Binance’s open interest up by 10% as Bitcoin trading fervor hits 3-month high

Binance’s open interest up by 10% as Bitcoin trading fervor hits 3-month high Quick Take

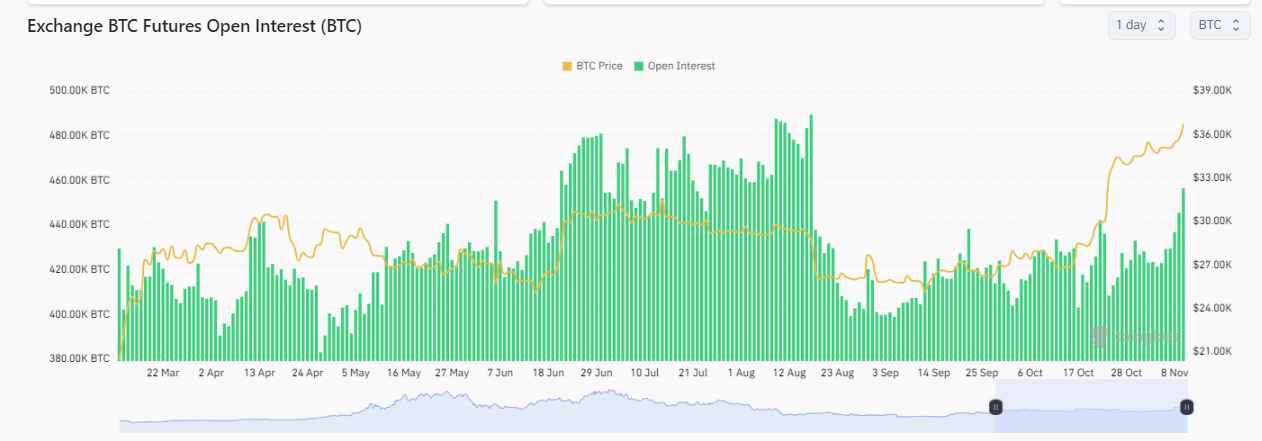

Bitcoin futures open interest has witnessed a considerable surge, marking a positive shift in the cryptocurrency market. Data from Coinglass reveals a 9% increase in the past 24 hours alone, showcasing a soaring interest in Bitcoin trading contracts. This equates to 488,000 Bitcoin in open interest contracts or a notional value of around $18 billion. The open interest expressed in Bitcoin has reached its peak since August.

A closer look at the leading exchanges shows that Binance saw a 10% increase in open interest, closely followed by CME with a 5% rise, which hit a new all-time high of 120,000 Bitcoin.

ByBit and Deribit saw more modest increases, 4% and 1%, respectively, while OKX and Bitget reported surprisingly high leaps of 11% and 32%.

The gap between Binance and its nearest competitor, CME, now stands at approximately 6,000 Bitcoin, indicating a competitive landscape, yet one that remains dominated by a few key players.

| Exchange | Open Interest in Bitcoin | 24h Change |

|---|---|---|

| Binance | 120k BTC | 10% |

| CME | 111k BTC | 5% |

| ByBit | 78k BTC | 4% |

| OKX | 56k BTC | 11% |

| Bitget | 38k BTC | 32% |

| Deribit | 31k BTC | 1% |

Table showing the 24-hour change in Bitcoin futures open interest on top exchanges on Nov. 9, 2023 (Source: Coinglass)