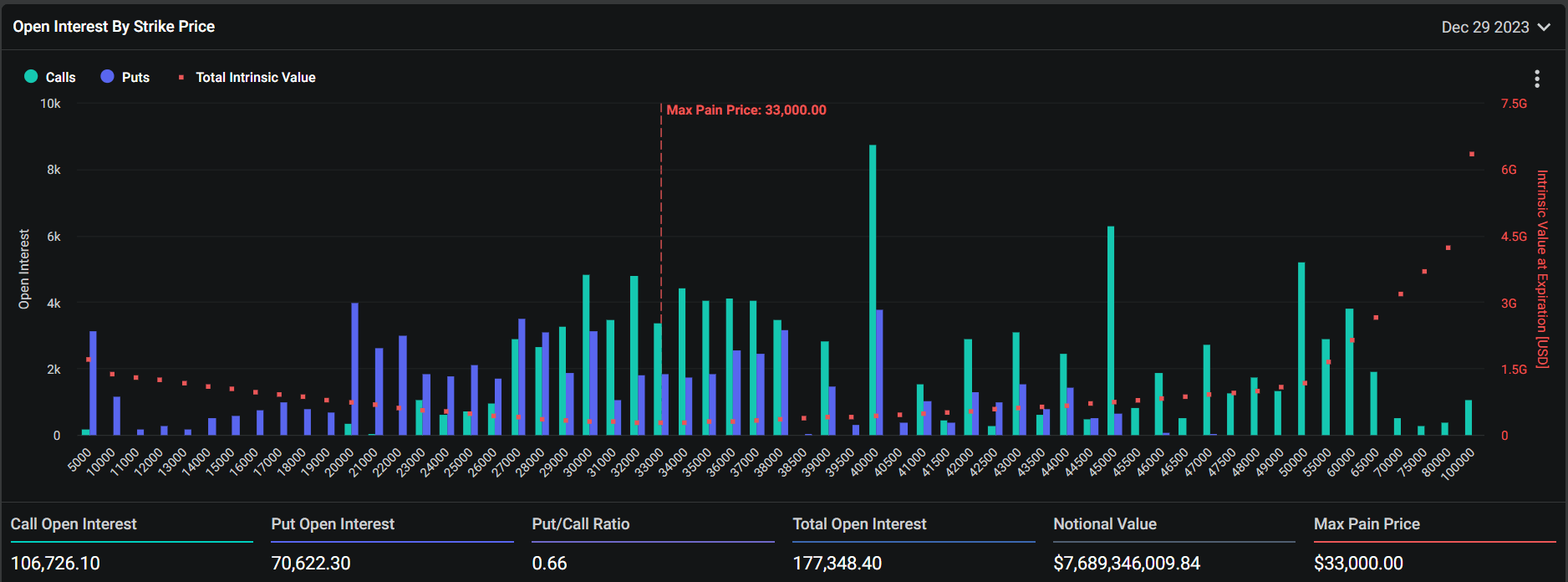

As 2023 draws to a close, analyzing options data provides revealing insights into Bitcoin’s perceived value. In the year-end options expiry on Dec. 29, $40,000 stands out as the distinct ‘call wall,’ a term used to describe the price at which the largest number of call options are set to expire.

The market open interest currently stands at 177,000 BTC. Out of this total open interest, 106,000 BTC is tied up in call options, while 70,000 BTC is tied up in put options. This distribution results in a put/call ratio of 0.66, providing a solid gauge of current market sentiment: a value below one typically indicates a bullish sentiment, meaning the market expects prices to rise.

The scale of these options is also noteworthy. The open interest’s notional value – the total value of the contracts – is around $7.7 billion. This figure highlights the significant role that options play in the Bitcoin market.

Looking at these numbers, the options market seems to be leaning towards $40,000 as a fair value estimate for Bitcoin.